How to get rich in a Covid-19 world

The coronavirus has made a lot of people get real about how they’re building their wealth. And given the virus has condemned government-safe term deposits at banks to the 1 per cent return region, it means other more risky money-making investments are going to have to be considered.

This means you need to do a number of smart moves to ensure you’re able to build up your wealth.

So let me list these for you. Here goes:

You’re going to have to take more risks.

You’ll need to be diversified.

You’ll need to invest for the longer term.

You’ll have to commit to understanding more about money and building wealth.

Let me look at these suggestions in more detail.

First, when you can’t grow your wealth the safest way using bank deposits backed by the Federal Government up to $250,000, you do need to look at other investments. This has led investors to look at bond funds, hybrids, stocks and funds that invest in stocks. Bond funds and hybrids, which are like a bond fund but also a bit like a share, can offer returns around 2-3 per cent nowadays.

Some can be outliers and can make better returns but it does depend on the smarts of the fund manager. These are relatively safe — that’s why their returns are so low. But remember this: if the promised yield or return is high, then the product is more risky.

Some people chasing income might invest in dividend-paying stocks or dividend-chasing funds, like my own Switzer Dividend Growth Fund, which has paid nice dividends but its unit price (like all shares and funds) fell in the COVID-19 crash.

More from Switzer: Shares v savings accounts: The risks and rewards

More from Switzer: The $100,000 reason you should become smarter with your money

More from Switzer: Revamp your finances: How to get a money strategy and stick to it

Second, because of the added risk of investing in other products rather than term deposits, you need to be diversified. When I construct a portfolio of stocks for myself or a financial planning client, we might select 20 stocks so the client isn’t overexposed to any one company.

We also split the money between local and foreign shares and funds, as well as look at fixed interest funds, such as bond funds, just to reduce the chances of one big investment going very badly. When you go risky, go diversified.

Third, I recently lost a client who didn’t like losing money when the coronavirus crashed the stock market by 36 per cent! Of course, no one did! He got cranky and pulled his money out. Within six weeks, it had rebounded so he lost on the way down and lost on the way up. Financial planners can’t be right always in the short term. Nor can an individual. But a professional working with you (over time) should learn how to invest to be right in the long term.

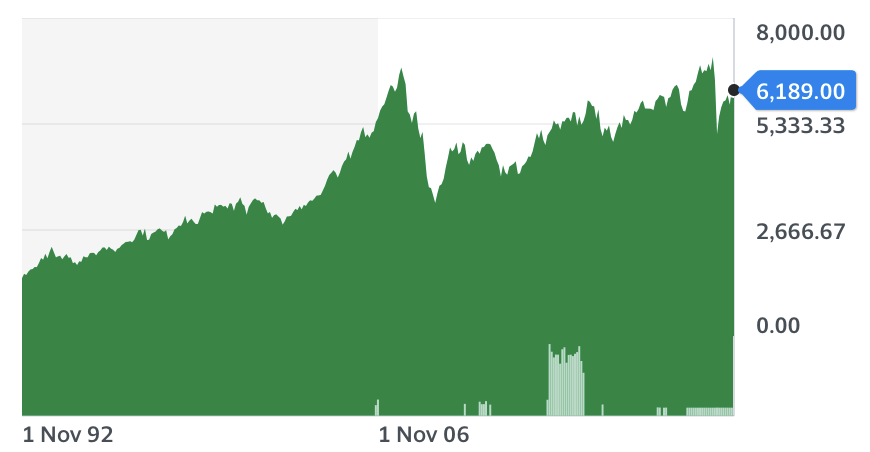

The chart below looks at the Australian stock market between 1992 and 2020 and you can see the ups and downs when investors felt great and scared. But note how over time the ‘feeling great’ experience well and truly beat the ‘feeling scared’ times.

Finally, you might be asking how someone can get access to returns like the ones implied in the chart above. If you do your money homework, you’ll learn that there are exchange trade funds or ETFs (such as IOZ or VAS) that give you the top 200 or 300 companies in one trade or ETF. You only have to sign up with an online stock broker and use this search engine to study up about ETFs for the Australian stock market — and you’ll be on the road to riches.

And it will happen. Give yourself time and keep on becoming money smart.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance