Important JPY Pairs’ Technical Checks: 05.10.2018

USD/JPY

With the 114.50-75 horizontal-region and overbought RSI restricting the USDJPY’s further upside, chances of the pair’s pullback to 113.35 and then to the 112.60 are quite high. However, the 112.15-10 and the 111.30-15 support-confluence, comprising 100-day SMA & upward slanting TL, could challenge the quote’s declines past-113.35. In case prices refrain to respect the 111.15 mark, the 200-day SMA level of 109.80 may gain Bears’ attention. On the upside, a D1 close beyond 114.75 can quickly flash 115.00 on the chart, breaking which 115.50 & 116.10 could become crucial to watch. Assuming the pair’s sustained rise above 116.10, the 117.00, the 117.80 & the 118.70 might appear on the Bulls’ radar to target.

AUD/JPY

Not only break of 81.35-30 support-zone but short-term descending trend-line also portrays the AUDJPY’s weakness, which in-turn highlights the importance of the 80.25 support-level prior to pushing sellers to aim for the 79.95-90 rest-area. Given the pair continue trading southwards below 79.90, the 79.50 and the 78.65 can become market favorites. Meanwhile, adjacent resistance-line figure of 80.65 can limit immediate advances of the pair, breaking which 81.00 & 81.30-35 may entertain buyers. In case the pair surpasses 81.35 barrier, it’s rally to 81.75 & 82.00 could be expected.

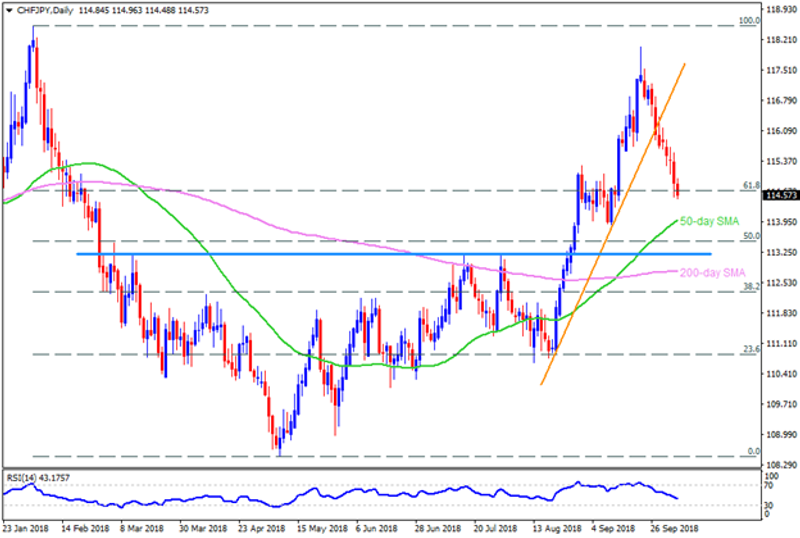

CHF/JPY

Ever since the CHFJPY dipped below month-old ascending trend-line, it never stopped declining and signals the test of 50-day SMA level, around 114.00 now. Should 114.00 fails to trigger the pair’s U-turn, the 113.50 and the 113.25-15 rest-region can try their lucks to confine following downturn, if not then 200-day SMA level of 112.80 seems critical support to observe. Alternatively, the 115.00, the 115.60 and the 116.70 could please the counter-trend traders before emphasizing on 117.20. Also, pair’s successful break of 117.20 can shift limelight to 118.00 and the 118.55 north-side numbers.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance