JPMorgan quant identifies a ‘once in a decade’ opportunity in stocks

There’s a rare phenomenon brewing in the stock market right now, according to JPMorgan’s quantitative strategist Marko Kolanovic.

“We think that the unprecedented divergence between various market segments offers a once in a decade opportunity to position for convergence,” Kolanovic wrote in a note to clients.

That position comes against a relatively muted outlook for the broader stock market. JPMorgan holds a 12-month 3,200 price target on the S&P 500 (^GSPC), representing roughly 6.5% upside from the index’s current threshold of 3,006. That pales in comparison to the index’s 20% gain so far this year.

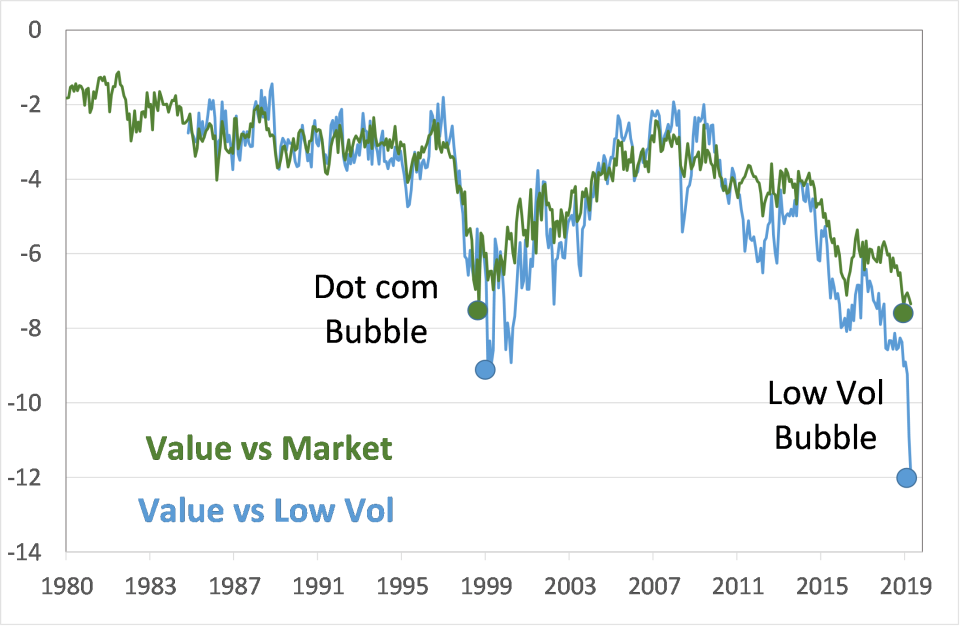

“Currently, there is a record divergence between value/cyclical stocks on one side, and low volatility/defensive stocks on the other side,” Kolanovic wrote. “The level of divergence is much more significant even when compared to the dot-com bubble valuations of late ’90s.”

The point is, the gap between value stocks and low volatility stocks is unusually wide, as the chart above shows in terms of forward P/E valuation.

“While there is a secular trend of value becoming cheaper and low volatility stocks becoming more expensive due to secular decline in yields, the nearly vertical move the last few months is not sustainable,” Kolanovic wrote. “The bubble of low volatility stocks vs. value stocks is now more significant than any relative valuation bubble the equity market experienced in modern history.”

To tie it together, should the divergence between the two stock groups lessen (perhaps because of easing trade tensions, a Fed rate cut or hedge fund repositioning), Kolanovic expects a host of different stock sectors to rise, like “small caps, oil and gas, materials, and more broadly stocks with low P/E and P/B ratios.”

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

More from Scott:

Morgan Stanley downgrades global stocks, projects ‘poor returns’ over the next year

Gabrielle Rubenstein’s new private equity firm focuses on healthy foods

The earnings picture for 2019 is showing more signs of deterioration

The next rate cut is unlikely to be caused by weak growth, economist explains

What the plunging 10-year Treasury yield says about the economy and stock market

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance