Here’s where jobs will crash and burn in 5 years’ time

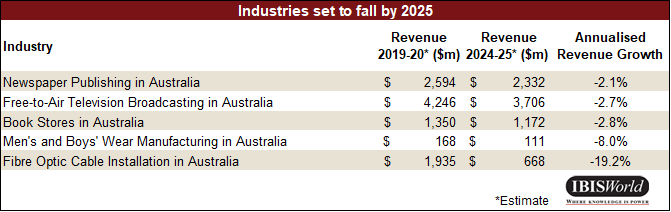

The newspaper industry, free-to-air TV, book stores, men’s clothing and fibre optic cable installation will be in freefall over the next five years, bringing jobs down with it.

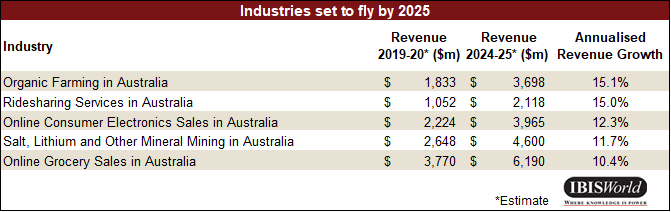

Meanwhile, the sectors of organic farming, ridesharing, online electronics sales, mineral mining and online grocery sales will boom leading up to 2025.

That’s according to global market research firm IBISWorld, which crunched the numbers on which sectors of the economy would rise and fall by 2025. This provides a hint at the industries where job numbers will likely boom or bust.

Related story: These are Australia’s fastest-growing jobs

Related story: The jobs most likely to see a pay rise in 2020

Related story: Australia’s 15 most in-demand job skills – and where to learn them for free

Where jobs will tank

Revenue in newspaper publishing and free-to-air broadcast TV in Australia will decline by $2.3 billion and $3.7 billion respectively by 2025 as people consume content through their smart devices.

“Newspaper publishers, both national and regional, will increasingly transition to digital media over the next decade,” said IBISWorld senior industry analyst Tom Youl.

“Revenue generated from online advertising is far less lucrative than traditional methods of publishing, which will likely to reduce industry profitability over the coming years.”

Bookstores, too, are on their way out, and will see a 2.8 per cent fall in revenue growth - with losses in revenue totalling $1.2 billion by 2025. Physical bookstores were one of the first to fall victim to the retail apocalypse, which has claimed several iconic Australian brands due to rising costs and a thriving e-commerce market.

Angus & Robertson and Borders sent shockwaves through the nation when many of their stores closed in 2011, and Launceston bookstore Birchalls shut its doors in 2017 after 173 years of trading.

Under tough retail conditions, book prices will remain low, according to Youl.

“Opportunities are available for some specialist bookstores that target niche markets, such as specialist language bookshops. These operators offering a dedicated product range are likely to be better positioned to withstand competition,” he said.

The growing demand for ebooks also adds extra pressure to the industry, he added.

Fierce competition and high domestic manufacturing cost will see revenue in the mens’ and boys’ wear manufacturing industry fall by 8 per cent over the next five years, a hit of $111 million all up.

Meanwhile, as the NBN nears the end of its roll-out and is expected to be complete by the end of 2020, the fibre optic cable installation industry will fall at a rate of 33.2 per cent over the next five years, with reduction in revenue totalling $668 million.

Where jobs will soar

On the other end of the spectrum, a growing focus on health, the environment, and the treatment of animals will see demand for organic food products grow.

The organic farming industry is slated to grow by 15.1 per cent, with revenue to jump $3.7 billion by 2025.

“As organic products gain traction among a larger share of the population, demand for a wider range of products is likely to increase,” Youl said.

“Profit across the organic farming product range is significantly higher than their non-organic counterparts. Over the next five years, an increasing supply of organic produce is forecast to place downward pressure on prices.”

As people ditch car ownership in favour of rideshare or car subscription services, that industry is expected to grow 15 per cent over the next five years, or $2.1 billion.

“Additionally, the ridesharing services industry is anticipated to expand throughout Australia’s regional cities, driving revenue growth,” said Youl.

The e-commerce sector will continue to grow, and online consumer electronic sales and online grocery sales industries in particular are projected to grow at 12.3 per cent and 21.6 per cent respectively in the next five years.

Innovation in electronic products and greater efficiency in online grocery shopping will drive growth in these sectors, supported by customer data.

Another sector projected to boom is the mining of salt, lithium and other minerals. This industry is forecast to see 11.6 per cent growth in revenue over the next five years.

This is because lithium is one of the key elements in most batteries – the demand and size for which is expected to grow significantly by 2025.

“The rising adoption of electric vehicles and energy storage infrastructure is forecast to drive demand for lithium, supporting Australian mining activity,” said Youl.

A relatively weak Australian dollar will also help revenue growth, he added.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance