Iovance (IOVA) Posts Narrower-Than-Expected Loss in Q1

Iovance Biotherapeutics, Inc. IOVA incurred a loss of 50 cents per share in first-quarter 2023, narrower than the Zacks Consensus Estimate and our model estimate of a loss of 84 cents and $1.46 per share, respectively. In the year-ago quarter, the company reported a loss of 58 cents.

Without any marketed product and revenue-generating collaboration, the company did not record any revenues during the quarter.

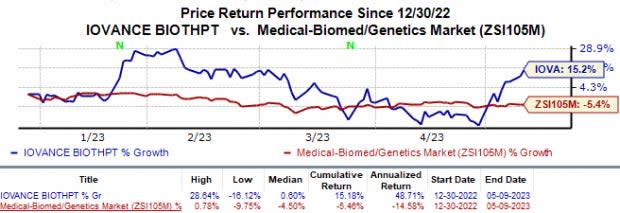

Shares of Iovance have gained 15.2% in the year-to-date period against the industry’s 5.4% fall.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development expenses were $82.7 million, up 21.1% from the year-ago quarter’s levels, primarily due to increased related personnel costs and facility building costs.

General and administrative expenses increased 20.1% from the prior-year quarter’s figure to $28.1 million due to an increase in related personnel costs and fees to support the Proleukin acquisition.

The company had $632.7 million in cash, cash equivalents, short-term investments and restricted cash as of Mar 31, 2023, compared with $478.3 million on Dec 31, 2022. During the quarter, Iovance raised $260.1 in net proceeds from ATM equity financing. Based on the cash position, management expects to fund the company’s current and planned operations in second-half 2024.

Proleukin Acquisition

In January, Iovance entered into an in-licensing agreement with U.K.-based Clinigen Limited for the latter’s interleukin-2 (IL-2) product, Proleukin (aldesleukin). Per the terms of the agreement, the company will acquire worldwide rights to this drug. Currently, Proleukin is approved by the FDA for treating two cancer indications in adults — metastatic renal cell carcinoma (mRCC) and metastatic melanoma.

In consideration of these rights, Clinigen will get an upfront payment of £166.7 million from Iovance and will be eligible to receive double-digit royalties on global Proleukin sales. The transaction is expected to close in second-quarter 2023.

Pipeline Updates

Iovance is developing its lead pipeline candidate, lifileucel, as a monotherapy for treating metastatic melanoma and metastatic cervical cancer in separate pivotal phase II studies — C-144-01 and C-145-04 — for metastatic melanoma and recurrent, metastatic or persistent cervical cancer, respectively, in previously-treated patients.

This March, Iovance completed the rolling biologics license application (BLA) submission for lifileucel in melanoma indication. The filing is based on data from cohorts 2 and 4 of the phase II C-144-01 study, which evaluated lifileucel in patients with post-anti-PD1 melanoma. Overall data from these cohorts shows that treatment with lifileucel achieved an objective response rate (ORR) of 31%, with the median duration of the response still not reached at 36.5 months. If the BLA is approved, lifileucel will be the first FDA-approved individualized, one-time cell therapy for melanoma patients. It will also be Iovance’s first-ever therapy to receive FDA approval.

Iovance recently started site activations for the phase III TILVANCE-301 study, to evaluate the combination of lifileucel and Merck’s MRK PD-L1 inhibitor, Keytruda (pembrolizumab) in frontline advanced melanoma. This late-stage study will also serve as a confirmatory study for the pivotal Cohort 4 of the C-144-01 study.

Other than lifileucel, Iovance is also evaluating another TIL therapy, LN-145, as a potential treatment for head and neck squamous cell carcinoma (HNSCC) and non-small cell lung cancer (NSCLC) in two separate mid-stage studies, C-145-01 and IOV-LUN-202, respectively. Management is currently in discussion with the FDA to determine if IOV-LUN-202 can serve as a registrational study for LN-145 to address second/third line metastatic NSCLC.

Another ongoing phase II study, IOV-COM-202, which is composed of seven cohorts is evaluating Iovance’s TIL therapies in multiple settings and for several indications, both as a monotherapy and in combination with Merck’s Keytruda or Bristol Myers’ Opdivo/Yervoy.

In January, management reported positive data from cohort 3A of the IOV-COM-202 study, which evaluated LN-145 plus Merck’s Keytruda in anti-PD-1 naïve metastatic NSCLC. Data from this cohort demonstrated an ORR of 47%. Management plans to discuss these results with the FDA later this year as well as plans to start a registrational study evaluating lifileucel in frontline advanced NSCLC.

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank & Stocks to Consider

Iovance currently has a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include Allogene Therapeutics ALLO and Athira Pharma ATHA, each carrying a Zacks Ranks #2 (Buy) at present. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

In the past 60 days, the estimate for Allogene’s 2023 loss per share has improved from $2.56 to $2.31. During the same period, the loss estimate per share for 2024 has narrowed from $2.53 to $2.20. In the year so far, the shares of Allogene have fallen 1.0%.

Allogene Therapeutics beat earnings estimates in three of the last four quarters, while missing the mark on one occasion. On average, the company’s earnings witnessed an earnings surprise of 5.08%. In the last reported quarter, ALLO delivered an earnings surprise of 7.94%.

In the past 60 days, the estimate for Athira’s 2023 loss per share has improved from $2.88 to $2.64. During the same period, the loss estimate per share for 2024 has narrowed from $5.22 to $4.76. In the year so far, the shares of Athira have lost 10.1%.

Athira Pharma beat earnings estimates in three of the last four quarters, while missing the mark on one occasion. On average, the company’s earnings witnessed an earnings surprise of 5.17%. In the last reported quarter, ATHA delivered an earnings surprise of 12.86%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Iovance Biotherapeutics, Inc. (IOVA) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Athira Pharma, Inc. (ATHA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance