Itron Inc (ITRI) Surpasses Analyst Expectations with Strong Q1 2024 Performance

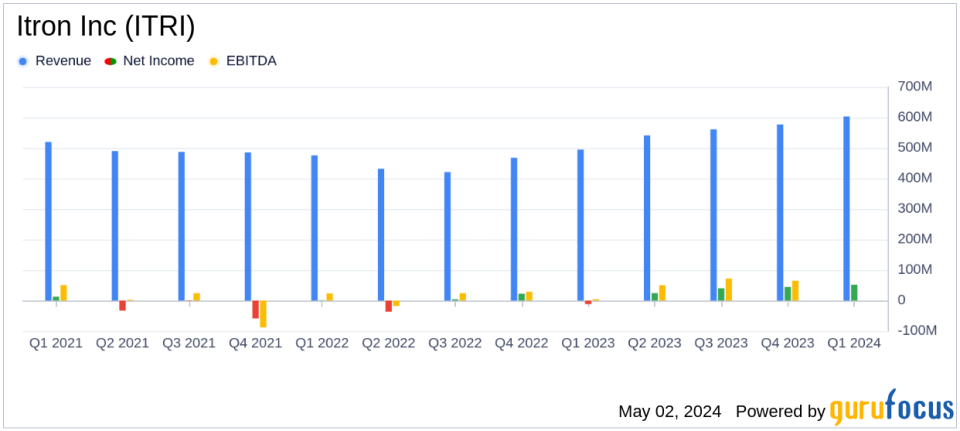

Revenue: $603 million, up 22% year-over-year, surpassing estimates of $579.49 million.

Net Income: $52 million, a significant increase from a net loss of $12 million in the previous year, exceeding estimates of $38.32 million.

Earnings Per Share (EPS): GAAP diluted EPS of $1.12, a substantial increase from $(0.26) last year, surpassing the estimated $0.84.

Gross Margin: Increased to 34.0% from 31.6% in the prior year, indicating improved operational efficiency.

Free Cash Flow: $34 million, a notable improvement from $(5) million in the previous year, reflecting stronger earnings and cash management.

Adjusted EBITDA: $76 million, nearly doubling from $39.468 million last year, highlighting significant operational gains.

Outlook for Q2 2024: Revenue expected between $595 million and $605 million with Non-GAAP diluted EPS between $0.90 and $1.00.

Itron Inc (NASDAQ:ITRI) released its 8-K filing on May 2, 2024, announcing robust financial results for the first quarter ended March 31, 2024. The company reported significant improvements across key financial metrics, notably surpassing analyst expectations with a quarterly revenue of $603 million against the estimated $579.49 million. This represents a 22% increase compared to the first quarter of 2023.

Itron Inc, a leader in innovative solutions for energy and water management, operates through three segments: Device Solutions, Networked Solutions, and Outcomes. These segments collectively contribute to the company's mission of enhancing utility management and sustainability.

Financial Highlights and Operational Success

The company's gross profit surged by 31% to $205 million, and its GAAP net income saw a dramatic turnaround from a loss of $12 million in Q1 2023 to a gain of $52 million in Q1 2024. Earnings per share (EPS) also reflected this positive shift, with GAAP diluted EPS increasing from $(0.26) to $1.12 and Non-GAAP diluted EPS rising from $0.49 to $1.24. This performance was driven by strong sales in the Networked Solutions and Device Solutions segments, alongside heightened activity in the Outcomes segment.

Operational efficiencies and a favorable product mix contributed to an improved gross margin of 34.0%, up from 31.6% in the previous year. Itron's operational expenses on a GAAP basis decreased by $24 million, further bolstering the company's financial position.

Challenges and Strategic Initiatives

Despite the positive outcomes, Itron faces ongoing challenges, including market competition and the need to continuously innovate. The company's strategic focus on deploying its Grid Edge Intelligence platform illustrates its proactive approach to these challenges, aiming to reduce complexity and enhance customer success in managing energy and water resources.

Looking Ahead: Q2 2024 Outlook

For the second quarter of 2024, Itron anticipates revenue to be between $595 million and $605 million, with Non-GAAP diluted EPS expected to range from $0.90 to $1.00. This guidance reflects the company's confidence in maintaining its growth trajectory amidst dynamic market conditions.

Conclusion

Itron's first-quarter results not only demonstrate a significant recovery but also highlight the effectiveness of its strategic initiatives and operational focus. With a solid financial foundation and a clear vision for the future, Itron is well-positioned to continue its growth and leadership in the energy and water management industry.

For detailed insights and further information, investors and interested parties are encouraged to access the full earnings report and listen to the webcast of the earnings conference call on Itron's Investor Relations website.

Explore the complete 8-K earnings release (here) from Itron Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance