Honda (HMC) Surpasses Q4 Earnings and Revenue Estimates

Honda HMC reported earnings of 63 per share for fourth-quarter fiscal 2022, surpassing the Zacks Consensus Estimate of 57 cents. The bottom line, however, fell from the year-ago profit of $1.17 per share. Quarterly revenues totaled $33,358 million, topping the Zacks Consensus Estimate of $33,180 million. The top line also edged up 7% year on year.

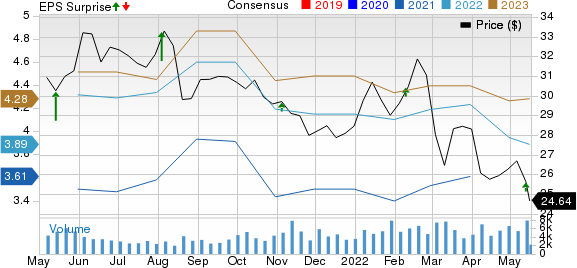

Honda Motor Co., Ltd. Price, Consensus and EPS Surprise

Honda Motor Co., Ltd. price-consensus-eps-surprise-chart | Honda Motor Co., Ltd. Quote

Segmental Highlights

For the three-month period, which ended on Mar 31, 2022, revenues from the Automobile segment increased 4.8% year over year to ¥2.53 trillion ($21.8 billion). The segment registered an operating profit of ¥47.6 billion ($410.3 million), up 26.6% on a year-over-year basis.

Revenues from the Motorcycle segment came in at ¥583.2 billion ($5 billion), up 10.2% year over year. The unit’s operating profit came in at ¥79.1 billion ($680.8 million), rising 9.4% year over year.

Revenues from the Financial Services segment totaled ¥706.8 billion ($6.1 billion), up 9.8% year on year. The unit’s operating profit, however, decreased 29.6% year over year to ¥74.8 billion ($644.5 million).

Revenues from the Life Creation and Other Business came in at ¥112.8 billion ($971 million), up 12.3% year over year. The segment incurred an operating loss of ¥2 billion ($17.7 million), narrower than the year-ago loss of ¥3 billion.

Financials

The company’s total annual dividend per share for fiscal 2022 was ¥120, which includes an interim dividend of ¥55 and a year-end dividend of ¥65. For fiscal 2023, Honda expects a total annual dividend of ¥120 per share, including an interim and year-end cash dividend of ¥60 each.

Consolidated cash and cash equivalents were ¥3.7 trillion ($30.26 billion) as of Mar 31, 2022. Long-term debt was ¥4.98 trillion ($41 billion).

FY23 View

For fiscal 2023, Honda forecasts sales of ¥16.3 trillion, implying an 11.7% uptick year over year. Honda projects sales volumes from Motorcycle and Automobile segments at 18.5 million units and 4.2 million units in fiscal 2023, up around 9% and 5%, respectively. Operating profit is now forecast at ¥810 billion, indicating a year-over-year decline of 7%. Pretax profit is envisioned at ¥1,035 billion, signaling a drop of 3.3% from fiscal 2022.

The company’s R&D expenses for fiscal 2023 are likely to be ¥840 billion, suggesting a rise from ¥804 billion spent in fiscal 2022. Capex is envisioned at ¥500 billion, indicating a jump from ¥278.4 recorded in fiscal 2022.

Honda currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Takeaways From Toyota’s Q4 Results

Honda’s closest peer Toyota TM posted fourth-quarter fiscal 2022 earnings of $3.34 per share, which surpassed the Zacks Consensus Estimate of $2.40 on higher-than-expected revenues. The bottom line, however, declined from the year-ago earnings of $5.18 a share amid chip woes and supply chain disruptions aggravated by the Russia-Ukraine war. Consolidated revenues came in at $69,824 million, beating the consensus mark of $68,197 million but contracting 3.8% year over year.

For fiscal 2023, Toyota projects consolidated vehicle sales of 8.85 million units, indicating an increase from 8.23 million units sold in fiscal 2022. Fiscal 2023 sales are expected to total ¥33 trillion, implying an increase from ¥31.4 trillion recorded in fiscal 2022. Operating income is projected at ¥2.4 trillion, indicating a decline of 19.8% year over year. Pretax profit is estimated at ¥3.1 trillion, down from ¥4 trillion generated in fiscal 2022. R&D expenses are envisioned at ¥1,130 billion, suggesting a nominal rise from ¥1,124 billion spent in fiscal 2022. Capex is forecast at ¥1.4 trillion, signaling an uptick from ¥1.34 trillion spent in fiscal 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Honda Motor Co., Ltd. (HMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance