Regions where houses are worth less than they were 10 years ago

The Australian housing market recorded its best quarter of growth in 10 years after property prices surged a staggering 4 per cent to the end of December.

Related story: The Red Rooster line: Does it actually affect property prices?

Related story: House prices in these cities are set to explode

Related story: Will the First Home Buyers’ scheme be effective?

And over the last 10 years, Australian dwelling values have grown a whopping 33.2 per cent, according to CoreLogic figures.

But for several Australian regions, the opposite has occurred.

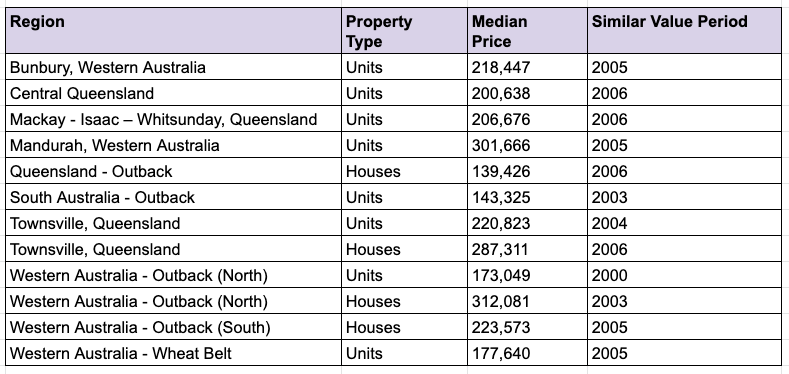

Analysis performed by property research group, RiskWise, highlighted the regions where property values are less than they were 10 years ago.

CEO Doron Peleg said these regions highlight the problems with believing that property values will always go up, with many of these regions former resource-heavy economies.

“The key drivers for price stabilisation, and later on price growth, depend on employment and population growth and in many SA4s [regions] these critical factors are still showing very negative indicators,” he said.

“In addition, it’s important to understand that even price stabilisation, or some positive price increases in a short period of time, does not necessarily mean there will be sustained price growth. For example, don’t expect the mining areas to deliver solid capital growth like that of Sydney and Melbourne as they simply don’t have the same employment and population growth rates.”

Worst-performing regions where values are less than they were 10 years ago

All the regions are in Western Australia, Queensland and the Northern Territory, Peleg said, noting that there were no regions in Sydney or Melbourne where prices were worth less than they were just five years ago.

In the majority of regions in NSW and Victoria, current prices are higher than they were in 2014 and earlier.

“This shows us very clearly that economy is crucial when it comes to driving property prices and that proximity to employment hubs that provide sustainable employment, for example Greater Sydney and Melbourne, carries lower risk,” he said.

“It’s important to realise too that, as with many of the mining areas, there is a tangible risk in the long term if you buy properties with inflated values and that this long-term risk can be way over 10 years and, in some cases as much as 20 years.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance