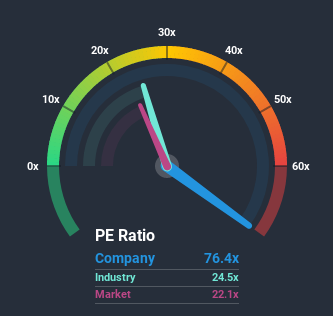

Investor Optimism Abounds Chorus Limited (NZSE:CNU) But Growth Is Lacking

With a price-to-earnings (or "P/E") ratio of 76.4x Chorus Limited (NZSE:CNU) may be sending very bearish signals at the moment, given that almost half of all companies in New Zealand have P/E ratios under 22x and even P/E's lower than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Chorus has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chorus

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Chorus.

How Is Chorus' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Chorus' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.9%. The last three years don't look nice either as the company has shrunk EPS by 58% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 10% per year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the market is forecast to expand by 9.4% per annum, which is not materially different.

With this information, we find it interesting that Chorus is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Chorus currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Chorus that you should be aware of.

If these risks are making you reconsider your opinion on Chorus, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance