Some HIVE Blockchain Technologies (CVE:HIVE) Shareholders Have Taken A Painful 71% Share Price Drop

HIVE Blockchain Technologies Ltd. (CVE:HIVE) shareholders should be happy to see the share price up 15% in the last month. But that doesn't change the fact that the returns over the last year have been stomach churning. Specifically, the stock price nose-dived 71% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The bigger issue is whether the company can sustain the momentum in the long term.

See our latest analysis for HIVE Blockchain Technologies

Because HIVE Blockchain Technologies made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year HIVE Blockchain Technologies saw its revenue grow by 19%. We think that is pretty nice growth. However, it seems like the market wanted more, since the share price is down 71%. One fear might be that the company might be losing too much money and will need to raise more. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

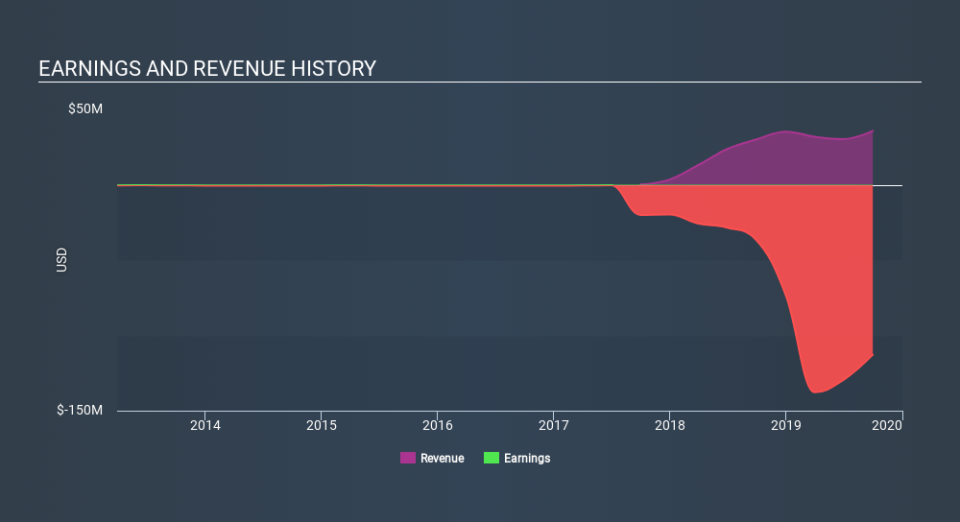

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of HIVE Blockchain Technologies's earnings, revenue and cash flow.

A Different Perspective

The last twelve months weren't great for HIVE Blockchain Technologies shares, which cost holders 71%, while the market was up about 14%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Investors are up over three years, booking 3.1% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like HIVE Blockchain Technologies better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance