Imagine Owning Urbanise.com (ASX:UBN) And Trying To Stomach The 93% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Urbanise.com Limited (ASX:UBN) investors who have held the stock for three years as it declined a whopping 93%. That'd be enough to cause even the strongest minds some disquiet. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Urbanise.com

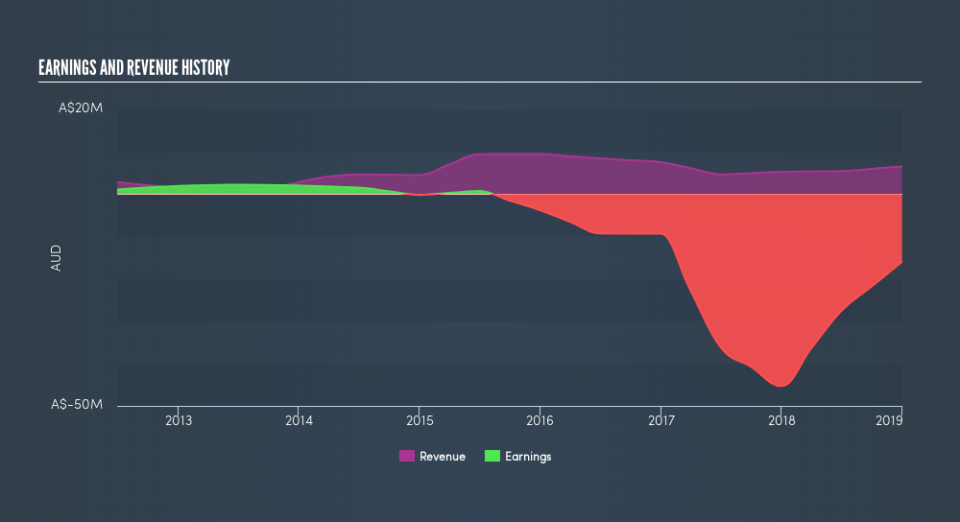

Urbanise.com isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Urbanise.com's revenue dropped 19% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 59% per year. We prefer leave it to clowns to try to catch falling knives, like this stock. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year Urbanise.com shareholders have received a TSR of 11%. Unfortunately this falls short of the market return of around 13%. On the bright side, that's certainly better than the yearly loss of about 58% endured over the last three years, implying that the company is doing better recently. We hope the turnaround in fortunes continues. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Urbanise.com better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance