Intel (INTC) Tops Q1 Earnings Estimates, Falters on Revenues

Intel Corporation INTC reported relatively healthy first-quarter 2024 results, largely due to strong operating leverage, expense discipline and significant traction from its IDM 2.0 (integrated device manufacturing) strategy.

Net Income

The company reported a GAAP loss of $381 million or a loss of 9 cents per share compared with a loss of $2,758 million or a loss of 66 cents per share in the year-ago quarter. The significantly narrower loss was primarily attributable to higher revenues and income tax benefits accrued in the quarter.

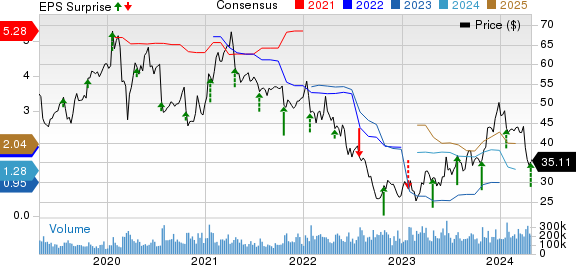

Non-GAAP earnings in the reported quarter were $759 million or 18 cents per share against a net loss of $169 million or a loss of 4 cents per share a year ago. The bottom line beat the Zacks Consensus Estimate by 5 cents.

Intel Corporation Price, Consensus and EPS Surprise

Intel Corporation price-consensus-eps-surprise-chart | Intel Corporation Quote

Revenues

GAAP revenues in the reported quarter were $12,724 million, up from $11,715 million a year ago. The quarterly revenues were in line with the guided range, although it missed the consensus estimate of $12,909 million. Management observed that weaker-than-anticipated demand trends were largely due to a challenging macroeconomic environment and near-term supply constraints. Intel expects a sequential improvement in revenues throughout the remainder of 2024 and in 2025, driven by solid momentum in AI PCs, data center recovery and cyclical recoveries in NEX, Mobileye and Altera.

Segment Performance

Effective first-quarter 2024, Intel implemented an internal foundry operating model, creating a foundry relationship between its products business (collectively CCG, DCAI, and NEX) and its foundry business (formerly IFS). The foundry operating model is a key component of the company's strategy and is designed to reshape operational dynamics and drive greater transparency, accountability and focus on costs and efficiency. The company also reported Altera (which was previously included in the DCAI segment) as a standalone business beginning the first quarter of 2024. Consequently, Intel modified its segment reporting to align with this new operating model.

Client Computing Group (CCG) revenues increased 31% year over year to $7,533 million. This was primarily due to strength in gaming and commercial segments, with nearly 5 million units of AI Pcs notebook shipped. The company remains firmly on track to ship more than 40 million units of AI PCs by the end of 2024.

Datacenter and AI Group (DCAI) revenues improved 5% year over year to $3,036 million owing to solid advancements in AI-accelerated high-performance computing (HPC). The company leveraged Intel Xeon Processors, Intel Gaudi 2 AI accelerators and Data Center GPU Max series to showcase its capability in supporting HPC and AI workloads.

Network and Edge Group (NEX) revenues declined 8% to $1,364 million as elevated inventory levels and soft demand trends with sluggish recovery in China affected segment sales.

While total Intel Products revenues were up to $11,933 million from $10,157 million a year ago, Intel Foundry revenues declined to $4,369 million from $4,831 million. All Other revenues, which include Altera, Mobileye and Other businesses, decreased to $775 million from $1,440 million a year ago.

Other Operating Details

Non-GAAP gross margin improved to 45.1% from 38.4% a year ago, while non-GAAP operating margin improved from -2.5% to 5.7%.

Cash Flow & Liquidity

As of Mar 31, 2024, Intel had cash and cash equivalents of $6,923 million, with $47,869 million of long-term debt. In the first quarter of 2024, Intel utilized $1,223 million of cash for operating activities compared with $1,785 million a year ago.

Outlook

For the second quarter of 2024, Intel expects GAAP revenues to be within $12.5-$13.5 billion. Non-GAAP gross margin is likely to be 43.5%. Non-GAAP earnings are expected to be around 10 cents per share.

Zacks Rank

Intel currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Qualcomm Incorporated QCOM is scheduled to release second-quarter fiscal 2024 earnings on May 1. The Zacks Consensus Estimate for earnings is pegged at $2.30 per share, suggesting growth of 7% from the year-ago reported figure.

Qualcomm has a long-term earnings growth expectation of 9.5%. QCOM delivered an average earnings surprise of 5.9% in the last four reported quarters.

Qorvo Inc. QRVO is slated to release fourth-quarter fiscal 2024 earnings on May 1. The Zacks Consensus Estimate for earnings is pegged at $1.21 per share, indicating stellar growth of 365.4% from the year-ago reported figure.

Qorvo has a long-term earnings growth expectation of 19.4%. QRVO delivered an average earnings surprise of 76.4% in the last four reported quarters.

Motorola Solutions Inc. MSI is due to release first-quarter 2024 earnings on May 2. The Zacks Consensus Estimate for earnings is pegged at $2.52 per share, implying a rise of 13.5% from the year-ago reported figure.

Motorola has a long-term earnings growth expectation of 9.2%. MSI delivered an average earnings surprise of 6.6% in the last four reported quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance