Intevac Inc (IVAC) Q1 2024 Earnings: Revenue Declines But Losses Narrow, Surpassing Analyst ...

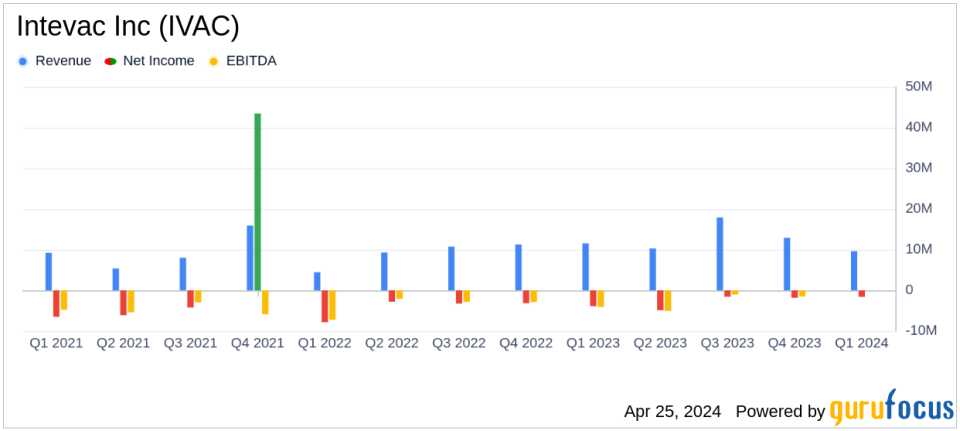

Revenue: Reported at $9.6 million, falling short of the estimated $10 million, and down from $11.5 million in the same quarter the previous year.

Net Loss: Recorded at $1.6 million, significantly better than the estimated loss of $4.62 million and an improvement from a net loss of $3.9 million in Q1 2023.

Earnings Per Share (EPS): Reported at -$0.06, surpassing the estimated -$0.17, and an improvement from -$0.15 in the same quarter last year.

Gross Margin: Improved to 43.7% from 40.9% year-over-year, indicating more efficient cost management.

Operating Expenses: Decreased to $8.7 million from $9.2 million in Q1 2023, reflecting ongoing cost control measures.

Order Backlog: Stood at $53.1 million as of March 30, 2024, down from $120.7 million on April 1, 2023, but up from $42.4 million at the end of the previous quarter.

Cash Position: Ended the quarter with $65.5 million in total cash, cash equivalents, restricted cash, and investments.

On April 25, 2024, Intevac Inc (NASDAQ:IVAC) disclosed its financial results for the first quarter ended March 30, 2024, through its 8-K filing. The company, a pioneer in designing and developing high-productivity, thin-film processing systems, reported a revenue of $9.6 million. This figure falls below the analyst's estimate of $6.5 million for the quarter, showcasing a stronger performance than anticipated despite a year-over-year decline from $11.5 million.

Intevac's net loss for the quarter was significantly reduced to $1.6 million, or $0.06 per diluted share, from a net loss of $3.9 million, or $0.15 per diluted share, in the first quarter of 2023. This improvement in net loss also surpassed the estimated loss per share of $0.17, indicating a more robust financial control and operational efficiency than market expectations.

Company Overview

Founded in 1991 and headquartered in Santa Clara, California, Intevac Inc has been instrumental in the hard disk drive (HDD) industry and is expanding its expertise into the display cover panel market with its innovative TRIO platform. The majority of its revenue is generated from Asia, reflecting its strong presence in high-volume manufacturing environments.

Operational Highlights and Strategic Focus

During the quarter, Intevac emphasized its strategic role within the HDD ecosystem, with significant sales stemming from HAMR technology upgrades. President and CEO Nigel Hunton highlighted the expansion of HAMR technology to multiple HDD customers, which is expected to bolster the HDD business segment in the coming years. Additionally, the shipment of the first TRIO system marks a pivotal step in addressing the consumer electronics market, potentially driving future revenue growth.

The company's operational focus was also evident in its improved gross margin, which increased to 43.7% from 40.9% in the prior-year period. This enhancement reflects better cost management and operational efficiency. Operating expenses were reduced to $8.7 million from $9.2 million, further supporting the reduced operating loss of $4.4 million, nearly consistent with the previous year.

Financial Position and Market Challenges

Intevac concluded the quarter with a strong balance sheet, having $65.5 million in total cash, cash equivalents, restricted cash, and investments. The order backlog stood at $53.1 million, although down from $120.7 million a year ago, it showed improvement from $42.4 million at the end of 2023. This backlog does not include any 200 Lean HDD systems, which were a part of the previous year's backlog.

Despite these positives, Intevac faces ongoing global macroeconomic uncertainties and supply chain challenges that could impact its operational and financial performance. These include potential shipment delays and changes in market dynamics that could affect system and upgrade deliveries.

Conclusion

Intevac's first quarter of 2024 reflects a company navigating through industry challenges with strategic focus and operational improvements. While revenue has seen a decline, the significant reduction in losses and better-than-expected financial metrics highlight the company's resilience and potential for future growth, particularly with its strategic investments in HDD technologies and the introduction of the TRIO platform. Investors and stakeholders may look forward to how these initiatives unfold in enhancing Intevac's market position and financial health in upcoming quarters.

Explore the complete 8-K earnings release (here) from Intevac Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance