KLA Corp (KLAC) Surpasses Revenue Forecasts and Aligns with EPS Projections in Q3 FY2024

Total Revenue: $2.36 billion, surpassing the estimate of $2.31 billion.

GAAP Net Income: $601.5 million, below the estimated $677.89 million.

GAAP EPS: $4.43, falling short of the estimated $5.01.

Non-GAAP EPS: $5.26, exceeding the estimated $5.01.

Operating Cash Flow: $910 million for the quarter, contributing to a robust $2.42 billion over the last nine months.

Free Cash Flow: $838.2 million for the quarter, indicating strong liquidity and financial health.

Capital Returns: $569.4 million returned to shareholders through dividends and share repurchases during the quarter.

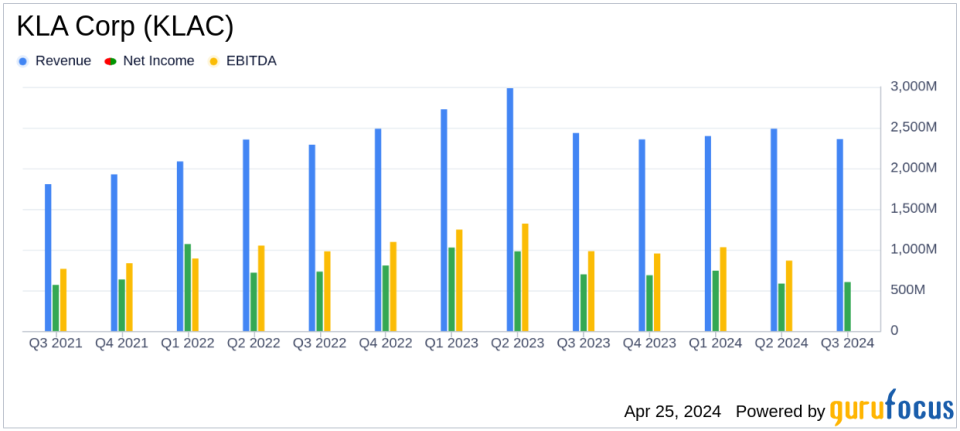

KLA Corp (NASDAQ:KLAC) released its 8-K filing on April 25, 2024, revealing third-quarter fiscal year 2024 results that surpassed revenue forecasts and aligned closely with earnings per share (EPS) projections. The company reported a total revenue of $2.36 billion, which exceeded the estimated $2.31 billion, and a non-GAAP diluted EPS of $5.26, closely aligning with the anticipated $5.01.

KLA Corp, a leading semiconductor process control equipment manufacturer, continues to dominate its market segment. The company's robust performance this quarter reflects its strong market position and ongoing demand from major clients like TSMC and Samsung.

Financial Performance Overview

The company's revenue of $2.36 billion represents an increase from the previous quarter's $2.49 billion and a slight decline from $2.43 billion in the same quarter last year. KLA's net income for the quarter stood at $601.5 million, with GAAP earnings per diluted share at $4.43. This performance demonstrates KLA's effective management and operational efficiency, particularly in a challenging global economic environment.

Operationally, KLA generated robust cash flows, with $910 million from operating activities and $838.2 million in free cash flow during the quarter. These figures underscore the company's solid financial health and its ability to generate cash amidst market fluctuations.

Strategic Insights and Future Outlook

President and CEO Rick Wallace commented on the results, noting,

KLAs March quarter results were above our adjusted guidance as customer demand and company execution tracked consistent with our expectations."

He also highlighted the stabilization in market conditions and potential improvements as the year progresses.

Looking ahead to the fourth quarter of fiscal 2024, KLA expects total revenues to range between $2.50 billion and $2.62 billion, with GAAP and non-GAAP diluted EPS anticipated to be in the range of $5.66 to $6.26 and $6.07 to $6.67, respectively. These projections reflect the company's confidence in its ongoing business strategies and market demand.

Analysis of Financial Statements

KLA's balance sheet remains strong with total assets increasing to $14.96 billion as of March 31, 2024, up from $14.07 billion on June 30, 2023. This growth is supported by significant increases in marketable securities and inventories, indicating readiness for increased production and sales.

Liabilities have also risen, primarily due to long-term debt, which is a common strategy for companies investing in growth. Stockholders equity increased modestly, reflecting retained earnings and ongoing capital management strategies.

Conclusion

KLA Corp's Q3 FY2024 results not only demonstrate its resilience in a volatile market but also its ability to exceed expectations. With strategic investments in technology and a strong market position, KLA appears well-equipped to handle future industry demands and capitalize on emerging opportunities. Investors and stakeholders can likely expect continued robust performance as the company navigates the dynamic semiconductor landscape.

For detailed financial figures and future projections, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from KLA Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance