Juniper (JNPR) Q4 Earnings Meet Estimates as Revenues Surge

Juniper Networks, Inc. JNPR reported mixed fourth-quarter 2022 results with the bottom line matching the Zacks Consensus Estimate and the top line missing the same. The company witnessed a strong business momentum in the December quarter. The double-digit year-over-year revenue upside was mostly driven by the cloud and enterprise business growth. Despite facing supply chain headwinds, it expects this healthy growth momentum to continue in 2023.

Net Income

On a GAAP basis, net income in the fourth quarter improved to $180.4 million or 55 cents per share from $132.9 million or 40 cents per share in the prior-year quarter. Double-digit revenue growth fuelled by a solid performance in the cloud and enterprise business resulted in higher net income.

Non-GAAP net income was $213.8 million or 65 cents per share compared with $184.7 million or 56 cents per share in the year-ago quarter. The bottom line matches the Zacks Consensus Estimate.

For full-year 2022, GAAP net income stands at $471.0 million or $1.43 per share, significantly higher $252.7 million or 76 cents per share recorded in 2021. A staggering 86% year-over-year increase can be attributed to higher revenues and one-time debt extinguishment costs in 2021.

Non-GAAP net income for 2022 rose to $642.6 million or $1.95 per share from $576.2 million or $1.74 per share in 2021.

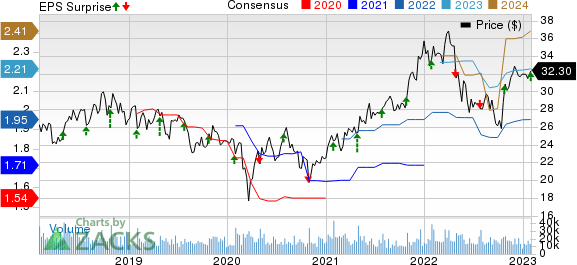

Juniper Networks, Inc. Price, Consensus and EPS Surprise

Juniper Networks, Inc. price-consensus-eps-surprise-chart | Juniper Networks, Inc. Quote

Revenues

Juniper’s quarterly revenues increased to $1,448.8 million from $1,299.9 million in the prior-year quarter. High growth in Cloud and Enterprise business boosted top-line performance. However, the company witnessed a year-over-year decline in Service Provider vertical. The top line missed the consensus estimate of $1,482 million. To enhance the end-user experience, JNPR resorts to the first networking strategy focused on AI and cloud-delivered automation that generated higher net sales. Full-year 2022 net sales amounted to $5,301 million, up 12% from the 2021 figure.

Product revenues totaled $988.3 million in the reported quarter, up 13% year over year. Compared to the same quarter last year, service revenue climbed to $460.5 million from $425.3 million.

By vertical, revenues in cloud increased to $380.3 million from $333.4 million. It was the company’s second-highest cloud revenue quarter. Enterprise business also performed exceptionally well as revenue rose to $599.2 million from $455.1 million. However, revenues from Service Provider declined to $469.3 million from $511.4 million in the year-ago quarter.

By region, revenues from Europe, the Middle East and Africa increased to $378.5 million from $343.2 million in the year-ago quarter. Revenues in the Americas increased to $857.4 million from $748.6 million. In the Asia Pacific, revenues were up 2.3% to $212.9 million.

Other Details

Gross profit was $827 million compared with $750.4 million in the year-ago quarter. Total operating expenses increased to $623.5 million from $596.5 million. Operating income was $203.5 million compared with $153.9 million in the year-ago quarter. Non-GAAP operating income was $276.5 million, up from $238.1 million, with respective margins of 19.1% and 18.3%.

Cash Flow & Liquidity

In 2022, Juniper generated $97.6 million of cash from operating activities compared with $689.7 million in 2021. The huge difference is primarily due to significantly higher prepaid expenses and deferred income taxes. As of Dec 31, 2022, the company had $880.1 million in cash and cash equivalents with $1,601.3 million of long-term debt vs 2021 figure of $1,686.8 million.

Outlook

Juniper is experiencing supply chain headwinds induced by shortages and high component and freight costs. Supply chain woes are expected to continue in 2023 as well. The company also anticipates that a normalized software mix and seasonality will likely affect first-quarter gross margin.

For the first quarter, the company approximates revenues of $1340 million (+/- $50 million). Non-GAAP gross margin is estimated at 57% (+/- 1%). Juniper expects non-GAAP operating expenses to be $580 million (+/- $5 million). It anticipates the non-GAAP operating margin to be 13.7% at the mid-point of revenue guidance. The non-GAAP tax rate is approximated at 19% ( +/- 1%). Assuming a share count of close to 330 million, non-GAAP net income is anticipated to be 42 cents per share (plus or minus 5 cents).

Zacks Rank & Other Stocks to Consider

Juniper currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 6.6%, on average, in the trailing four quarters. Earnings estimates for MSI for the current year have remained unchanged in the past 60 days at $10.20 per share.

Motorola is a leading communications equipment manufacturer and has strong market positions in bar code scanning, wireless infrastructure gear, and government communications.

Nokia Corporation NOK, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 9.65%, on average, in the trailing four quarters. It delivered an earning surprise of 14.29% in the last reported quarter.

Nokia is well-positioned to benefit from the growing demand for next-generation connectivity and aims to accelerate its product roadmaps and cost competitiveness through additional 5G investments.

Jabil Inc. JBL, sporting a Zacks Rank #1(Strong Buy), delivered an earnings surprise of 8.7%, on average, in the trailing four quarters. Earnings estimates for JBL for the current year have remained unchanged in the past 30 days at $8.37 per share.

Jabil is one of the largest global suppliers of electronic manufacturing services. The company offers electronics design, production, product management and after-market services to customers catering to aerospace, automotive, computing, consumer, defense, industrial, instrumentation, medical, networking, peripherals, storage and telecommunications industries.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nokia Corporation (NOK) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance