Introducing eCargo Holdings (ASX:ECG), The Stock That Tanked 74%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's not possible to invest over long periods without making some bad investments. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of eCargo Holdings Limited (ASX:ECG) investors who have held the stock for three years as it declined a whopping 74%. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 46% in the last year. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days.

View our latest analysis for eCargo Holdings

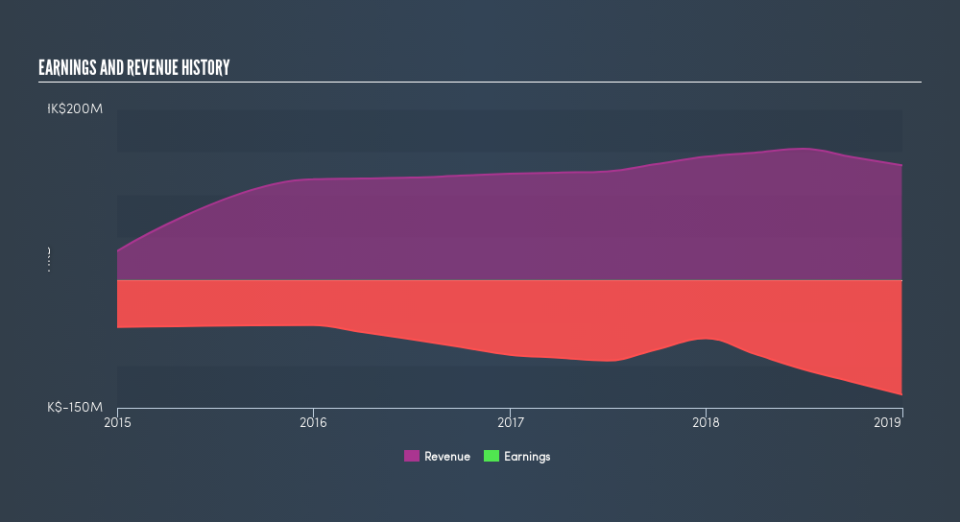

Given that eCargo Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, eCargo Holdings saw its revenue grow by 8.1% per year, compound. That's a fairly respectable growth rate. So it seems unlikely the 36% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year, eCargo Holdings shareholders took a loss of 46%. In contrast the market gained about 8.8%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 36% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. You could get a better understanding of eCargo Holdings's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like eCargo Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance