Hudson (HDSN) Boosts Portfolio With USA Refrigerants Deal

Hudson Technologies HDSN announced that it acquired all assets of USA United Suppliers of America, Inc., which operates under the trade name USA Refrigerants. This move will allow Hudson to expand its expertise and service to a broader customer base.

The deal totaled $20.7 million, subject to customary post-closing adjustments and around $2 million in future earnout payments. The estimated value of this transaction is in line with HDSN's purchase price valuation target of 6X EBITDA.

USA Refrigerants is a national refrigerant distributor. The company generated average annual revenues of approximately $20 million over the last three years. It has long-term working relationships with ACCA members and other industry groups for purchasing recovered refrigerants. This, along with giving the buying team access to Hudson's customer base, will improve the capacity to acquire all recovered refrigerants.

USA Refrigerants customers will receive additional resources and expertise in field service, recovery and reclamation.

With the support of this acquisition, HDSN will be able to expand its capacity for locating recovered and reclaimed refrigerants. This will allow the company to gain from the increased sales of these higher-margin refrigerants and the market becomes imbalanced due to the present and upcoming phase-downs of virgin refrigerants.

The company is expected to gain from the increased sales of these higher-margin refrigerants, capitalizing on the impending imbalance in the market due to the ongoing and upcoming phase-downs of virgin refrigerants.

The company reported earnings per share of 20 cents in first-quarter 2024, which beat the Zacks Consensus Estimate of 19 cents. The bottom line declined 39.4% year over year. Hudson’s quarterly sales dipped 15.6% year over year to $65 million. However, the top line beat the consensus estimate of $61 million.

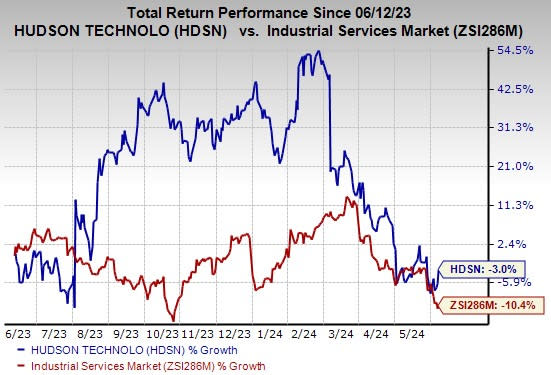

Price Performance

In the past year, HDSN shares have lost 10.4% compared with the industry’s 3% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Hudson currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Industrial Products sector are Intellicheck, Inc. IDN, Applied Industrial Technologies AIT and Cintas Corporation CTAS. IDN currently sports a Zacks Rank #1 (Strong Buy), and AIT and CTAS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Intellicheck’s 2024 earnings is pegged at 2 cents per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 28.9%. IDN shares have gained 15.2% in the past year.

Applied Industrial has an average trailing four-quarter earnings surprise of 8.2%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.62 per share, which indicates year-over-year growth of 9.9%. Estimates have moved north by 2% in the past 60 days. The company’s shares have gained 51.2% in the past year.

The Zacks Consensus Estimate for Cintas Corporation’s 2024 earnings is pegged at $14.95 per share. The consensus estimate for 2024 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 4.3%. CTAS shares have gained 42.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Hudson Technologies, Inc. (HDSN) : Free Stock Analysis Report

Intellicheck Mobilisa, Inc. (IDN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance