Insights Into Expectations From Tesla's (TSLA) Q4 Earnings

Tesla TSLA is set to post fourth-quarter 2023 results on Jan 24, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at 74 cents per share and $26 billion, respectively.

Tesla’s 10-quarter winning streak snapped in the third quarter of 2023. Earnings declined year over year and missed the Zacks Consensus Estimate. Throughout the third quarter, Tesla slashed prices on its inventory vehicles and existing models, which adversely impacted profits.

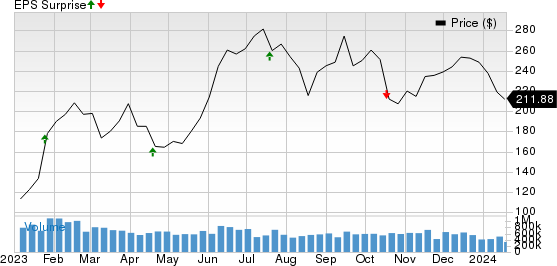

The EV behemoth delivered a trailing four-quarter earnings surprise of 3.22%, on average.

Tesla, Inc. Price and EPS Surprise

Tesla, Inc. price-eps-surprise | Tesla, Inc. Quote

Estimate Revisions

The Zacks Consensus Estimate for fourth-quarter earnings per share has moved up by a penny in the past 30 days. The estimate for the bottom line, however, implies a year-over-year decline of 37.8%. The Zacks Consensus Estimate for quarterly revenues suggests a year-over-year rise of 7%.

Factors to Shape Q4 Results

Tesla reported record deliveries for the quarter ended December and also beat Street estimates. Fourth-quarter deliveries reached 484,507 (comprising 461,538 Model 3/Y and 22,969 other models) units worldwide, up 19.5% and 11.4% on a yearly and sequential basis, respectively. The deliveries also surpassed our forecast of 476,620 units.

Tesla's record-breaking fourth-quarter deliveries were driven by high sales of Model 3 in the United States before federal tax credits for certain variants phased out with the Inflation Reduction Act. The ending of these tax incentives may have contributed to the fourth-quarter delivery spike, as consumers rushed to take advantage of the benefits before they expired. The company offered incentives such as increased discounts and six months of free, fast charging to encourage deliveries by December-end.

During the final quarter of 2023, Tesla introduced the updated "Highland" variant of the entry-level Model 3 sedan in select markets. In December, the company commenced the delivery of a limited quantity of Cybertruck within the United States.

Buoyed by record deliveries, our projections indicate 5% year-over-year growth in automotive revenues. The metric is expected to be $22.38 billion. However, steep discounts on its models in the United States, China and elsewhere, along with high costs of raw materials and logistical constraints, are expected to have put pressure on its margins. We expect automotive gross profit to decline 25.5% year over year. Gross margin for the segment is projected at 18.4%, significantly down from 25.9% recorded in the year-ago period.

Meanwhile, the company is benefiting from increasing energy generation and storage revenues, thanks to the positive reception of Megapack and Powerwall products. Tesla is ramping up production at a dedicated Megapack factory to meet rising demand. These factors are likely to contribute positively to the upcoming results.

Our estimate for Services/Other unit is pegged at $2.2 billion, implying growth of 30% year over year. We expect revenues from the Energy Generation/Storage segment to be $1.6 billion, suggesting growth of 21.5% on a yearly basis.

What Does Our Model Say?

Our proven model doesn’t conclusively predict an earnings beat for Tesla this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Earnings ESP: Tesla has an Earnings ESP of -1.04%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Tesla currently carries a Zacks Rank of 3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

A Stock With the Favorable Combination

While an earnings beat looks uncertain for Tesla, Oshkosh Corporation OSK is one automotive player, which, according to our model, has the right combination of elements to post an earnings beat for the quarter to be reported:

The auto equipment provider is slated to report fourth-quarter 2023 results on Jan 30. The company has an Earnings ESP of +0.93% and a Zacks Rank #2.

The Zacks Consensus Estimate for Oshkosh’s to-be-reported quarter’s earnings and revenues is pegged at $2.17 per share and $2.47 billion, respectively. OSK beat earnings estimates in three of the trailing four quarters and missed once, with the average surprise being 40.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance