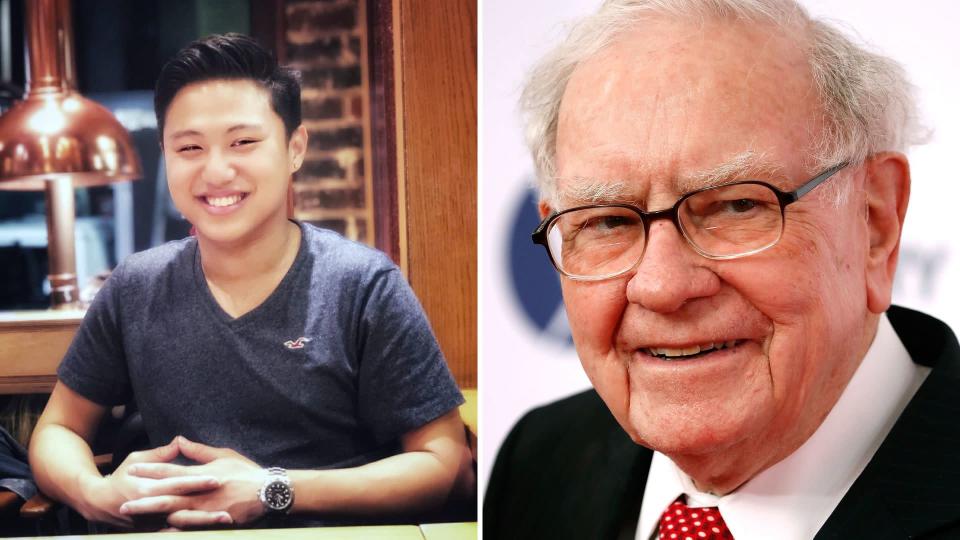

Is this Australian student the next Warren Buffett?

Alan Ng could probably consider a career change, if he wanted to.

Currently a medical student, he’d likely be able to also carve out a stratospheric career in finance after achieving a total return of 36.39 per cent during a six-week trading competition, which he also – not surprisingly – won.

It’s the kind of return that makes you look twice, and it’s what’s led the hosts of the Equity Mates podcast, which hosted the competition, to describe Ng as Australia’s Warren Buffett.

What did he trade?

The competition among 500 university students asked students to invest at least $50 of their own money over a six-week period in the US stock market, with the prize a trip to New York City.

Ng’s trades through the competition were in these names:

1. Qualcomm +61.07%

2. VelocityShares 3x Inverse Natural Gas +25.57%

3. VelocityShares 3x Long Natural Gas ETN -26.59%

How did he do it?

The average return among competitors was 4.46 per cent, with Ng attributing his success to two rules.

Don’t be greedy

Follow your own rules.

“During the process, I think the biggest lesson would be to always follow the rules that you have set before you get into trade,” Ng told Yahoo Finance.

He realised that it was natural to want to make big profits over the short term - especially during a six week competition. But these attitudes can also lead to failure.

“When [a trade] actually goes well, I try to set a stop loss… so that I can actually take in the profit if anything goes wrong, so I’ll end the day in the green anyway.”

Ng said trading stocks with slightly larger profit margins increased profit potential, but that it largely came back to building on smaller daily successes.

Related story: Warren Buffett: I've made bigger mistakes than not investing in Amazon

Related story: WATCH: Warren Buffett speaks, the world will listen

Related story: The 8 money mistakes that even millionaires make

“Obviously I also have a target for myself, but then I feel like it’s really important to just try to be profitable [in the] long term,” he explained.

“When my friends are trading I also recommend them to not focus on the shorter term but to perform well, to try not to make any mistakes with their trades, so that long term they’re profitable.”

Ng also said listening to podcasts and reading material was also critical, and led to his decision to trade Qualcomm - the trade he attributes most to his huge return.

The medicine student also relied on a set of indicators like whether a stock was oversold, if it was going to have a reversal, whether the stock was going up and just how much the stock fluctuated.

He said for long-term investors, large cap companies were generally more predictable and a surer bet.

Can I do it?

A common barrier to trading is a belief that financial nous, or a Buffett-sized brain is necessary.

But, says Ng, trading is for everyone. It’s just a matter of jumping in and learning on the go. He said he began trading a year before the competition, slowly growing in confidence as he read, listened, analysed and learnt.

“You can start with $50 or even less and try to start trading,” Ng said.

“Because when you have your method, when you practice your method and it's profitable, then no matter how much money you put in, you'll be making profits.

“If you are able to do the basic things well, you will be trading well.”

Warren Buffett will deliver an address at Berkshire Hathaway’s annual shareholder meeting on Saturday. Yahoo Finance has exclusive streaming rights. We have the details here.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance