Investors Who Bought Urbanise.com (ASX:UBN) Shares Five Years Ago Are Now Down 96%

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Anyone who held Urbanise.com Limited (ASX:UBN) for five years would be nursing their metaphorical wounds since the share price dropped 96% in that time. But it's up 6.3% in the last week. The buoyant market could have helped drive the share price pop, since stocks are up 2.9% in the same period.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Urbanise.com

Given that Urbanise.com didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

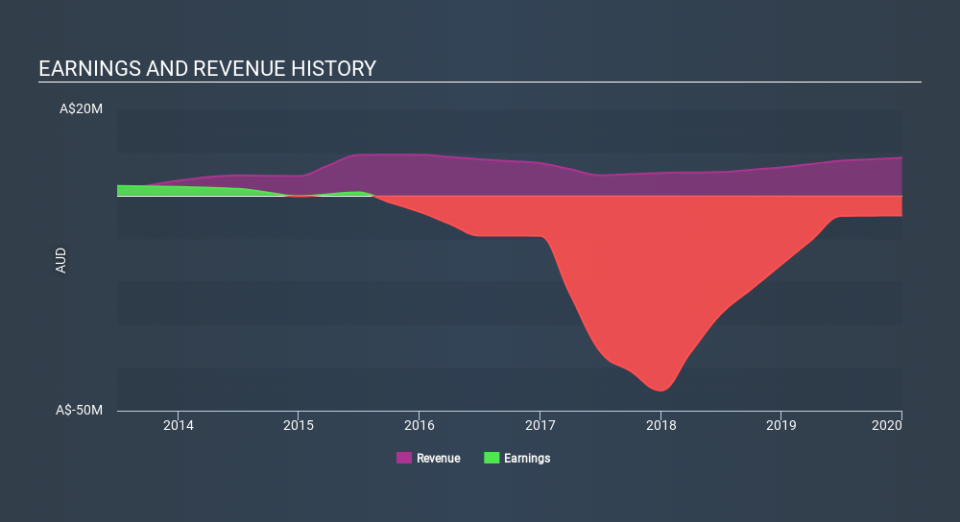

Over half a decade Urbanise.com reduced its trailing twelve month revenue by 2.1% for each year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 47% each year in that time. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We've already covered Urbanise.com's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Urbanise.com hasn't been paying dividends, but its TSR of -96% exceeds its share price return of -96%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Urbanise.com shareholders have received a total shareholder return of 46% over one year. Notably the five-year annualised TSR loss of 46% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Urbanise.com better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Urbanise.com (at least 2 which can't be ignored) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance