Japanese Yen to Look Past BOJ, Eyeing China CPI and Euro Crisis

Fundamental Forecast for Japanese Yen: Neutral

The Japanese Yen continues to sit firmly on the safe-haven side of the asset spectrum, with the Dow Jones FXCM Yen Index, an average of the currency’s value against its top counterparts, showing a formidable inverse correlation with the MSCI World Stock Index (-0.82 on 20-day percent-change studies). That puts familiar themes – the degree of this year’s slowdown in global economic growth and the severity of the Eurozone debt crisis – front and center once again. A monetary policy announcement from the Bank of Japan is a wildcard.

On the economic growth front, traders will look to a sparse economic calendar for direction cues. Chinese CPI figures are expected to show inflation slowed to an annual pace off 1.7 percent in July, marking the lowest reading since January 2010. Traders may treat the figure as allowing the PBOC some space for added stimulus after the ECB and the Federal Reserve disappointed hopes for further accommodation last week. China is the third-largest engine of global output after the US and the Euro area (taken collectively), so further easing there has scope to boost market-wide risk appetite. A pair of speeches from Fed Chairman Ben Bernanke round out the docket of big-ticket event risk. Murmurs of a QE3 announcement at September’s FOMC meeting are already swirling and traders will look for confirmation in the Fed chief’s comments, though little new guidance is likely to emerge just days after the last rate decision.

Turning to the Eurozone, all eyes are on Spain after Prime Minister Mariano Rajoy took a small step toward asking for a formal bailout at a press conference on Friday, saying he would condition such a decision on the non-standard measures to contain periphery countries’ borrowing costs being planned at the ECB. For his part, ECB President Mario Draghi has clearly started to plant the seeds for the unveiling of some kind of funding-stress relief. Draghi first brought runaway bond yields into the ECB mandate with a speech in London two weeks ago and then alluded to “non-standard policy measures” to be hashed out in the “coming weeks” at the monthly press conference last week. Details remain absent however and traders will keep a close eye on Augusts’ ECB Monthly Report for any additional guidance.

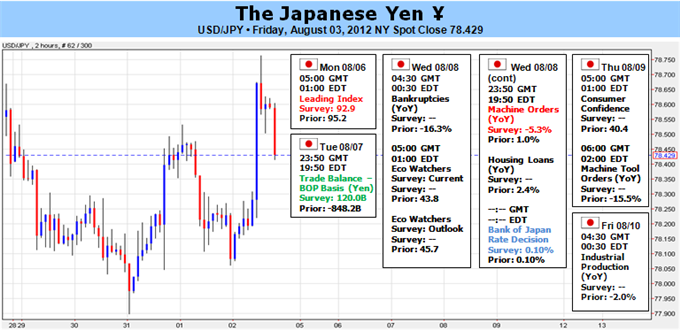

The Bank of Japan monetary policy announcement is expected to be a non-event. BOJ Governor Maasaki Shirakawa and company are widely forecast to keep the policy mix largely unchanged. Further fine-tuning in the bank’s non-standard stimulus programs similar to last month’s reshuffling may emerge, but the relative stability of USDJPY near the 78.00 figure over recent weeks even in the face of major event risk including FOMC downplays the urgency off doing something more substantive near-term. With that in mind, this meeting will mark the first time that new BOJ board members Takehiro Sato and Takahide Kiuchi take part in the policy debate. Both are ardent doves and may begin to press for a more activist BOJ posture given recent disappointments on the economic data front. Their leverage to affect change on the BOJ board remains untested and represents a wildcard.-IS

Yahoo Finance

Yahoo Finance