Important CHF Pairs’ Technical Update: 01.12.2017

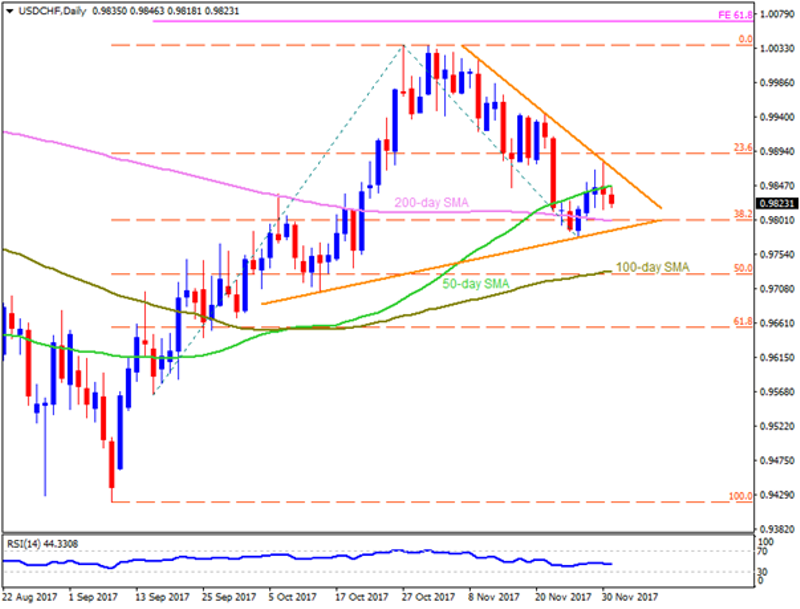

USD/CHF

With the three-week old descending trend-line aptly restricting the USDCHF’s upside, chances of the pair’s dip to re-test 200-day SMA level of 0.9800 become brighter. However, an upward slanting TL, at 0.9780 now, might confine the pair’s following downside. Should the quote refrains to respect the 0.9780 mark, the 0.9755 and the 0.9730 level, comprising 100-day SMA, may flash on the chart. On the upside, 50-day SMA level of 0.9850 seems an immediate resistance for the pair to clear before challenging the 0.9875 TL, which if broken could quickly escalate its advances to 0.9915 and the 0.9940. Moreover, pair’s successful trading beyond 0.9940 enables it to aim for 0.9980 and the 1.0040 resistances.

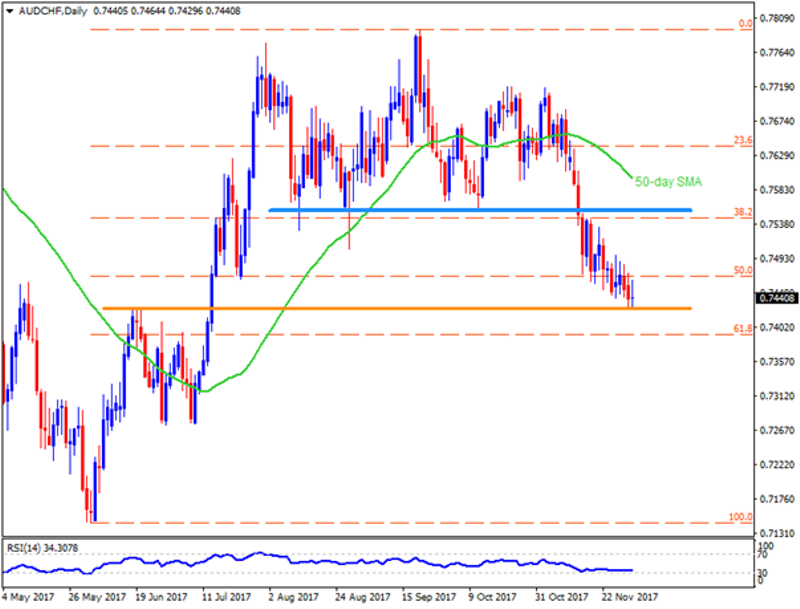

AUD/CHF

AUDCHF’s recent bounce from 0.7430-25 horizontal-line reignites the possibilities to witness 0.7480 and the 0.7510 as price-levels but the 0.7555-60 region could limit the pair’s additional up-moves. Given the pair manages to surpass 0.7560 on a daily closing basis, buyers can target 50-day SMA level of 0.7600. Meanwhile, inability to hold the latest U-turn with a D1 close below 0.7425 can further weaken the pair to rest 0.7395 and the 0.7375 supports, breaking which it 0.7320 and the 0.7300 may gain sellers’ attention. In case if 0.7300 fails to conquer the Bears, the 0.7270 and the 0.7230 may appear in their radar.

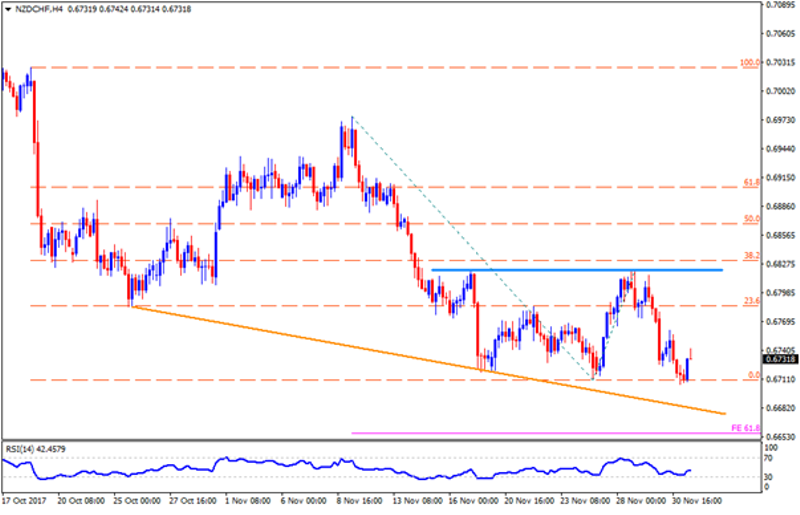

NZD/CHF

Alike AUDCHF, the NZDCHF also bounced from near-term important support-zone and is indicating extended recovery towards 0.6770 and the 0.6800 levels. However, pair’s ability to rise further can only be justified if it can break the 0.6820-25 horizontal-area, which in-turn could help it claim the 0.6855 and the 0.6880 resistances. Alternatively, break of 0.6710-0.6700 may drag the pair to 0.6680 TL support ahead of highlighting the 61.8% FE level of 0.6655. Further, pair’s sustained trading below 0.6655 can open the door for its southward trajectory in direction to 0.6620 and the 0.6580 rest-points.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance