House prices fall for the first time in 11 months

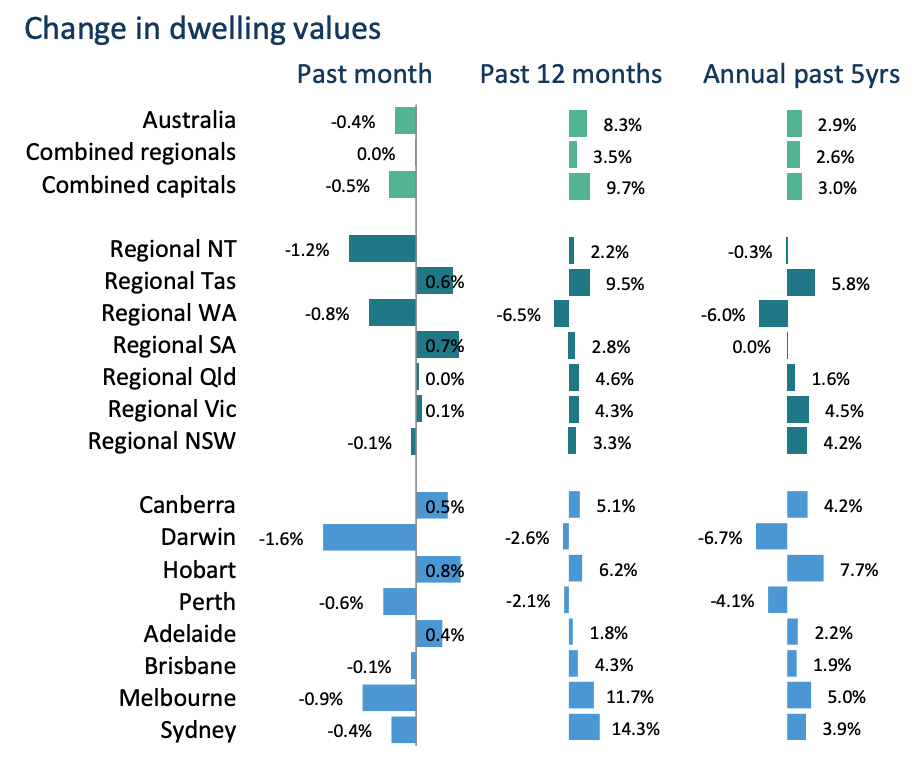

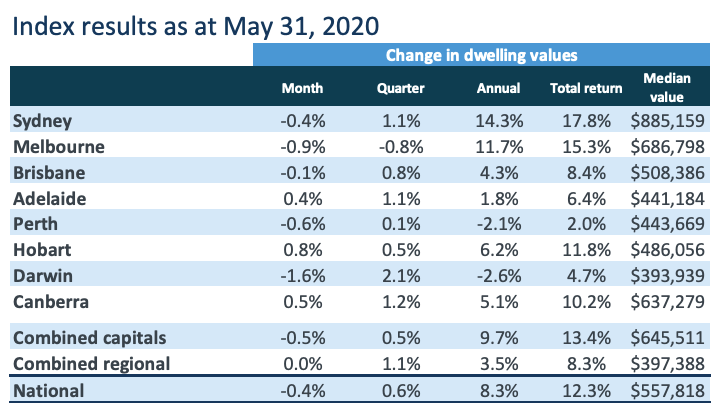

Australia’s house prices saw a drop of 0.4 per cent over the month of May, representing the first monthly drop in property values since June last year, new data has revealed.

According to fresh figures by CoreLogic, the domestic property market has copped some bruising with five of the nation’s eight capital cities seeing price falls.

Darwin recorded the largest monthly fall of -1.6 per cent, followed by Melbourne at -0.9 per cent.

But the national average drop of 0.4 per cent means the damage to the property market has been less than experts had anticipated for.

“Considering the weak economic conditions associated with the pandemic, a fall of less than half a percent in housing values over the month shows the market has remained resilient to a material correction,” said CoreLogic head of research Tim Lawless.

“With restrictive policies being progressively lifted or relaxed, the downwards trajectory of housing values could be milder than first expected.”

In mid-May, the Commonwealth Bank was predicting house price falls of as high as 32 per cent.

Also read: ‘Remarkably resilient’: Australian property marks surprising April result

Also read: ‘The risks are there’: JobKeeper warning for home owners

Some good news

But there are other indications that the property market is already starting to pick up: CoreLogic’s estimate of sales activity rebounded by 18.5 per cent in May after a drop of 33 per cent in April.

A rise in consumer sentiment also generally means that housing market activity will heat up. ANZ Roy Morgan’s weekly consumer confidence index has risen for eight weeks in a row.

“With consumers feeling more confident, households are better equipped to make high commitment decisions such as buying or selling a home,” said Lawless.

“A lift in housing market activity should also support broader economic activity, with housing turnover providing positive flow-on effects to other sectors including retail, construction and banking.”

Rising levels of consumer confidence is also seeing a lift in listing numbers and improvements across auction markets.

Some bad news

However, the long-term outlook is still looking uncertain, given that government stimulus payments will end at some point and repayment deferrals will also expire.

“In the absence of these policies, housing values could come under some additional downwards pressure if economic conditions haven’t picked up towards the end of the year,” said Lawless.

Capital cities are also less resilient to property value falls than regional areas, the report indicated.

Month on month, house values in regional areas remained flat, while Australia’s capital cities saw a combined drop of -0.5 per cent.

Compared to the same time last year, capital city property prices have dropped by 9.7 per cent but only 3.5 per cent in regional areas.

The biggest price drops across the last month happened among Sydney and Melbourne’s most expensive properties.

“Melbourne’s most expensive quartile of the market recorded a 1.3% drop in values over the month, compared with a 0.6% fall across the broad ‘middle’ of the market and a 0.3% fall across the most affordable quartile,” said the CoreLogic report.

“Similarly, in Sydney, the top quartile was down 0.6% while the lower quartile posted a 0.1% increase in values.”

But compared to 12 months ago, Melbourne’s top quartile property values are still up 13.9 per cent and Sydney’s is up 16.5 per cent.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance