Australian house prices record the best quarter in a decade

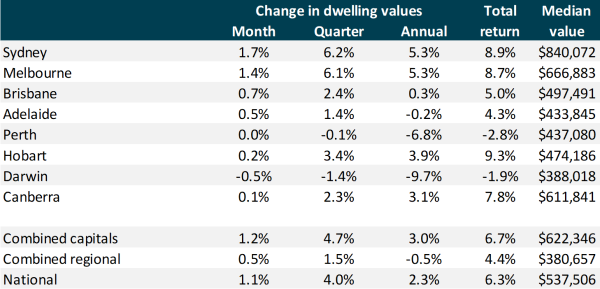

Australian dwelling values rose by 1.1 per cent in December and 4 per cent in the last three months of 2019, bringing national house price growth to 2.3 per cent over the course of the year.

The 4 per cent growth in the December quarter represents the fastest growth over a three-month period since November 2009, according to CoreLogic’s newly released figures.

Every Australian capital city recorded a growth in property values aside from Darwin during December, which fell by 0.5 per cent.

Related story: 'The X factor': 11 lessons learnt about the Aussie property market in 2019

Related story: Then, now and in the future: A glance at Australian property

Related story: Bargain homes: Where to find ‘cheapie’ property hotspots

Sydney and Melbourne were again the main drivers of growth during December, with property values in these cities rising 1.7 per cent and 1.4 per cent over the month respectively.

Unsurprisingly, the nation’s two biggest cities also recorded the strongest growth over the year of 2019.

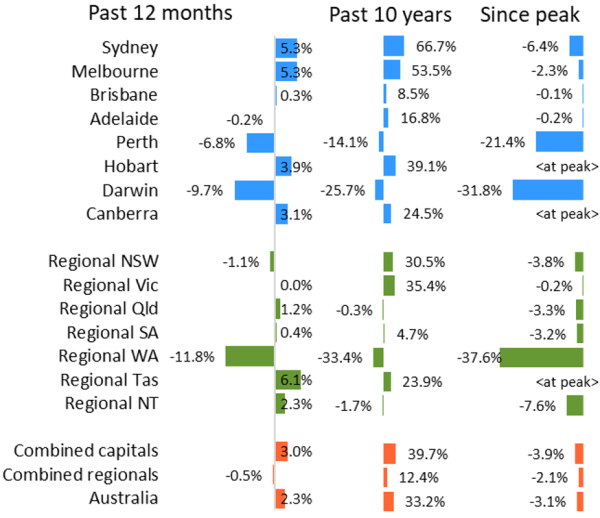

Only Perth and Darwin saw the year out in negative growth territory, with dwelling values plummeting by 6.8 per cent and 9.7 per cent respectively over the last 12 months.

Though December was another month of growth, the pace has slowed compared to previous months.

“Although the monthly capital gains trend remains fast-paced, the 1.1 per cent rise in December was softer relative to the 1.7 per cent gain in November and the 1.2 per cent rise in October,” said CoreLogic head of research Tim Lawless.

“This would suggest that the pace of capital gains may have been dampened by higher advertised stock levels or worsening affordability pressures through early summer.”

Lawless added that the positive year-end results marked “a year of two distinct halves”.

“We saw capital city dwelling values fall by 3.8 per cent over the first six months of 2019 and then rebound by 7 per cent over the second half of the year.

“The housing value rebound was spurred on by lower mortgage rates, a relaxation in borrower serviceability assessments, improved housing affordability and renewed certainty around property taxation policies post the federal election.”

However, we’re not back at peak levels

Though property values rebounded in the second half of 2019, they’re still on average 3.3 per cent below the nation’s previous record highs.

However, this isn’t the case for Hobart, Canberra and regional Tasmania, which are currently at peak.

The bounce-back in the housing market is good news for homeowners – but bad news for those wanting to get a foot on the property ladder, said Lawless.

“A nominal recovery in housing values implies home owners are becoming wealthier, which may also help to support household spending.

“However, the flipside is that housing affordability is set to deteriorate even further as dwelling values outpace growth in household incomes, signalling a set-back for those saving for a deposit,” he said.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance