Interest rate cuts could switch ‘from stroll to a sprint’ after US jobs surprise

Traders have pulled forward their expectations for the first interest rate cuts in the US as the economy added fewer jobs than expected.

Money markets indicate the US Federal Reserve will cut rates by September, compared to expectations of a change by November before the publication of the latest nonfarm payrolls data from the Labor Department.

The data showed that the world’s largest economy added 175,000 jobs last month, down from a revised March figure of 315,000, while the jobless rate edged slightly higher to 3.9pc.

US stock indexes on Wall Street jumped sharply higher and the FTSE 100 hit a new record high as the report also showed wages grew at a slower pace than expected at 3.9pc, compared to estimates of 4pc. It was down from 4.1pc in the year to March.

The US Federal Reserve opted on Wednesday to hold interest rates steady for a sixth meeting in a row at their 23-year highs of 5.25pc to 5.5pc.

Chairman Jerome Powell had warned that it is still too early to declare victory against stubborn inflation after “a lack of further progress” in a blow to hopes of imminent rate cuts.

Richard Flynn, managing director at Charles Schwab UK, said: “In recent months, it has become clear that the Fed is happy to move slowly in the cutting part of the rate cycle, but unwanted and unexpected weakness in the economy, as we are seeing today, may cause a shift in this approach.

“A dive in the labour market may be what it takes to push the Fed from a stroll to a sprint.”

Read the latest updates below.

06:00 PM BST

Signing off...

That’s it for the Markets blog this week. We’ll be back on Tuesday before the markets open in London to cover the latest business and financial news.

In the meantime, you can follow the latest business stories in The Telegraph’s Business section.

05:40 PM BST

FTSE hits new record as global stocks are buoyed by US interest rate hopes

The FTSE 100 has had another record-breaking week, closing at a fresh all-time high after being boosted on hopes of interest rate cuts across the pond.

It is the first time the blue-chip index has surpassed the 8,200 mark.

Experts said new jobs data from the US was helping boost the mood of investors at the end of the week, because it could encourage the central bank to start lowering interest rates.

It comes after the US Federal Reserve said on Wednesday that rates could stay higher for longer until there is firmer evidence that inflation is slowing toward its target level.

Susannah Streeter, head of money and markets for Hargreaves Lansdown, said:

London’s blue-chip index has powered higher, as a relief wave cascaded over markets amid hopes for earlier interest rate cuts in the US.

The latest snapshot of the weakening labour market fired up stocks on Wall Street, and positive sentiment is washing over the FTSE 100, which passed the 8,200 mark for the first time today.

With overall US economic output also slowing by more than expected in the first quarter, hopes are riding high that that this era of painfully-high borrowing costs might start to come to an end, sooner rather than later.

It was a good session for other European markets. In Frankfurt, the Dax moved 0.54pc higher and in Paris, the Cac 40 also closed up by the same percentage.

05:34 PM BST

Michael Gove urged to reject M&S Marble Arch redevelopment for a second time

Michael Gove should stand his ground and block Marks & Spencer’s flagship Marble Arch redevelopment for a second time, campaigners have said, despite the High Court forcing the Housing Secretary to reconsider. Our retail editor Hannah Boland reports:

Henrietta Billings, director of SAVE Britain’s Heritage, said the Housing Secretary would be “firmly justified” in once again refusing M&S’s request to demolish its flagship Oxford Street building.

Mr Gove rejected the plans last year and SAVE Britain’s Heritage said he would be justified in coming to the same conclusion to block the project a second time. The Housing Secretary has been forced to reconsider his decision after a successful legal challenge by M&S.

Ms Billings said: “M&S’s destructive plans were conceived more than six years ago and they’re looking increasingly outdated.

“So much has changed since then, from our understanding of the sustainability impacts of demolition and re-building from scratch – to the widespread public interest in this case and growing awareness about the need for change.”

04:56 PM BST

Footsie closes up

Thge FTSE 100 closed up 0.5pc. The biggest riser was pensions business Phoenix, up 6.5pc, followed by housebuilder Berkeley, up 5pc. Intercontinental Hotels Group was the biggest faller, down 2pc, followed by insurer Beazley, down 12.6pc.

Meanwhile, the FTSE 250 rose 0.6pc. The biggest riser was Trainline, up 6.6pc, followed by property company Tritax EuroBox, up 5.7pc. The biggest faller was TBC Bank, down 8.6pc, followed by Bank of Georgia, down 7.2pc.

04:52 PM BST

Newly qualified lawyers can earn £150,000 in City ‘war for talent’

Freshly qualified lawyers are to be paid £150,000 at a City law firm, the FT has reported.

The newspaper said that Freshfields Bruckhaus Deringer increased the base pay for new solictions by 20pc from May 1.

The “magic circle” firm also increased London salaries for trainees in their first year from £50,000 to £56,000 and for those in their second year from £55,000 to £61,000.

A hike in law firm salaries comes amid intense competition between UK and US law firms operating in London for the best talent.

04:28 PM BST

Sony awaits news on its offer to buy Paramount

Sony Pictures and private equity firm Apollo Global Management on Wednesday submitted a $26bn (£21bn) offer for Paramount but have yet to receive a response as of Friday, Reuters reported.

A special committee of the Paramount board, created to evaluate offers for the company, has been holding exclusive deal talks with Skydance Media. That period of exclusivity ends today, and a source familiar with the matter said the exclusivity period is unlikely to be extended, opening the doors to other bidders.

Sony and Apollo reportedly submitted a non-binding offer letter on Wednesday. The $26bn offer is a combination of cash and assumption of debt.

Paramount is behind major film and television brands such as Star Trek, Mission: Impossible and Indiana Jones.

has been struggling to recover from last year’s months-long strikes by Hollywood writers and actors and a soft advertising market.

Its streaming service also widely trails rivals such as Netflix and Disney+ in subscriber numbers.

Sony Pictures and Apollo have been approached for comment. Paramount declined to comment.

04:05 PM BST

Japanese steel giant delays closing the purchase of US Steel after US government request

Nippon Steel has postponed the expected closing of its $14.1bn (£11.2bn) takeover of US Steel by three months after the US Department of Justice requested more documentation related to the deal.

Tokyo-based Nippon Steel said the deal, already approved by US Steel’s shareholders, is still expected to go through.

The sale has drawn opposition from President Joe Biden’s administration on economic and national security grounds, and from former President Donald Trump, the likely Republican presidential candidate in November’s election.

The new timing could push the closing beyond the election, but Nippon Steel denied the delay was related to that.

Initially the deal was supposed to have closed by September. Now it will close by December, meaning it could still close as early as September, according to a company spokesman.

03:57 PM BST

US services activity shrinks for first time since 2022

Activity in the US services sector contracted last month, a first since December 2022, on the back of a cooldown in business and slower growth in orders, according to survey data released today.

The services index of the Institute for Supply Management (ISM) slipped unexpectedly to 49.4 percent in April, dipping below the 50-point mark separating growth from contraction.

Analysts generally expected the sector to continue growing.

The figure was a shift from March’s reading of 51.4 percent and ended a stretch of 15 straight months of growth.

ISM survey chair Anthony Nieves said:

The decline in the composite index in April is a result of lower business activity, slower new orders growth, faster supplier deliveries and the continued contraction in employment.

03:53 PM BST

Risk of olive oil shortages as weather hits crops

Britain is at risk of olive oil shortages as the industry is wracked by a production crisis. Daniel Woolfson has the details:

Fears are growing over the risk of empty shelves as growers across Europe battle a combination of extreme weather, inflation and high interest rates.

Giles Henschel, the owner of Olives et Al, a retailer of olives and olive oils, said: “The price of olive oil is unlikely to come down from where it is now. There will be shortages, there will not be enough.”

Mr Henschel has spent recent weeks on a motorcycle tour of olive growers across Europe, interviewing farmers and investigating the effects of climate change on the kitchen cupboard staple. He said: “I think we’re facing an existential threat to the business that we created.

“Will we still be able to actually sell olives in three years time? I don’t know. And part of the reason for doing this is what have we got? Do we actually still have a business? Should we diversify?”

His comments come after Deoleo, Spain’s largest producer of olive oil, warned this week that the industry was facing “one of the most difficult moments in the history of the sector”.

03:47 PM BST

US court to rule on whether Google is an illegal monopoly

Google’s preeminence as an internet search engine is an illegal monopoly propped up by more than $20bn (£16bn) spent each year by the tech giant to lock out competition, US Justice Department lawyers argued towards the end of a high-stakes competition law court case.

Google, on the other hand, maintains that its ubiquity flows from its excellence, and its ability to deliver consumers the results that they are looking for.

The US government and Google made their closing arguments today in the 10-week lawsuit to judge Amit Mehta, who must now decide whether Google broke the law in maintaining a monopoly status as a search engine.

Much of the case, the biggest US competition law trial in more than two decades, has revolved around how much Google derives its strength from contracts it has in place with companies such as Apple to make Google the default search engine preloaded on mobile phones and computers.

At trial, evidence showed that Google spends more than $20bn a year on such contracts. US Justice Department lawyers have said the huge sum is indicative of how important it is for Google to make itself the default search engine and block competitors from getting a foothold.

Google says that customers could easily click away to other search engines if they wanted, but that they invariably prefer Google. Companies such as Apple testified at trial that they partner with Google because they consider its search engine to be superior.

03:32 PM BST

Handing over

That’s all from me for this week but Alex Singleton will keep sending live updates until the evening.

I hope you have a good extended weekend (if you’re off all three days) - and no doubt many of you will be considering a bit of gardening.

If that is the case, here is some inspiration from the Harrison Tulip Festival in Agassiz in British Columbia:

03:15 PM BST

US services sector shrinks

Private sector companies in the services sector in the US suffered a slump in output last month, a closely watched survey shows.

The ISM Services PMI delivered a reading of 49.4 in April, which was its lowest in two years.

Analysts had predicted a reading of 52. A reading above 50 indicates growth.

With a reading of 49.4 (down 2.0 points), economic activity in the services sector contracted in April for the first time since December 2022, ending a period of 15 consecutive months of growth. pic.twitter.com/vLKIOiIrSS

— Dr Thomas Kevin Swift (@DrTKSwift) May 3, 2024

03:02 PM BST

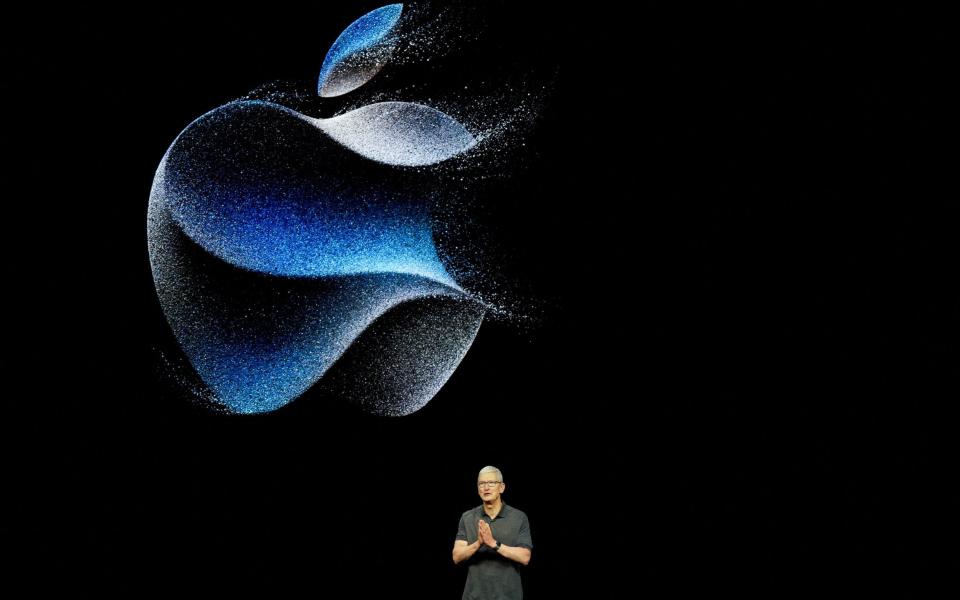

Apple adds £135bn in value after record share buyback unveiled

Apple shares jumped nearly 7pc as the iPhone maker’s record stock buyback plan and promise of sales growth brought back investors worried about increased competition in China.

The company late on Thursday approved an additional $110bn in share repurchases, its largest ever, and forecast third-quarter sales that exceeded the modest market expectations.

The company was on track to add more than $170bn (£135bn) to its market value if the stock gains hold.

Apple is confident that product updates, starting with an iPad event on May 7, will drive demand in its hardware business after months of sluggish growth that made some investors doubt its status as a must-own stock.

02:45 PM BST

Amgen surges after ‘encouraging’ weight loss drug tests

US biopharmaceutical company Amgen made its biggest one-day jump since 2009 as markets opened on Wall Street after publishing results for a new weight loss drug.

Amgen climbed 14pc after its chief executive said on Thursday that he was “very encouraged” by early analysis from a study of its MariTide treatment.

Shares of Europe’s most-valuable company Novo Nordisk - which makes weight loss drug Wegovy - slumped by as much as 5.3pc today following a 2.7pc decline in the previous trading session after sales missed expectations.

02:38 PM BST

US stock markets surge at the open

Wall Street’s main indexes opened higher after the US jobs market slowed down in April, reviving hopes of the Federal Reserve cutting interest rates this year.

The Dow Jones Industrial Average rose 483.7 points, or 1.3pc, at the open to 38,709.36 as it was also supported by gains from Apple and Amgen after upbeat corporate updates.

The S&P 500 rose 58.6 points, or 1.2pc, at the open to 5,122.78​, while the Nasdaq Composite rose 306.5 points, or 1.9pc, to 16,147.482 at the opening bell.

02:27 PM BST

US unemployment under 4pc for 27th consecutive month

US unemployment crept up, official data showed, indicating that the world’s largest economy could be on track for a hallowed “soft landing” from its period of high interest rates.

The unemployment rate edged slightly higher from 3.8pc in March to 3.9pc last month, as employers grapple with interest rates at their highest level since 2001.

However, unemployment reached a milestone as it remained under 4pc for a 27th consecutive month despite a slowdown in hiring from 315,000 in March to 175,000 in April.

The US economy also looks to have avoided a recession despite the economy facing elevated borrowing costs.

The US Unemployment Rate has now been below 4% for 27 straight months, the longest streak since 1967-70. pic.twitter.com/yNkhGYra5g

— Charlie Bilello (@charliebilello) May 3, 2024

02:12 PM BST

FTSE hits new record and pound jumps as US jobs market slows

The pound spiked the FTSE 100 was propelled to a new record high as the US jobs market slowed down sharply in April.

Sterling rose by 0.5pc against the dollar to nearly $1.26 as the American economy added 175,000 jobs last month, which was down from 315,000 in March and well below analyst expectations.

The FTSE 100 was also propelled to a new all-time peak of 8,248.73 - a gain of 0.9pc - amid hopes that the cooldown in the US labour market will embolden the US Federal Reserve to begin cutting interest rates.

01:59 PM BST

US jobs surprise ‘could be the start of a positive trend’

As the US jobs market slowed down, Premier Miton chief investment officer Neil Birrell said:

What will the Fed make of this? At last there is evidence of some weakness in the US jobs market.

Rate cuts will move back up the agenda as a result and there is little doubt that markets will take this as good news.

While we shouldn’t make too much of single data prints, this could be the start of a positive trend for the Fed.

01:47 PM BST

Traders expected faster interest rate cuts after US jobs surprise

Traders have pulled forward their expectations for the first interest rate cuts in the US as the economy added fewer jobs than expected.

Money markets indicate the US Federal Reserve will cut rates by September, compared to expectations of a change by November before the publication of the latest nonfarm payrolls data from the Labor Department.

The data showed that the world’s largest economy added 175,000 last month, down from a revised March figure of 315,000, while the jobless rate edged slightly higher to 3.9pc.

Jobs Day Charts!

1/ Nonfarm payrolls up 175K in April. Small downward revisions to the prior 2 months.

This is about the same pace of employment gains we've seen over the past year.

No acceleration, no deceleration either. pic.twitter.com/hGj3XHnmFv— Guy Berger (@EconBerger) May 3, 2024

01:41 PM BST

Wall Street poised to open higher after US jobs surprise

US stock indexes extended gains in premarket trading as the latest jobs figures boosted hopes that the Federal Reserve could cut interest rates sometime this year.

A Labor Department report showed nonfarm payrolls increased by 175,000 jobs in April, compared with expectations for an increase of 243,000, according to economists polled by Reuters.

The unemployment rate stood at 3.9pc compared with expectations that it would remain steady at 3.8pc, while average earnings rose 0.2pc on a monthly basis against forecasts of 0.3pc growth.

In premarket trading, the Dow Jones Industrial Average was up 520 points, or 1.4pc, the S&P 500 was up 55 points, or 1.1pc, and Nasdaq 100 futures were up 249.5 points, or 1.4pc.

01:36 PM BST

Slower hiring in US could push rate cuts ‘from a stroll to a sprint’

US hiring slowed at a deeper pace than expected in April, which could help “push the Fed from a stroll to a sprint” when it comes to interest rate cuts this year.

Hiring in the world’s biggest economy came in at 175,000 last month, down from a revised March figure of 315,000, while the jobless rate edged slightly higher to 3.9pc, according to data from the Department of Labor.

Richard Flynn, managing director at Charles Schwab UK, said:

Investors will interpret today’s weak jobs report as a sign that demand is slowing in the labour market.

Both markets and central bankers have been looking for evidence that disinflation may be ahead, and today’s figures could indicate that the economy is slowing down.

In recent months, it has become clear that the Fed is happy to move slowly in the cutting part of the rate cycle, but unwanted and unexpected weakness in the economy, as we are seeing today, may cause a shift in this approach.

A dive in the labour market may be what it takes to push the Fed from a stroll to a sprint.

01:33 PM BST

US economy adds fewer jobs than expected

US employers added far fewer jobs than expected in April in a boost to hopes for interest rate cuts.

Nonfarm payrolls expanded by 175,000 last month, which was well below estimates of 240,000.

The previous month’s figure was revised slightly higher from 303,000 to 315,000.

In a further boost to hopes of interest rate cuts, wages grew at a slower pace than expected a 3.9pc, compared to estimates of 4pc.

It was down from 4.1pc in the year to March.

01:26 PM BST

Extreme weather boosts gas prices

Natural gas prices have risen amid growing global demand.

Europe’s benchmark contract has gained 2.2pc today to more than €31 per megawatt hour, its highest level since mid-April when Iran’s attack on Israel triggered a spike in prices.

Demand in Asia and Egypt has begun to pick up as extreme temperatures boost the need for air conditioning.

01:06 PM BST

TGI Fridays operator reduces losses in ‘transitional year’

TGI Fridays operator Hostmore has narrowed its losses for the past year as it pushed forward with its turnaround strategy that includes buying its US-based francishor.

The UK hospitality company reported lower revenues in the face of the challenging backdrop for the hospitality sector.

The update comes weeks after Hostmore, which runs 89 sites across the UK, agreed a deal to merge with US-based TGI Fridays Inc, to create a larger company which will remain listed in London.

Hostmore said that 2023 was a “transitional year” as it sought to put its finances back on a strong footing.

It revealed revenues last year of £190.7m, dropping from £195.7m in 2022. Nevertheless, it heavily reduced its pre-tax losses to £25.5m from £108.3m a year earlier.

The reduction came after significant cost-cutting, which it said provided a £6.2m boost last year.

It also deferred planned restaurant opening for last year to the end of this current year, saving it around £15m in capital expenditure.

Stephen Welker, chair of Hostmore, said: “2023 was a transitional year for Hostmore during which we successfully implemented a turnaround of the business.”

12:46 PM BST

Second Boeing whistleblower dies in two months

A second Boeing whistleblower has died just two months after his colleague was found dead with gunshot wounds in a car park.

Our reporter Verity Bowman has the details:

Joshua Dean, a former quality auditor at Boeing supplier Spirit AeroSystems, warned of manufacturing defects in the planemaker’s 737 Max.

He filed a complaint with the Federal Aviation Administration (FAA) alleging “serious and gross misconduct by senior quality management of the 737 production line” at Spirit.

The 45-year-old died on Tuesday after developing pneumonia following a “fast-moving” infection of Influenza B and MRSA.

It comes as Boeing has been plagued by a series of incidents involving its planes.

12:29 PM BST

Wall Street poised to rise after Apple results

US stock markets are on track to open higher after strong results from Apple on Thursday - but that could all change after the latest jobs figures are published this afternoon.

Apple jumped 5.8pc in premarket trading, outpacing other megacap stocks, after the iPhone maker unveiled a record $110bn share buyback program and beat expectations for quarterly results and forecast.

Amgen climbed 13.5pc as the biotechnology company said it was very encouraged after completing an interim analysis of its mid-stage study of experimental weight-loss drug MariTide and as it reported first-quarter earnings.

However, investors will be keeping a close eye on the nonfarm payrolls report for April, which could offer a clearer picture of labour demand in the US economy and its impact on the interest rates.

The Labor Department’s report is expected to show US job growth probably slowed to a still-solid clip in April, with wages maintaining their steady rise.

Money markets see a 61.9pc chance of the first interest rate cut being delivered in September, while pricing in a greater 73.8pc chance for November, according to CME FedWatch tool.

In premarket trading, the Dow Jones Industrial Average was up 0.7pc, the S&P 500 had gained 0.3pc and the Nasdaq 100 was up 0.7pc.

12:06 PM BST

FTSE 100 hits record high amid speculation over Anglo American bid

The FTSE 100 has hit another record high amid speculation of a bidding war for mining giant Anglo American.

Anglo American shares have risen more than 3pc to lead the UK’s flagship stock index a report that London-listed rival commodities group Glencore was considering a takeover attempt.

The speculation emerged one week after Anglo had rejected a blockbuster £31.1bn takeover offer from Australian rival BHP, which it called highly unattractive and opportunistic.

Anglo and Glencore declined to comment on the Reuters report about Glencore’s interest.

However, it did not stop the FTSE 100 index of top companies extending its record-breaking run to strike a new high at 8,215.29 points, dragging Frankfurt and Paris higher in its wake.

11:53 AM BST

Paco Rabanne owner’s shares jump in Europe’s biggest listing this year

The owner of Paco Rabanne surged higher as its shares floated in Europe’s biggest listing so far this year.

The stock in Spanish beauty and fragrance group Puig opened up 4.1pc at €25.50 from its initial public offer (IPO) price of €24.50, which was already at the top of its proposed range.

The Barcelona-based company, which also owns Charlotte Tilberry and Jean Paul Gaultier, sold 106.5m shares, giving it a market value of €13.9bn (£11.9bn).

Members of the 110-year-old Puig dynasty are the biggest individual winners in the IPO.

Two third-generation family members work for the group, which is run by chief executive Marc Puig Guasch, who is a grandson of its founder.

11:41 AM BST

Oil on track for weekly decline amid Gaza ceasefire hopes

Oil is heading for its biggest weekly decline since February amid hopes for a ceasefire in Gaza.

Brent crude, the international benchmark, has edged up 0.3pc today but remains below $84 a barrel and down more than 6pc this week.

It comes as Hamas studies a proposal for a temporary ceasefire with Israel, with plans to send a delegation to Egypt for negotiations.

Prices have fallen about 10pc from a five-month high set in mid-April after Iran launched an unprecedented attack on Israel.

11:16 AM BST

Water company takeover ‘could impact’ regulation

Britain’s competition watchdog has said Pennon’s buyout of Sutton and East Surrey Water (SES) could hurt the regulator’s ability to compare water companies.

The Competition and Markets Authority (CMA) said the deal could undermine Ofwat’s authority as water regulator, by wiping SES from its dataset.

This would reduce the number of comparators available for it to estimate cost allowances and set service quality targets, it said in a May 3 notice.

Pennon was given until May 13 to respond to the concerns. The CMA said it will start a new, in-depth investigation into the deal unless it accepts Pennon’s response.

FTSE 250-listed Pennon bought Sumisho Osaka Gas Water UK, including its subsidiary SES Water, in January for £380m.

SES Water supplies drinking water to south-east England, with 845,000 customers across East Surrey, West Sussex, west Kent and south London.

Joel Bamford, executive director of mergers at the CMA, said: “Water services are vital to our day-to-day lives, whether at home or in the workplace, and we’re concerned that this deal could impact Ofwat’s ability to make comparisons and carry out its role of regulating the water sector.”

11:00 AM BST

Government’s new climate action plan unlawful, High Court rules

The Government acted unlawfully by approving a strategy to meet the UK’s climate targets, a High Court judge has ruled.

Environmental charities Friends of the Earth and ClientEarth, and the Good Law Project, took joint legal action against the Department for Energy Security and Net Zero over its decision to approve the Carbon Budget Delivery Plan (CBDP) in March last year.

The plan outlines how the country will achieve targets set out in the sixth carbon budget, which runs until 2037, as part of wider efforts to reach net zero by 2050.

The three groups argued at a hearing in February that the then-secretary of state, Grant Shapps, acted unlawfully by approving the plan as he lacked information on whether individual policies could be delivered in full.

In a ruling today, Mr Justice Sheldon ruled in their favour, stating that Mr Shapps’ decision was “simply not justified by the evidence”.

He said: “If, as I have found, the Secretary of State did make his decision on the assumption that each of the proposals and policies would be delivered in full, then the Secretary of State’s decision was taken on the basis of a mistaken understanding of the true factual position.”

10:53 AM BST

Societe Generale shares jump as earnings beat forecast

Societe Generale suffered a big drop in profits in the first quarter but its shares rose after a strong performance in its investment business.

Shares in the French bank jumped by almost 6pc on the Paris stock exchange - exceeding their mid-September level - after it published the forecast-beating earnings.

Profits after tax sank by 21.7pc to €680m (£581.5m) compared with the same period last year, while revenues fell 0.4 pc to €6.6bn.

But the bank’s earnings were slightly better than forecast by analysts.

The global banking and investor solutions arm posted a net profit of €690m, a 26.4pc jump from a year ago, though its revenues fell 5.1pc to €2.6bn.

10:38 AM BST

Mike Ashley seals peace deal with Morgan Stanley over ‘snobbery’ claims

The Frasers billionaire Mike Ashley has ended his legal attack on Morgan Stanley over claims “snobbery” was behind a $1bn cash demand that threatened to destabilise his empire.

Our reporter Adam Mawardi has the details:

Frasers and the Wall Street investment bank have agreed a settlement following hearings in February, meaning no judgment will be passed by the High Court. The terms of the settlement are confidential following a trial which would have been costly for both sides.

It marks an anti-climatic ending to Mr Ashley’s pursuit of Morgan Stanley and some of its most senior bankers.

However, as well as being embarrassing for an investment banking business which trades on discretion, the case raised questions over the conduct and policies of one of the world’s most powerful financial institutions which could invite unwelcome attention from financial regulators on both sides of the Atlantic.

Read how the settlement comes as Morgan Stanley faces pressure from regulators over its internal processes.

10:13 AM BST

Pound rises ahead of US jobs figures

The pound has risen against the dollar ahead of official figures on US employment and wage growth.

Sterling was 0.2pc higher at $1.255 as traders turn their attention to the release of nonfarms payroll data, which could play a major role in the Federal Reserve’s decision-making on when to lower interest rates.

A string of data this year showing inflation was holding stubbornly above target has seen investors lower their forecast for 2024 rate cuts from six in January to one or two now.

Comments from Fed boss Jerome Powell on Wednesday appeared to breathe a little life into the rate-cut narrative when he said that, while he expected borrowing costs to stay high for longer, officials were unlikely to announce another hike.

The pound was flat against the euro, which is worth 85p.

09:54 AM BST

Minimum wage pushes up costs for UK businesses

UK services businesses faced surging costs after the increase in the minimum wage, according to the PMI data.

Higher wages, partly driven by a considerable rise in the National Living Wage in April, resulted in the sharpest overall increase in input costs since August.

The National Living Wage increased by £1.02 to £11.44 for those over the age of 21 from April 1.

In contrast, prices charged by service sector firms rose at the slowest pace for three years.

However, the sector grew as order books filled up amid greater optimism about the economic outlook.

Higher levels of new work from abroad also boosted total order books in April, with growth the fastest since March 2023 amid ongoing reports of strengthening sales to clients in the US and Asia.

Tim Moore of S&P Global said:

Business activity expectations for the year ahead were upbeat overall in April, therefore adding to signs that the recovery in service sector performance has further to run.

Election uncertainty and fading prospects for interest rate cuts were cited as headwinds on the horizon, but survey respondents still mostly reported positive sentiment towards their business investment plans and longer-term growth opportunities.

09:38 AM BST

UK economy ‘pulling out of recession’ as private sector grows

Britain’s economy is “pulling further out of last year’s shallow recession” as the dominant services sector grew at its fastest pace in nearly a year, according to a closely-watched survey.

The S&P Global UK Services PMI - considered a key measure of activity - rose to 55 in April from 53.1 in March, marking a sixth consecutive month of growth.

It was also the fastest rate of business activity growth since May last year.

Tim Moore, economics director at S&P Global, said:

The latest survey results are consistent with the UK economy growing at a quarterly rate of 0.4pc and therefore pulling further out of last year’s shallow recession.

Relief at a turnaround in the economic outlook was commonly cited as a factor supporting sales pipelines in April.

However, there were also reports that clients remained somewhat risk averse and under pressure from elevated inflation.

09:14 AM BST

Norway signals interest rates to stay high for longer

Norway’s central bank kept its interest rates on hold at 4.5pc as expected and said a tight monetary policy stance may be needed for somewhat longer than planned.

Norges Bank said: “The data so far could suggest that a tight monetary policy stance may be needed for somewhat longer than previously envisaged.”

The Norwegian krone strengthened by 0.3pc to 13.74 to the pound after the decision.

No Norges Bank held its key interest rate unchanged at 4.5% in its May 2024 decision, as expected.https://t.co/RAO8lhjMAC pic.twitter.com/BAXEpy53YZ

— TRADING ECONOMICS (@tEconomics) May 3, 2024

09:09 AM BST

Turkey inflation rises to 69.8pc

Turkey’s inflation rate accelerated for a sixth month in a row despite a rapid campaign of interest rate rises after years of ultra-loose monetary policy.

Consumer prices grew 69.8pc in April, up from 68.5pc the previous month, which was the fastest since late 2022 and among the highest inflation rates in the world.

It comes after Turkey’s central bank increased interest rates to 50pc from 8.5pc in June last year as in a sharp U-turn after President Recep Tayyip Erdogan pushed for lower borrowing costs.

08:51 AM BST

Anglo American and Diageo push FTSE 100 towards new record

The FTSE 100 opened near record highs amid boosts for Anglo American and Diageo.

The blue-chip index was up 0.3pc to leave it a whisker away from its all-time peak, It is set for a second straight week of gains.

Anglo American has jumped 3.4pc after Reuters reported that Glencore was mulling an approach for the 107-year old miner, a move that could spark a bidding war.

Glencore was down 1.9pc.

Diageo gained as much as 1.7pc after the global drinks group named Nik Jhangiani as its chief financial officer after poaching him from Coca-Cola Europacific Partners.

The rise in shares comes after Apple created an upbeat mood in Asian stocks after the iPhone maker announced a $110bn share buyback programme - the largest in history.

The mid-cap FTSE 250 was up 0.1pc.

Investors will be watching out today for UK PMI data for April, the eurozone’s unemployment rate for March, and US nonfarm payrolls data for April.

08:37 AM BST

Asda refinances £3.2bn of debt

Asda has refinanced around £3.2bn of its debt created by through its takeover by the billionaire Issa brother and private equity firm TDR Capital.

The supermarket said it had secured the new bond agreements, which will now mature in 2030 and 2031, amid “strong demand” from investors.

As part of the refinancing, the UK’s third largest grocery chain said it also used £300m of cash from its balance sheet to reduce its gross debt.

Asda had net debt of £3.8bn at the end of 2023, built up following the Issa brothers’ acquisition of the supermarket from Walmart for £6.8bn in 2021.

Zuber Issa is close to agreeing a deal to offload his 22.5pc share in the retailer to TDR Capital, which would hand majority control of the chain to the private equity giant, according to Bloomberg News.

Michael Gleeson, Asda’s chief financial officer, said:

We saw strong demand from investors after taking a thoughtful and prudent approach to refinancing our near-term debt well ahead of maturities - to further strengthen our balance sheet.

The refinancing also reflects the wider strength of Asda as a diversified retail group with a strong grocery business at its core supported by a fantastic non-food offering in George and following recent investments, a major presence in the high-growth convenience and food-service markets.

08:24 AM BST

Drinks maker Diageo poaches Coca-Cola finance boss

Guinness owner Diageo has poached the finance boss of the world’s largest Coca-Cola bottler as it seeks to recover from a drop in sales and profits.

Nik Jhangiani will join the company as chief financial officer in the autumn from Coca-Cola Europacific Partners, where he holds the same position.

Mr Jhangiani was also finance boss at Bharti Enterprises, one of India’s leading business groups with operations in 21 countries and interests in telecoms, food, retail and real estate.

His appointment comes after shares in Diageo slumped by a quarter over the last year.

The company warned in November that it expected sales in Latin America and the Caribbean to drop by as much as 20pc in the first half of its current financial year.

Its shares have climbed 1.5pc in early trading.

08:13 AM BST

Anglo American shares jump as Glencore eyes bid

UK-listed miner Anglo American jumped in early trading amid reports that Glencore is considering a takeover approach.

Anglo American shares gained 4pc amid speculation of a bidding war for the De Beers owner, which rejected a £31.1bn takeover approach from BHP last month.

Glencore has held internal discussions about a bid, which are preliminary at this stage and may not result in an approach, according to Reuters.

08:03 AM BST

UK markets open higher

The FTSE 100 gained as trading got underway following a strong overnight performance from stocks in Asia.

The UK’s blue chip index began the day by rising 0.3pc to 8,194.34 while the midcap FTSE 250 was up 0.5pc to 20,027.77.

07:48 AM BST

Trainline doubles profits amid fewer rail strikes

Trainline’s pre-tax profit more than doubled to £48m last year, as the rail tickets seller enjoyed fewer strike days in Britain, further post-pandemic travel recovery and significant growth in European markets such as Spain.

The London-listed company sold £3.5bn-worth of UK tickets in the year ending February 29, up 23pc year on year, which was partly helped by a decrease in strike days to 25, down from 30 the previous 12 months.

Meanwhile, sales across Spain and Italy grew a combined 43pc, as Trainline further penetrated both international markets where competition is more widespread than in other major European economies.

Jody Ford, chief executive of Trainline said:

New entrant carrier competition is revolutionising rail in Europe as more customers benefit from greater choice, lower prices and the opportunity to choose greener travel.

We are becoming the aggregator of choice in the UK and internationally and are delivering strong growth, particularly in those markets liberalising fastest such as Spain.

07:35 AM BST

Holiday Inn owner boosted by Europe and China

Holiday Inn operator Intercontinental Hotels Group (IHG) has revealed stronger revenues over the first quarter of 2024 driven by growth in Europe and Asia.

IHG told shareholders that global revenues per available room grew by 2.6pc for the quarter.

It came as the company, which also runs Crowne Plaza hotels, continued to expand by opening more than 6,200 rooms across 46 hotels during the period.

Elie Maalouf, chief executive officer of IHG Hotels & Resorts, said:

There was an impressive performance in EMEAA (Europe Middle East Africa and Asia) which was up nearly 9pc.

The Americas, having already recovered very strongly, was broadly flat due to some adverse calendar timing, and Greater China grew by 2.5pc and will continue to benefit from returning international inbound travel this year.

Global occupancy moved up to 62pc and average daily rate increased by a further 2pc as pricing remained robust, reflecting the complete return of leisure, business, and group travel.

07:27 AM BST

Hong Kong stocks surge as China bails out markets

Hong Kong stocks led a surge in Asian markets as China stepped-up efforts to boost the economy.

The Hang Seng Index climbed as much as 2.2pc to put it on track for a ninth consecutive day of gains, which would be its longest winning streak since January 2018.

Gains were driven by e-commerce giant Alibaba climbing 3.5pc and rival JD.com gaining 4.2pc. Chinese markets have been closed for holidays from May 1-3.

China’s authorities have struggled to spur an economic rebound since emerging from stringent Covid lockdown measures in late 2022.

Officials have in recent months announced a series of targeted measures and the issuance of sovereign bonds to boost infrastructure spending and revive economic activity - with mixed results.

However, the world’s second largest economy continues to fight a crisis in its debt-ridden property market, with home prices sliding in recent months, while retail sales have been hit by poor domestic demand.

China’s Communist Party said in its politburo statement at the end of April that it will step up support for the economy with prudent monetary and proactive fiscal policies, including interest rates and bank reserve requirement ratios (RRR).

Jason Lui, head of APAC Equity and derivative strategy at BNP Paribas, said the statement “indicates a stronger commitment to a pro-growth and pro-reform policy agenda”.

Vey-Sern Ling, managing director at Union Bancaire Privee, added: “The strong performance in the past two weeks is probably attracting more fund inflows for fear of missing out.

“Even after the sharp rally, valuations for the China tech stocks are still well below historical average as well as when compared with global peers.”

More widely, Asian stocks surged to their highest in 15 months led by tech and Hong Kong stocks, while the yen put more distance from recent 34-year lows to cap a tumultuous week that saw suspected intervention from Japanese authorities.

With markets in Japan and mainland China closed today, regional trading activity is likely to be subdued as traders look ahead to the US nonfarm payrolls data later in the day.

MSCI’s broadest index of Asia-Pacific shares outside Japan surged to 550.49, its highest since February 2023 and was last up 1pc at 547.72.

Hong Kong’s Hang Seng Index was last up 1.5pc, on track for a ninth consecutive day of gains and on its the longest winning streak since January 2018.

07:16 AM BST

Good morning

Thanks for joining me. Hong Kong led another rally across Asian markets thanks to a surge in tech giants, putting it on course for its strongest run since 2018.

The Hang Seng was the standout performer overnight thanks to buying of heavyweights including Alibaba and JD.com.

5 things to start your day

1) Apple suffers biggest iPhone sales slump in three years | Decline comes as Chinese shoppers turn their back on the tech company

2) Inflation crisis was fuelled by economic groupthink, says Lord Mervyn King | Former Bank of England Governor blames 40-year-high CPI on lack of dissenting voices

3) Oil boss accused of driving up petrol prices by colluding with rivals | Leading US energy executive barred from ExxonMobil board over alleged Opec collaboration

4) How Barclays became a lightning rod for Gaza activists | After bowing to pressure from climate protesters, the bank is facing a fresh wave of accusations

5) Annabel Denham: Angela Rayner’s humiliation is a rare gift to Britain | Labour’s decision to water down its workers’ rights plan proves it was never needed in the first place

What happened overnight

Asian shares were mostly higher ahead of a report on the US jobs market, while several major markets including Tokyo and Shanghai were closed for holidays.

The Japanese yen strengthened slightly against the US dollar amid signs of heavy central bank intervention.

The financial newspaper Nihon Keizai Shimbun reported that estimates showed the Bank of Japan spending an estimated 8 trillion yen (about £42bn) this week in trying to keep the yen from slipping further against the dollar.

While a weak yen can be a boon to Japanese companies that earn much of their revenues overseas, significant shifts in the foreign exchange market can play havoc with corporate planning and a sharply weaker yen also boosts costs for imports of oil and other vital commodities.

The dollar was trading at 153.08, down from 153.65 late Thursday. The pound rose 0.2pc $1.255.

Elsewhere in Asia, Hong Kong’s Hang Seng jumped 1pc to 18,301.11, tracking gains on Wall Street. News of fresh moves by Chinese leaders to energise the economy helped drive buying of technology shares.

E-commerce giant Alibaba climbed 3.5pc and rival JD.com was up 4.2pc.

Australia’s S&P/ASX 200 gained 0.7pc to 7,637.00 and the Kospi in Seoul edged 0.2pc higher. Taiwan’s Taiex picked up 0.8pc.

In America, the Dow Jones Industrial Average of 30 leading US companies rose 0.9pc, to 38,225.66, while the S&P 500 gained 0.9pc, to 5,064.20; and the Nasdaq Composite index gained 1.5pc, to 15,840.96.

US Treasury yields were choppy in the wake of the Fed and economic data, and the yield on benchmark US 10-year bonds fell to 4.583pc, from 4.591pc late on Wednesday.

Yahoo Finance

Yahoo Finance