Introducing Eden Innovations (ASX:EDE), The Stock That Zoomed 140% In The Last Five Years

It certainly might concern Eden Innovations Ltd (ASX:EDE) shareholders to see the share price down 41% in just 30 days. But that doesn't change the fact that the returns over the last five years have been very strong. It's fair to say most would be happy with 140% the gain in that time. We think it's more important to dwell on the long term returns than the short term returns. The more important question is whether the stock is too cheap or too expensive today. While the returns over the last 5 years have been good, we do feel sorry for those shareholders who haven't held shares that long, because the share price is down 92% in the last three years.

View our latest analysis for Eden Innovations

With just AU$2,068,214 worth of revenue in twelve months, we don't think the market considers Eden Innovations to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that Eden Innovations will discover or develop fossil fuel before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Eden Innovations has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

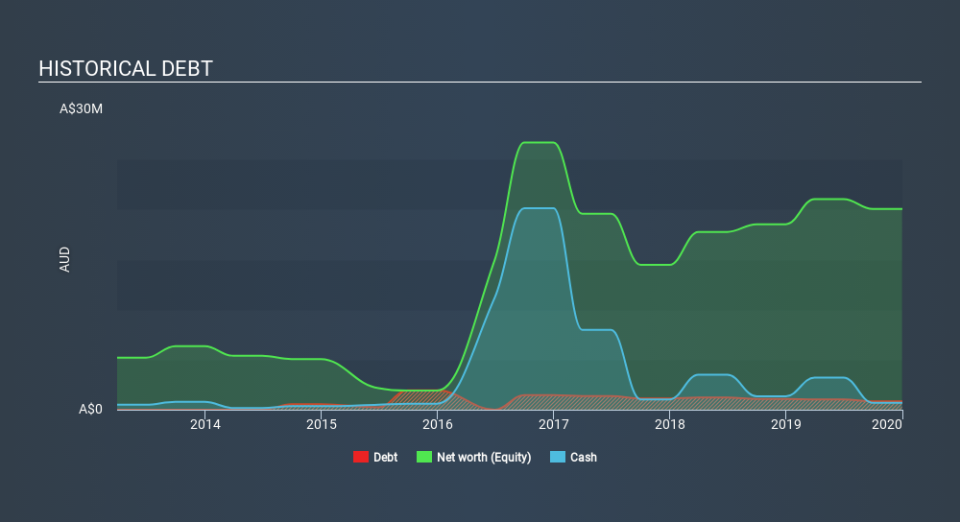

Eden Innovations had liabilities exceeding cash by AU$1.0m when it last reported in December 2019, according to our data. That puts it in the highest risk category, according to our analysis. So the fact that the stock is up 87% per year, over 5 years shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. The image below shows how Eden Innovations's balance sheet has changed over time; if you want to see the precise values, simply click on the image. You can see in the image below, how Eden Innovations's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

We regret to report that Eden Innovations shareholders are down 47% for the year. Unfortunately, that's worse than the broader market decline of 7.8%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 19%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 7 warning signs with Eden Innovations (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance