Karoon Energy (ASX:KAR) shareholders have earned a 25% CAGR over the last three years

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the Karoon Energy Ltd (ASX:KAR) share price is up 82% in the last three years, clearly besting the market return of around 16% (not including dividends).

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Karoon Energy

Karoon Energy wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Karoon Energy's revenue trended up 136% each year over three years. That's much better than most loss-making companies. The share price rise of 22% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. So now might be the perfect time to put Karoon Energy on your radar. If the company is trending towards profitability then it could be very interesting.

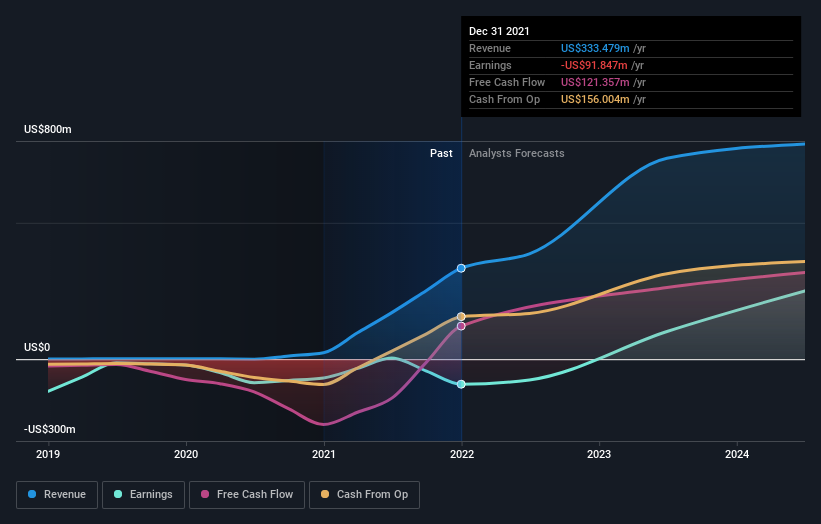

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Karoon Energy in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Karoon Energy's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Karoon Energy's TSR, at 98% is higher than its share price return of 82%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's good to see that Karoon Energy has rewarded shareholders with a total shareholder return of 75% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Karoon Energy is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance