Introducing APN Convenience Retail REIT (ASX:AQR), A Stock That Climbed 11% In The Last Year

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the APN Convenience Retail REIT (ASX:AQR) share price is 11% higher than it was a year ago, much better than the market return of around 1.2% (not including dividends) in the same period. That's a solid performance by our standards! APN Convenience Retail REIT hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for APN Convenience Retail REIT

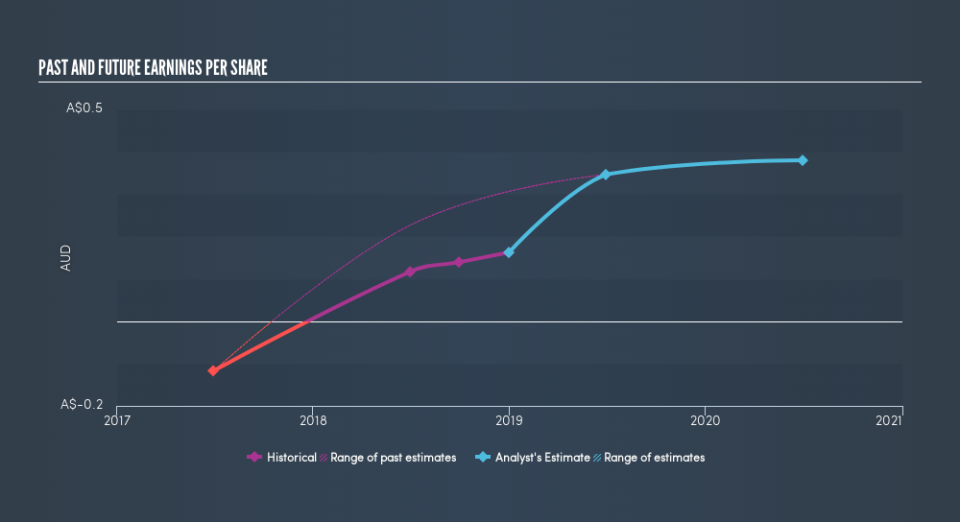

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year APN Convenience Retail REIT saw its earnings per share (EPS) increase strongly. While that particular rate of growth is unlikely to be sustained for long, it is still remarkable. So we'd expect to see the share price higher. We're real advocates of letting inflection points like this guide our research as stock pickers.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that APN Convenience Retail REIT has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for APN Convenience Retail REIT the TSR over the last year was 20%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that APN Convenience Retail REIT shareholders have gained 20% over the last year, including dividends. The more recent returns haven't been as impressive as the longer term returns, coming in at just 3.4%. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). If you would like to research APN Convenience Retail REIT in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance