Japanese Yen Unmoved After July CPI Report, Jackson Hole Next

DailyFX.com -

Talking Points

USD/JPY little changed against its major peers after CPI report

Japan’s National CPI -0.4% y/y in July versus -0.4% y/y expected

Fed’s Chair Janet Yellen speech at Jackson Hole remains key event

Showcase your trading skills against your peers in FXCM’s $10,000 Monthly Challenge here.

The Yen was unmoved against its major counterparts after Japan’s CPI report crossed the wires. National prices clocked in at -0.4 percent (YoY) in July versus -0.4 percent expected and -0.4 percent in June. CPI excluding volatile factors such as food and energy climbed 0.3 percent (YoY) versus 0.4% expected and 0.5% prior. Meanwhile, CPI excluding fresh food declined 0.5% (YoY) versus -0.4% expected and -0.4% in June.

Perhaps the minimal response could be explained by recent Bank of Japan price estimates from its July monetary policy announcement. The central bank expects that CPI – less fresh food - will remain slightly negative or 0 percent for the time being. This hints that today’s release may not make stimulus expansion seem any more urgent in the eyes of the central bank.

Looking forward, tomorrow’s Jackson Hole symposium is on the docket. Fed’s Chair Janet Yellen is expected to present a speech that could potentially offer a lifeline for the US Dollar if it appears as though the central bank favors the resumption of stimulus withdrawal in the near term.

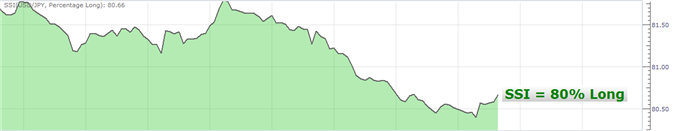

Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing a reading that roughly 80 percent of open speculative retail positions in USD/JPY are long. The SSI is typically a contrarian indicator, implying further USD/JPYweakness ahead.

Want to learn more about the DailyFX SSI indicator? Click here to watch a tutorial.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance