ITT's Q2 Earnings and Revenues Surpass Estimates, Up Y/Y

ITT Inc. ITT pulled off a positive earnings surprise of 4.5% in the second quarter of 2019. Quarterly adjusted earnings came in at 93 cents per share, outpacing the Zacks Consensus Estimate of 89 cents. The bottom line also came in 13.4% higher than the year-ago figure.

Revenues totaled $719.9 million, up 3% year over year. The top line also surpassed the consensus estimate by 2.3%. Notably, revenues jumped 5% year over year on an organic basis.

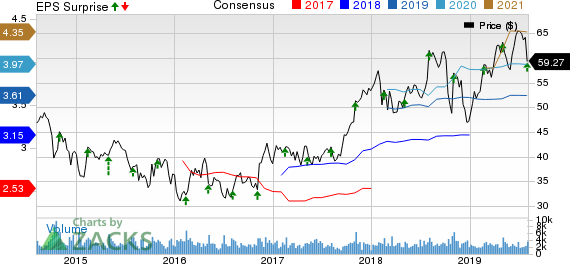

ITT Inc. Price, Consensus and EPS Surprise

ITT Inc. price-consensus-eps-surprise-chart | ITT Inc. Quote

Segmental Breakup

Second-quarter revenues of the company’s Industrial Process segment were $232.6 million, up 14.5% year over year. Organic sales jumped 12.6%, driven by increase in pump projects and strong aftermarket demand in oil and gas, chemical parts and service markets.

Quarterly revenues of the company’s Motion Technologies segment declined 3.8% year over year to $317.7 million. Notably, forex woes had 5.3% adverse impact on sales. Organic sales increased 1.3% in the quarter, mainly on account of global rail share gains and Friction OEM growth, partially offset by softness in the Wolverine business.

Connect & Control Technologies segment generated $170.2 million revenues, up 3.7% year over year. Organic sales increased 4.8%, driven by rise in commercial aerospace connectors and components.

Costs/Margins

Cost of sales in the second quarter was $487.9 million, up 3.6% year over year. Gross profit margin was 32.2%, down 20 basis points (bps).

Sales and marketing expenses were $42.7 million compared with $43.4 million in the year-ago quarter. Operating margin increased 40 bps to 11.9%.

Income tax expenses were $19.3 million, up from $8.9 million.

Balance Sheet/Cash Flow

Exiting the second quarter, ITT had cash and cash equivalents of $531.9 million, down from $561.2 million recorded as of Dec 31, 2018.

In the first six months of 2019, the company generated $101.1 million cash from operating activities, lower than $119.3 million recorded in the year-ago period. Capital expenditure totaled $45.8 million, declining from $46.3 million spent in the first six months of 2018. Adjusted free cash flow was $82.1 million, down from $91 million.

Notable Developments

The company completed the acquisition Rockledge, FL-based Matrix Composites, Inc. for approximately $29 million. This move is in sync with its growth policies.

The buyout will infuse new strength to the Connect and Control Technologies segment’s aerospace product offerings, and help in solidifying its technological capabilities and add 115 skilled people to its employee base. Earnings accretion from the buyout is predicted in the first year.

Outlook

Based on the existing market conditions, the company anticipates total revenue growth of 3-5% for 2019. Also, it continues to anticipate organic revenue growth in the range of 3-5%. Adjusted earnings view for the year has been increased to $3.58-$3.68 per share, reflecting a 5-cent increase to the mid-point from its prior guidance.

Zacks Rank & Key Picks

ITT currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space are Federal Signal Corporation FSS, Danaher Corporation DHR and United Technologies Corporation UTX. While Federal Signal sports a Zacks Rank #1 (Strong Buy), Danaher and United Technologies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Federal Signal delivered average earnings surprise of 16.48% in the trailing four quarters.

Danaher pulled off average positive earnings surprise of 3.25% in the trailing four quarters.

United Technologies delivered average earnings surprise of 13.19% in the trailing four quarters.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Technologies Corporation (UTX) : Free Stock Analysis Report

Federal Signal Corporation (FSS) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

ITT Inc. (ITT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance