Ichimoku Alert: Bearish Pressure On XAU/USD With Strong Post-Election Reversal

DailyFX.com -

Ichimoku Alert: Bearish Pressure On XAU/USD With Strong Post-Election Reversal

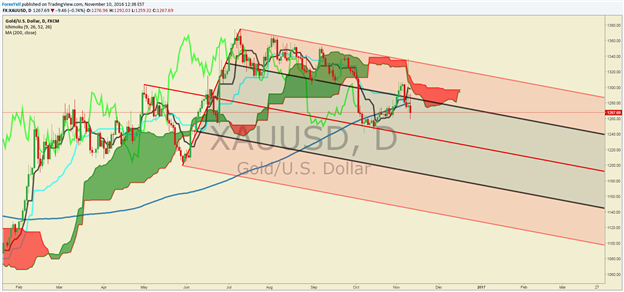

Chart:

XAU/USD price moved lower aggressively after a knee-jerk reaction higher after President-Elect Trump won the November 8 U.S. Presidential Election. The $77/oz drop in price showed the quick shift from risk-off to risk-on that is also displayed in JPY weakness since Wednesday morning. From a technical perspective, we can see that price has shown two bearish developments independent of Ichimoku. First, the price was rejected on Wednesday morning at the top of a falling channel drawn known as Andrew’s Pitchfork. Secondly, the price has traded back below the 200-DMA, which is a classic trend filter in addition to the Ichimoku Cloud.

Looking at Ichimoku, you can see that the price had moved aggressively higher toward the top of the cloud, which is seen as a trend filter. However, traders did not continue to buy XAU/USD above 1,330 and the price aggressively reversed. Eventually, the price continued to trade below the cloud by the end of Wednesday’s trading day.

Ichimoku traders who look at the Daily chart can look to see if the price stays below the cloud, which has turned a Bearish color (red) on that chart. In addition to price, keeping an eye on the lagging line (bright green line behind price) staying below the price and the cloud would be indicative of Bearish pressure remains.

Lastly, the DXY strength post-election should be watched for continuation. There is a view that President-Elect Trump could bring inflationary pressure that may push up the pace of expected rate hikes. If DXY continues to strengthen and the XAU/USD price breaks below the October low and 76.4% Fibonacci Retracement at $1,241/oz, the Bearish pressure may continue to build.

A move of the Gold price above the 200-DMA and the Cloud on a Closing basis would indicate a reversal may be underway. Traders could look to the DXY and FOMC rate hike expectations to confirm a move higher in Gold should such a reversal surface.

What Is Ichimoku Cloud? Read Our Definitive Guide to Trading Trends with Ichimoku Cloud

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance