Investors Who Bought eSense-Lab (ASX:ESE) Shares A Year Ago Are Now Down 67%

eSense-Lab Limited (ASX:ESE) shareholders should be happy to see the share price up 21% in the last quarter. But that doesn't change the fact that the returns over the last year have been disappointing. Like a receding glacier in a warming world, the share price has melted 67% in that period. Some might say the recent bounce is to be expected after such a bad drop. You could argue that the sell-off was too severe.

See our latest analysis for eSense-Lab

eSense-Lab recorded just US$27,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that eSense-Lab comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some eSense-Lab investors have already had a taste of the bitterness stocks like this can leave in the mouth.

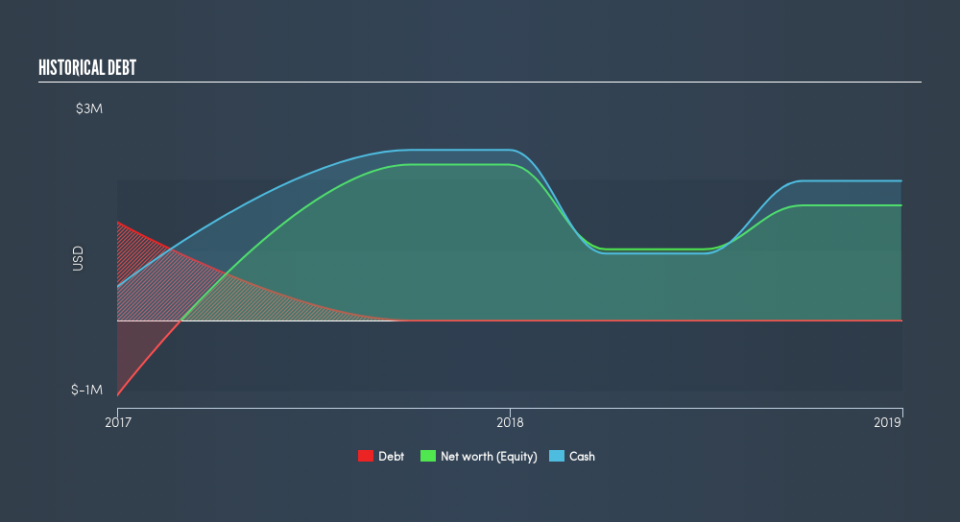

eSense-Lab had cash in excess of all liabilities of just US$1.5m when it last reported (December 2018). So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. That probably explains why the share price is down 67% in the last year. You can click on the image below to see (in greater detail) how eSense-Lab's cash levels have changed over time. You can see in the image below, how eSense-Lab's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

Given that the market gained 7.1% in the last year, eSense-Lab shareholders might be miffed that they lost 67%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 21% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like eSense-Lab better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance