Introducing Mediland Pharm (ASX:MPH), The Stock That Dropped 35% In The Last Year

It's nice to see the Mediland Pharm Limited (ASX:MPH) share price up 11% in a week. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 35% in the last year, significantly under-performing the market.

See our latest analysis for Mediland Pharm

Mediland Pharm wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, Mediland Pharm increased its revenue by 13%. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 35% in a year. It's important not to lose sight of the fact that profitless companies must grow. So remember, if you buy a profitless company then you risk being a profitless investor.

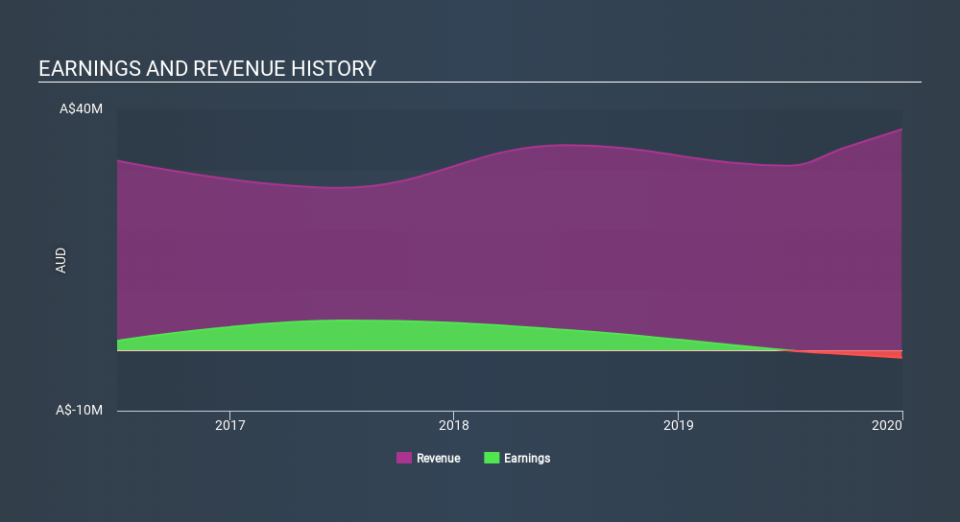

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Mediland Pharm's earnings, revenue and cash flow.

A Different Perspective

Mediland Pharm shareholders are down 35% for the year, even worse than the market loss of 19%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Notably, the loss over the last year isn't as bad as the 42% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Mediland Pharm (at least 2 which are significant) , and understanding them should be part of your investment process.

But note: Mediland Pharm may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance