Investors Give Evolva Holding SA (VTX:EVE) Shares A 81% Hiding

The Evolva Holding SA (VTX:EVE) share price has fared very poorly over the last month, falling by a substantial 81%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 96% loss during that time.

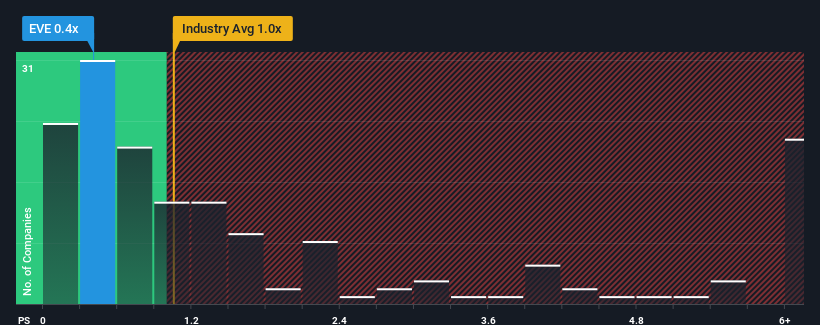

Since its price has dipped substantially, given close to half the companies in Switzerland's Chemicals industry have price-to-sales ratios (or "P/S") above 4x, you may consider Evolva Holding as a highly attractive investment with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Evolva Holding

How Has Evolva Holding Performed Recently?

There hasn't been much to differentiate Evolva Holding's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Evolva Holding will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Evolva Holding will help you uncover what's on the horizon.

Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Evolva Holding would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 29% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 83% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 4.6%, which is noticeably less attractive.

With this information, we find it odd that Evolva Holding is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Evolva Holding's P/S?

Shares in Evolva Holding have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Evolva Holding's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 5 warning signs for Evolva Holding (4 are a bit concerning!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance