Interpublic's (IPG) Q1 Earnings Surpass Estimates, Revenues Miss

The Interpublic Group of Companies, Inc.’s (IPG) first-quarter 2023 earnings beat the Zacks Consensus Estimate but revenues missed the same.

Adjusted earnings (considering 5 cents from non-recurring items) came in at 38 cents per share, beating the Zacks Consensus Estimate and our estimate by 22.6% but declined 19.2% on a year-over-year basis.

Net revenues of $2.18 billion missed the consensus estimate by 0.9% and our estimate by 1.4% and decreased 15.2% on a year-over-year basis. Total revenues of $2.52 billion decreased 1.9% year over year.

Shares of IPG have gained 7.5% in the past year against its industry’s 5.9% decrease.

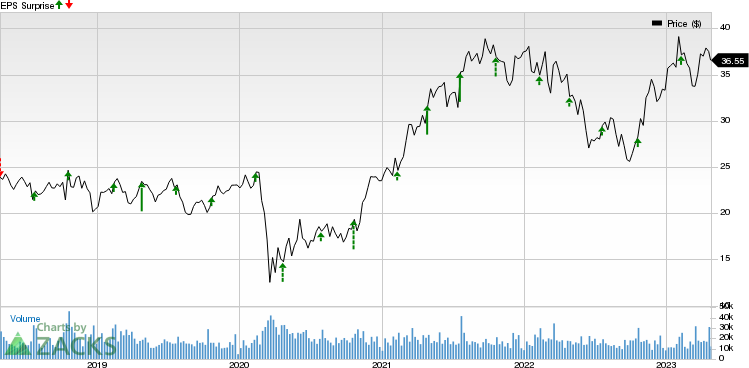

Interpublic Group of Companies, Inc. (The) Price and EPS Surprise

Interpublic Group of Companies, Inc. (The) price-eps-surprise | Interpublic Group of Companies, Inc. (The) Quote

Operating Results

The operating income in the quarter came in at $188.3 million, down 23.4% from the prior-year quarter’s levels. The operating margin on net revenues decreased to 8.7% from 11% in the year-ago quarter. The operating margin on total revenues also decreased to 7.5% from 9.6% in the year-ago quarter.

Adjusted EBITA came in at $209.2 million, decreasing 21.6% from the prior-year quarter’s level. Adjusted EBITA margin on net revenues declined to 9.6% from 12% in the year-ago quarter. The same on total revenues jumped to 8.3% from 10.4% in the year-ago quarter. Total operating expenses of $2.33 billion decreased 0.4% year over year.

Balance Sheet & Cash Flow

As of Mar 31, 2023, Interpublic had cash and cash equivalents of $1.68 billion, down from $2.55 billion held a quarter ago. Total debt was $2.90 billion, reduced from the $2.92 billion reported at the end of the previous quarter.

For the first quarter of 2023, IPG repurchased 2.2 million shares at an average cost of $35.5 per share, totaling $77.8 million including fees. In the reported quarter, IPG declared and paid out a common stock cash dividend of 31 cents per share to a total of $123.2 million.

2023 Guidance

The company expects organic net revenues to grow at around 2-4%.

The adjusted EBITA margin is expected to be 16.7%.

Currently, Interpublic carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Earnings Snapshot

Equifax EFX reported better-than-expected first-quarter 2023 results. Adjusted earnings (excluding 52 cents from non-recurring items) came in at $1.43, beating the Zacks Consensus Estimate by 4.4% but declining 35.6% from the year-ago figure. Total revenues of $1.3 billion surpassed the consensus estimate by 1.5% but decreased 4.5% on a reported basis from the year-ago figure. The top line was down 3% on a local currency basis.

Omnicom OMC reported better-than-expected first-quarter 2023 results. OMC’s earnings of $1.56 per share beat the Zacks Consensus Estimate by 13% and our estimates by 11.4%. Earnings per share increased 12.2% year over year. Total revenues of $3.4 billion surpassed the consensus estimate by 2.3% and our estimate by 1.4%. The top line increased 1% year over year.

Fiserv, Inc. FISV reported impressive first-quarter 2023 results, wherein earnings and revenues beat the Zacks Consensus Estimate. Adjusted earnings per share (excluding 69 cents from non-recurring items) of $1.58 increased 12.9% year over year, beating the consensus mark by 1.3%. Earnings beat our estimate by 2.6%. Adjusted revenues of $4.28 billion beat the Zacks Consensus Estimate by 3% and increased 9.5% year over year. Revenues surpassed our estimates by 4.65%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Fiserv, Inc. (FISV) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance