Interactive Brokers (IBKR) Stock Gains on Q4 Earnings Beat

Shares of Interactive Brokers Group IBKR gained 1.4% in after-market trading following its fourth-quarter 2022 results. Adjusted earnings per share of $1.30 handily surpassed the Zacks Consensus Estimate of $1.16. The bottom line reflects a rise of 56.6% from the prior-year quarter.

Results were primarily aided by an improvement in revenues. Also, the capital position was strong. However, higher expenses and a fall in daily average revenue trades (DARTs) were headwinds.

After considering non-recurring items, net income available to common shareholders (GAAP basis) was $136 million or $1.31 per share, up from $67 million or 67 cents per share in the prior-year quarter.

Interactive Brokers reported comprehensive income available to common shareholders of $174 million or $1.68 per share compared with $66 million or 67 cents in the prior-year quarter.

For 2022, adjusted earnings per share of $4.05 handily surpassed the Zacks Consensus Estimate of $3.92. The bottom line reflects a rise of 20.2% from the prior-year period. Net income available to common shareholders (GAAP basis) was $380 million or $3.75 per share, up from $308 million or $3.24 per share recorded in 2021.

Revenues Improve, Expenses Rise

Total quarterly GAAP net revenues were $976 million, up 61.9% year over year. The top line beat the Zacks Consensus Estimate of $926.8 million. Adjusted net revenues were $958 million, up 40.3%.

For 2022, GAAP net revenues were $3.07 billion, up 13% year over year. However, the top line missed the Zacks Consensus Estimate of $3.18 billion. Adjusted net revenues were $3.21 billion, up 15.6%.

Total quarterly non-interest expenses increased 24.8% year over year to $287 million. The rise was due to an increase in almost all cost components, except for occupancy, depreciation and amortization-related costs, and communications expenses.

Income before income taxes was $689 million, increasing 84.7% from the prior-year quarter’s $373 million.

The adjusted pre-tax profit margin was 70%, up from 66% a year ago.

In the reported quarter, total customer DARTs declined 22.5% year over year to 1.89 million. Total cleared DARTs decreased from 2.16 million to 1.69 million.

Customer accounts grew 24.8% from the year-ago quarter to 2,091,000.

Capital Position Strong

As of Dec 31, 2022, cash and cash equivalents (including cash and securities set aside for regulatory purposes) totaled $60.38 billion compared with $40.40 billion as of Dec 31, 2021.

As of Dec 31, 2022, total assets were $115.14 billion compared with $109.11 billion as of Dec 31, 2021. Total equity was $11.62 billion, up from $10.22 billion as of Dec 31, 2021.

Our Viewpoint

Interactive Brokers' efforts to develop proprietary software and an increase in emerging market customers are expected to keep aiding financials. Also, its efficient capital deployment activities indicate strong liquidity and capital positions. However, increasing expenses will likely hamper the bottom line to an extent in the near term.

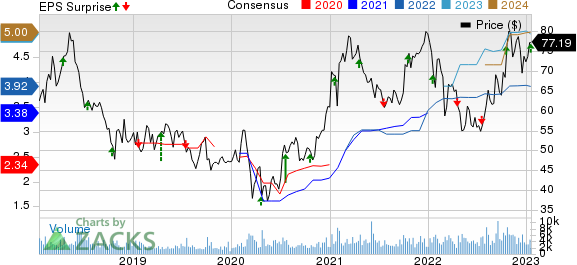

Interactive Brokers Group, Inc. Price, Consensus and EPS Surprise

Interactive Brokers Group, Inc. price-consensus-eps-surprise-chart | Interactive Brokers Group, Inc. Quote

Currently, Interactive Brokers sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Release Dates of Other Firms

Robinhood Markets HOOD is slated to report fourth-quarter 2022 results on Feb 8.

Over the past 30 days, the Zacks Consensus Estimate for HOOD’s quarterly earnings has been unchanged and is pegged at a loss of 14 cents, which suggests a 71.14% increase from the prior-year reported number.

Raymond James RJF is scheduled to announce first-quarter fiscal 2023 (ended Dec 30, 2022) numbers on Jan 25.

Over the past 30 days, the Zacks Consensus Estimate for Raymond James’ quarterly earnings has been revised 2.2% lower to $2.21, suggesting a 4.3% increase from the prior-year reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance