Investors Who Bought Epizyme (NASDAQ:EPZM) Shares Three Years Ago Are Now Up 81%

One simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks, you could make more than that. For example, Epizyme, Inc. (NASDAQ:EPZM) shareholders have seen the share price rise 81% over three years, well in excess of the market return (40%, not including dividends).

View our latest analysis for Epizyme

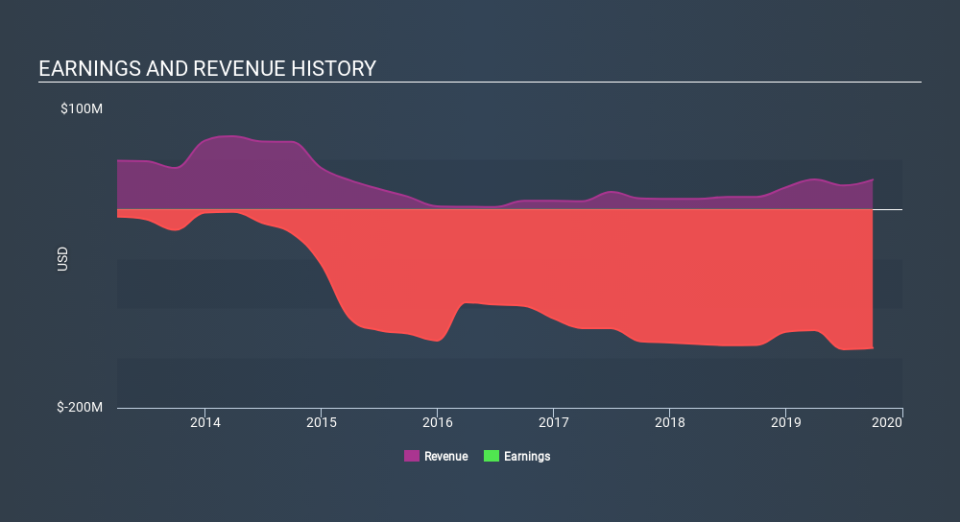

Epizyme isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Epizyme saw its revenue grow at 45% per year. That's much better than most loss-making companies. While the compound gain of 22% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. So now might be the perfect time to put Epizyme on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Epizyme has rewarded shareholders with a total shareholder return of 76% in the last twelve months. Notably the five-year annualised TSR loss of 1.8% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 3 warning signs we've spotted with Epizyme .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance