ImmunoGen (IMGN) Surges on Successful Ovarian Cancer Study

ImmunoGen, Inc. IMGN announced that its pivotal study — SORAYA —evaluating its lead pipeline candidate, mirvetuximab soravtansine, met its primary endpoint of objective response rate (ORR). The study evaluated the candidate as monotherapy for patients with platinum-resistant ovarian cancer whose tumors express high levels of FR alpha and who have received prior treatment with Roche’s RHHBY Avastin (bevacizumab).

The company remains on track to file a biologics license application (“BLA”) with the FDA seeking accelerated approval for mirvetuximab in the first quarter of 2022.

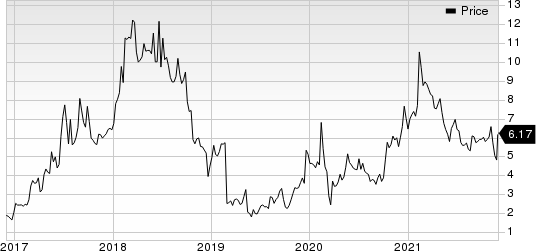

Shares of ImmunoGen surged almost 30% on Nov 30, following the successful completion of its pivotal study. ImmunoGen’s shares have lost 4.4% so far this year compared with the industry’s decrease of 19%.

Image Source: Zacks Investment Research

The SORAYA study was designed to rule out an ORR of 12%, decided based on expected outcomes from Roche’s AURELIA study that evaluated single-agent chemotherapy in platinum-resistant ovarian cancer patients. The AURELIA evaluated the addition of Roche’s Avastin to chemotherapy for treating platinum-resistant ovarian cancer. Roche has already received approval for Avastin as treatment of platinum-resistant, recurrent ovarian cancer based on the AURELIA study in 2014.

Data from the SORAYA study demonstrated that treatment with mirvetuximab achieved an ORR of 32.4% and 31.6% as assessed by a study investigator and a blinded independent central review (BICR), respectively. The median duration response (“DOR”) was 5.9 months as of the data cut-off date. Nearly half of responding patients have continued on therapy and the company expects the final median DOR to improve and could range from 5.7 to just above 7 months. The candidate also demonstrated impressive tolerability with a 10% discontinuation rate.

ImmunoGen believes the promising study data supports its goal of making mirvetuximab standard of care treatment for FR alpha-high ovarian cancer.

ImmunoGen is currently focusing on the potential launch of mirvetuximab next year, following an anticipated approval. The company is also evaluating the candidate in a confirmatory study — MIRASOL — for a similar patient population like the SORAYA study. Data from the MIRASOL study will support full or continued approval for the candidate. It is also developing mirvetuximab combination regimens for earlier lines of treatment in FR alpha-high ovarian cancer patients.

ImmunoGen, Inc. Price

ImmunoGen, Inc. price | ImmunoGen, Inc. Quote

Zacks Ranks & Stocks to Consider

ImmunoGen currently carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the drug sector include Endo International ENDP and Assertio ASRT. While Endo sports a Zacks Rank #1 (Strong Buy), Assertio carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings per share estimates for Endo have moved north from $2.32 to $2.84 for 2021 and from $2.25 to $2.47 for 2022 in the past 30 days.

Endo delivered an earnings surprise of 57.69%, on average, in the last four quarters.

Estimates for 2021 have narrowed from a loss of 33 cents to 7 cents for Assertio in the past 30 days. Estimates for Assertio’s 2022 bottom line have changed from a loss per share of 20 cents to earnings per share of 20 cents in the past 30 days.

Assertio delivered an earnings surprise of 33.33%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Endo International plc (ENDP) : Free Stock Analysis Report

ImmunoGen, Inc. (IMGN) : Free Stock Analysis Report

Assertio Holdings, Inc. (ASRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance