Household income is actually rising amid coronavirus: Here’s how

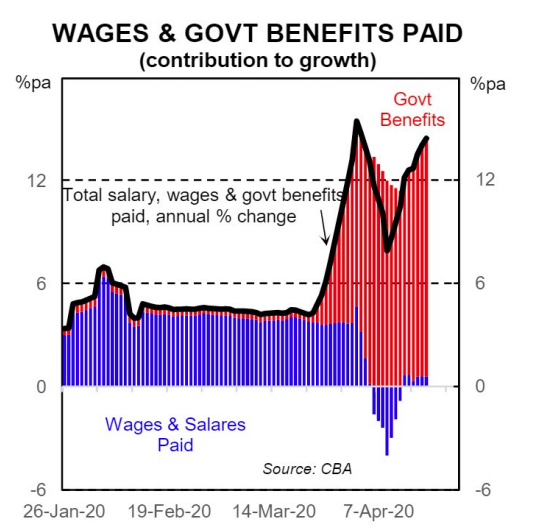

The government’s stimulus payments have outweighed the fall in wages and salaries that have occurred over the coronavirus crisis, new data from the Commonwealth Bank has revealed.

In a report, CBA head of economics Gareth Aird acknowledged that economic activity had ground to a halt as a result of the pandemic, but said analysis of payments to CBA bank accounts painted “a very different picture” of household income.

“Our data indicates that at an aggregate level the reduction in household income from job losses to date has been more than offset by an increase in government benefit payments,” Aird wrote.

Also read: $550 vs $750 vs $1,500: Which coronavirus cash payment do I get?

Also read: Here is every single date for your coronavirus cash payments

Also read: 5 ways to safeguard your finances from Coronavirus

“Indeed, the annual growth rate in our partial read on household income that comprises wages and salaries paid plus government benefits paid has risen over April.”

Essentially, it means that though workers have seen reduced hours or lost their jobs, the data shows they’re actually better off with the stimulus payments.

Aird said the volume of government benefits paid to CBA accounts had “surged” in the last month, with a 50 per cent rise in bank accounts receiving JobSeeker.

The first one-off $750 Economic Support payment has also been paid, with the second tranche to hit bank accounts on 13 July for eligible Australians.

Looking at wages and salaries paid into CBA bank accounts combined with government benefits paid into CBA bank accounts gives a “partial read” on household income – and early indicators is that it’s rising.

“Our data indicates the profound impact that fiscal stimulus has had on the household sector,” said Aird.

The cash payment won’t exactly be able to boost a goods and services sector that has shut down. “But fiscal stimulus can help to plug the gap in household income that is a natural consequence of job losses.”

There is lag time that needs to be accounted for in the data, given that not all the stimulus payments have begun flowing yet, as well as those employees who have lost their jobs but are receiving some form of payment in the form of leave being paid out or 4 weeks’ termination notice.

The data also doesn’t take into account the $550 JobSeeker payments that commenced this Monday.

JobKeeper payments will also technically be captured in the data under ‘salaries and wages’.

The $550 boost to JobSeeker is not expected to last, with Prime Minister Scott Morrison all but confirming that the boost will not extend beyond the six months that it has been locked in for.

Also read: JobKeeper passed: Am I eligible for the $1,500 wage subsidy?

Also read: Does your employer qualify for JobKeeper?

An income reporting misstep by Centrelink saw thousands of Australians’ $550 Coronavirus Supplement payments delayed for some applicants as they did not report their income by 27 April.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance