Kintara (KTRA) Rises 41% on $2M Grant for Breast Cancer Therapy

Kintara Therapeutics KTRA recently received a $2 million Small Business Innovation Research grant from the National Institutes of Health to support the development of REM-001. Notably, REM-001 is the company’s proprietary second-generation photodynamic therapy photosensitizer agent, which is set to be developed for the treatment of cutaneous metastatic breast cancer (CMBC).

Kintara reported that the funds received from this grant will enable the company to restart the REM-001 CMBC program. In the program, the company expects to generate clinical evidence to demonstrate proof of concept for the photodynamic therapy platform in CMBC. The success of this evidence-finding study will help the company design its planned phase III registrational study for REM-001.

The stock of the company swiftly jumped about 41% on Thursday in response to the encouraging news. Year to date, shares of Kintara have plunged 38.9% compared with the industry’s 9.8% fall.

Image Source: Zacks Investment Research

REM-001 therapy has previously been studied in four mid-late-stage studies in patients with CMBC after receiving chemotherapy and/or failed radiation therapy. The entire therapy comprises the laser light source, the light delivery device and the REM-001 drug product. Per KTRA, REM-001 has demonstrated clinical efficacy to date of 80% complete responses of CMBC evaluable lesions. So far, there have been no reported safety concerns for the drug.

Management firmly believes that the company’s REM-001 program has the potential to address the serious unmet medical need by significantly improving the quality of life and reducing co-morbidities for patients with CMBC. Currently, there are little or no treatment options for this disease.

Per Kintara, a meta-analysis of more than 20,000 cancer patients, conducted in 2003, demonstrated that 24% of breast cancer patients included in the analysis had developed cutaneous metastases. This was reportedly recorded as the highest rate of any cancer type. The prevalence of CMBC is anticipated to be more than 50,000 cases annually in the United States.

Other than REM-001, KTRA is also engaged in the developmental program of another candidate, VAL-083, for treating glioblastoma (GBM). VAL-083 is the company’s first-in-class, small-molecule chemotherapeutic with a novel mechanism of action. VAL-083 has reportedly shown clinical effectiveness across a range of cancer types during the studies conducted in the United States,sponsored by the National Cancer Institute. These cancer types include the central nervous system, ovarian and other solid tumors.

Based on prior evidence, Kintara is currently advancing VAL-083 in the global registrational phase II/III GBM AGILE study to support the development and potential commercialization of VAL-083 in GBM.

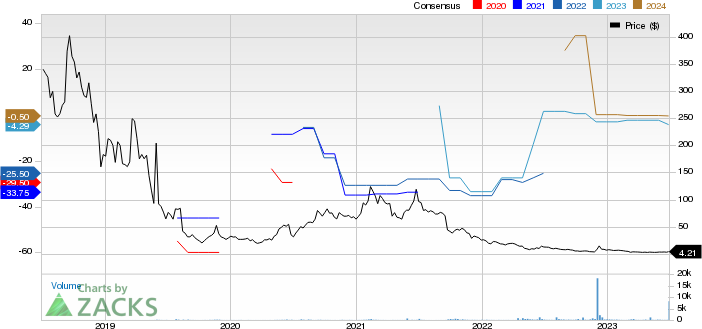

Kintara Therapeutics, Inc. Price and Consensus

Kintara Therapeutics, Inc. price-consensus-chart | Kintara Therapeutics, Inc. Quote

Zacks Rank and Stocks to Consider

Kintara currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector are Adaptimmune Therapeutics ADAP, Akero Therapeutics AKRO and ADMA Biologics, Inc. ADMA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate for Adaptimmune Therapeutics’ 2023 loss per share has narrowed from 63 cents to 46 cents. During the same period, the estimate for Adaptimmune Therapeutics’ 2024 loss per share has narrowed from 59 cents to 56 cents. Year to date, shares of ADAP have fallen by 35.9%.

ADAP beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 36.89%.

In the past 90 days, the Zacks Consensus Estimate for Akero Therapeutics’ 2023 loss per share has narrowed from $2.96 to $2.80. During the same period, the estimate for Akero Therapeutics’ 2024 loss per share has narrowed from $3.40 to $3.27. Year to date, shares of AKRO have lost 18.6%.

AKRO beat estimates in three of the trailing four quarters, missing the mark on one occasion, delivering an average earnings surprise of 7.96%.

In the past 90 days, the Zacks Consensus Estimate for ADMA Biologics’ 2023 loss per share has narrowed from 14 cents to 9 cents. The consensus estimate for 2024 earnings is currently pegged at 7 cents per share. Year to date, shares of ADMA have lost 6.4%.

ADMA beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 19.13%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Adaptimmune Therapeutics PLC (ADAP) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report

Kintara Therapeutics, Inc. (KTRA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance