Infosys (INFY) Unveils Proximity Center in Sweden's Gothenburg

Infosys INFY recently announced the launch of a proximity center in Sweden’s Gothenburg city with an aim to accelerate digital transformation among the company’s clients in the Nordic region.

The newly opened center intends to provide next generational digital technologies and skills to clients from Gothenburg, helping them navigate to the next level in their digitization journeys. Clients from the major Swedish city will be leveraging solutions in digital manufacturing, connected products, and online customer experiences combined with technologies like cloud, Internet of Things, software engineering and artificial intelligence from Infosys.

The center will allow Infosys to not only expand its opportunities in the local industries of Gothenburg but also increase its reach to the Swedish market and clients. Thus, this investment will enhance Infosys’ localization strategy in the Nordic region.

Infosys has been reinforcing its digital-transformation capabilities to expand and solidify its position in the highly competitive environment. It enables its clients across more than 45 countries to create and execute strategies for their digital transformation. Such efforts in the digital-transformation business will aid the company in competing with peers like Accenture and Cognizant.

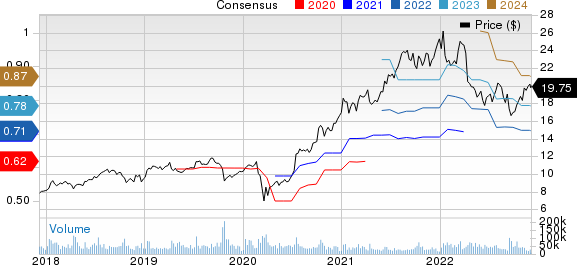

Infosys Limited Price and Consensus

Infosys Limited price-consensus-chart | Infosys Limited Quote

In November, INFY’s wholly-owned subsidiary, Infosys BPM, unveiled the Center of AI and Automation at the company’s Business Experience Lounge in Poland, in collaboration with International Business Machines IBM, to enhance the digital capabilities of global enterprise clients in the AI and hybrid cloud spaces.

The center enables both Infosys and IBM clients to analyze workflows, design AI-infused apps with low-code tooling, assign tasks to bots, and track performance on the go. Infosys BPM’s Center of AI and Automation, which emphasizes a two-year agreement with IBM, is launched to commemorate the subsidiary firm’s 15th anniversary.

In September, Infosys collaborated with Bpost (Belgium Post), a postal operator and e-commerce logistics provider headquartered in Brussels, to provide cloud security solutions that will identify and ensure rapid response to suspicious security events.

In the same month, Infosys collaborated with Spirit AeroSystems, Inc., one of the world’s largest manufacturers of aerostructures for commercial airplanes, defense platforms, and business/regional jets. Per the five-year contract, the IT company intends to offer end-to-end aerostructure and systems engineering services for product development of commercial, business jet and emerging aircraft programs.

Back-to-back contract wins are driving Infosys’ top-line performance. In the last reported financial results for second-quarter fiscal 2023, the company’s revenues jumped 13.9% year over year to $4.56 billion.

Infosys’ near-term growth prospects are likely to be hurt as organizations are postponing their plans of investing in big and expensive technology products on growing global slowdown concerns amid the persistent macroeconomic headwinds and geopolitical tensions. Moreover, elevated operating expenses related to hiring new employees and sales and marketing strategies to capture more market share are likely to strain margins in the near term.

These, along with the rapid proliferation of customizable Internet-based software, have been hampering Infosys’ traditional outsourcing business. These challenges might weigh on the company’s profitability going ahead.

Shares of INFY have dropped 11.2% while IBM jumped 23% in the past year.

Zacks Rank & Stocks to Consider

Infosys currently holds Zacks Rank #4 (Sell) while IBM carries Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader Computer and Technology sector are Celestica CLS and Fabrinet FN. While Celestica flaunts a Zacks Rank #1 (Strong Buy), Fabrinet carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Celestica’s fourth-quarter 2022 earnings has increased by 9 cents to 53 cents per share over the past 60 days. For 2022, earnings estimates have moved 16 cents up to $1.86 per share in the past 60 days.

CLS' earnings beat the Zacks Consensus Estimate in all the preceding four quarters, the average surprise being 11.8%. Shares of the company have moved up 1.6% in the past year.

The Zacks Consensus Estimate for Fabrinet's second-quarter fiscal 2023 earnings has been revised 16 cents northward to $1.89 per share over the past 30 days. For fiscal 2023, earnings estimates have improved by 7.6% to $7.48 per share in the past 30 days.

FN’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters, missing once, the average surprise being 5.4%. Shares of the company have gained 12.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Infosys Limited (INFY) : Free Stock Analysis Report

Celestica, Inc. (CLS) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance