Investors Who Bought Iridium Communications (NASDAQ:IRDM) Shares Three Years Ago Are Now Up 202%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. To wit, the Iridium Communications Inc. (NASDAQ:IRDM) share price has flown 202% in the last three years. That sort of return is as solid as granite. In more good news, the share price has risen -0.3% in thirty days.

View our latest analysis for Iridium Communications

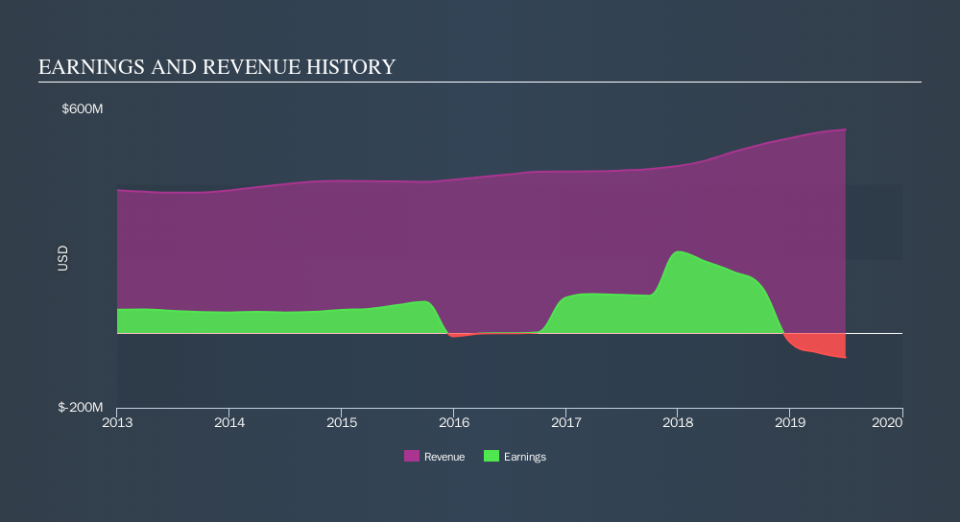

Iridium Communications isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years Iridium Communications has grown its revenue at 9.1% annually. That's a very respectable growth rate. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 44% per year over three years. The business has made good progress on the top line, but the market is extrapolating the growth. Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Iridium Communications stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Iridium Communications has rewarded shareholders with a total shareholder return of 19% in the last twelve months. Having said that, the five-year TSR of 21% a year, is even better. Before spending more time on Iridium Communications it might be wise to click here to see if insiders have been buying or selling shares.

Of course Iridium Communications may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance