Imagine Owning Anika Therapeutics (NASDAQ:ANIK) And Wondering If The 33% Share Price Slide Is Justified

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Anika Therapeutics, Inc. (NASDAQ:ANIK) share price slid 33% over twelve months. That contrasts poorly with the market return of 10%. Even if you look out three years, the returns are still disappointing, with the share price down (the share price is down 30%) in that time. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

Check out our latest analysis for Anika Therapeutics

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

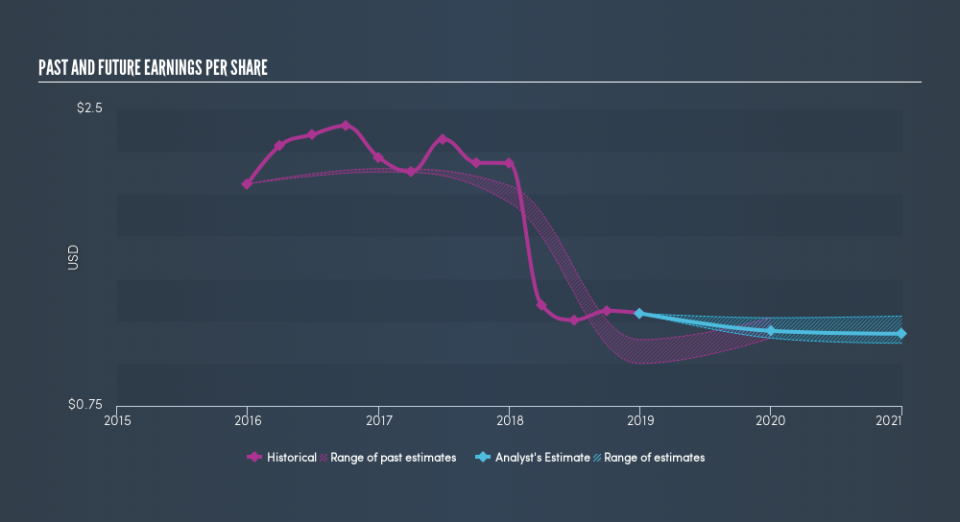

Unfortunately Anika Therapeutics reported an EPS drop of 41% for the last year. This fall in the EPS is significantly worse than the 33% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Anika Therapeutics's key metrics by checking this interactive graph of Anika Therapeutics's earnings, revenue and cash flow.

A Different Perspective

Investors in Anika Therapeutics had a tough year, with a total loss of 33%, against a market gain of about 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.4% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you would like to research Anika Therapeutics in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance