Should Investors Consider These 3 Low-Beta Stocks?

A hawkish Federal Reserve has been a thorn in the side of many stocks in 2022, causing widespread volatility. Other than energy, the market landscape has been dim.

During times of heightened volatility, adding low-beta stocks can help blend in an extra layer of portfolio defense.

Stocks with a beta of less than 1.0 are less volatile than the general market, and the opposite is also true – stocks with a beta of higher than 1.0 are more volatile than the general market.

Three low-beta stocks – Merck & Co, Inc. MRK, The J M Smucker Company SJM, and General Mills, Inc. GIS – could all be considered during a volatile market.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

Merck & Co, Inc.

Merck is a global healthcare company that delivers innovative health solutions through prescription medicines, vaccines, biologic therapies, and animal health products.

The company has witnessed positive earnings estimate revisions over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

For those that like income, MRK has that covered – the company’s annual dividend currently yields a solid 2.5%, well above that of its Zacks Medical sector average.

Further, the company has shown a commitment to its shareholders, increasing its dividend seven times over the last five years, translating to a 9% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

The J M Smucker Company

The J.M. Smucker Company is a leading marketer and manufacturer of consumer food and beverage products and pet food and pet snacks in North America. The company sports a favorable Zacks Rank #2 (Buy).

Analysts have upped their earnings outlook across most timeframes over the last several months.

Image Source: Zacks Investment Research

Additionally, SJM rewards its shareholders via its annual dividend that currently yields roughly 2.7%, a tick above that of its Zacks Consumer Staples sector.

Like MRK, the company has shown a commitment to increasingly rewarding its shareholders, upping its dividend payout five times over the last five years.

Image Source: Zacks Investment Research

General Mills, Inc

General Mills is a global manufacturer and marketer of branded consumer foods sold through retail stores. We see their products on nearly every shelf.

GIS’ earnings outlook has turned positive over the last several months regarding its current and next fiscal year, helping push the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

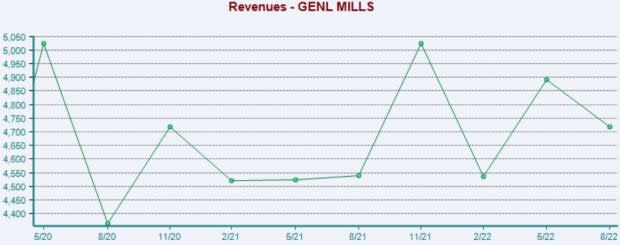

GIS carries an impressive earnings track record, exceeding EPS estimates in three consecutive quarters.

Just in its latest print, the company registered a solid 11% EPS beat paired with a 1% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

With volatility rocking the market back and forth in 2022, considering low-beta stocks could prove to be a successful approach.

Low-beta stocks are generally less volatile than the general market, providing a nice shield for investors.

All three stocks above – Merck & Co, Inc. MRK, The J M Smucker Company SJM, and General Mills, Inc. GIS – are classified as low-beta.

Further, all three carry a favorable Zacks Rank, indicating that analysts have a positive view on their near-term business outlook.

And for the cherry on top, all three have outperformed the general market in 2022, indicating positive momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance