James Hardie Industries (ASX:JHX) Has Gifted Shareholders With A Fantastic 114% Total Return On Their Investment

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the James Hardie Industries share price has climbed 92% in five years, easily topping the market return of 7.7% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 39% , including dividends .

See our latest analysis for James Hardie Industries

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

James Hardie Industries' earnings per share are down 13% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

In contrast revenue growth of 10% per year is probably viewed as evidence that James Hardie Industries is growing, a real positive. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

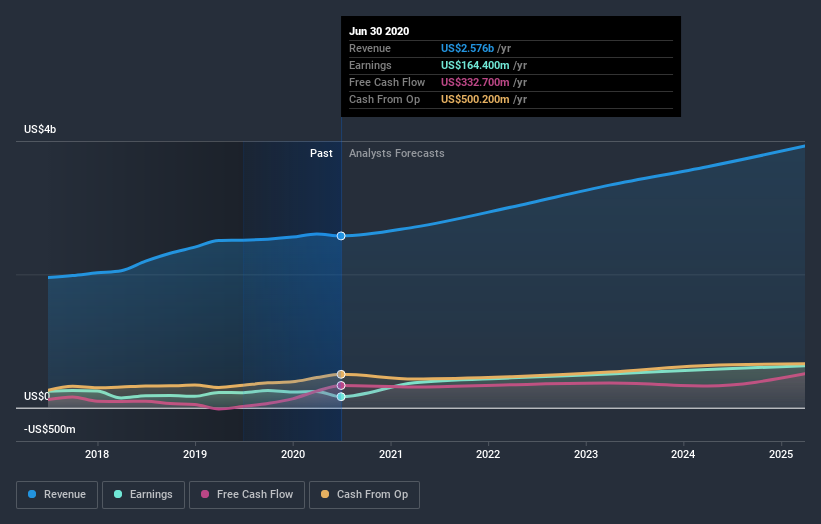

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

James Hardie Industries is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between James Hardie Industries' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. James Hardie Industries' TSR of 114% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that James Hardie Industries has rewarded shareholders with a total shareholder return of 39% in the last twelve months. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand James Hardie Industries better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with James Hardie Industries .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance