Hibbett (NASDAQ:HIBB) Misses Q1 Revenue Estimates

Athletic apparel and footwear retailer Hibbett (NASDAQ:HIBB) missed analysts' expectations in Q1 CY2024, with revenue down 1.8% year on year to $447.2 million. It made a GAAP profit of $2.67 per share, down from its profit of $2.74 per share in the same quarter last year.

Is now the time to buy Hibbett? Find out in our full research report.

Hibbett (HIBB) Q1 CY2024 Highlights:

Revenue: $447.2 million vs analyst estimates of $453.9 million (1.5% miss)

Gross Margin (GAAP): 35.8%, up from 33.7% in the same quarter last year

Locations: 1,169 at quarter end, up from 1,143 in the same quarter last year

Same-Store Sales fell 5.8% year on year

Market Capitalization: $1.03 billion

JD Sports will acquire the company for $87.50 per share in a $1.1 billion transaction, expected to close in 2H24

Mike Longo, President and Chief Executive Officer, stated, “Our sales and diluted earnings per share for the first quarter of Fiscal 2025 were in line with our expectations in a very challenging athletic footwear and apparel retail market. Despite these challenges, we continue to execute our long-term strategy, establishing Hibbett and City Gear stores as preferred shopping destinations for the compelling product assortment we offer to underserved communities across the country.

With a focus on small and mid-sized markets, Hibbett (NASDAQ:HIBB) is a specialty retailer that sells athletic apparel and footwear as well as select sports equipment.

Sports & Outdoor Equipment Retailer

Some of us spend our leisure time vegging out, but many others take to the courts, fields, beaches, and campsites; sports equipment retailers cater to the avid sportsman as well as the weekend warrior. Shoppers can find everything from tents to lawn games to baseball bats to satisfy their athletic and leisure needs along with competitive prices and helpful store associates that can talk through brands, sizing, and product quality. This is a category that has moved rapidly online over the last few decades, so these sports and outdoor equipment retailers have needed to be nimble and aggressive with their e-commerce and omnichannel presences.

Sales Growth

Hibbett is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

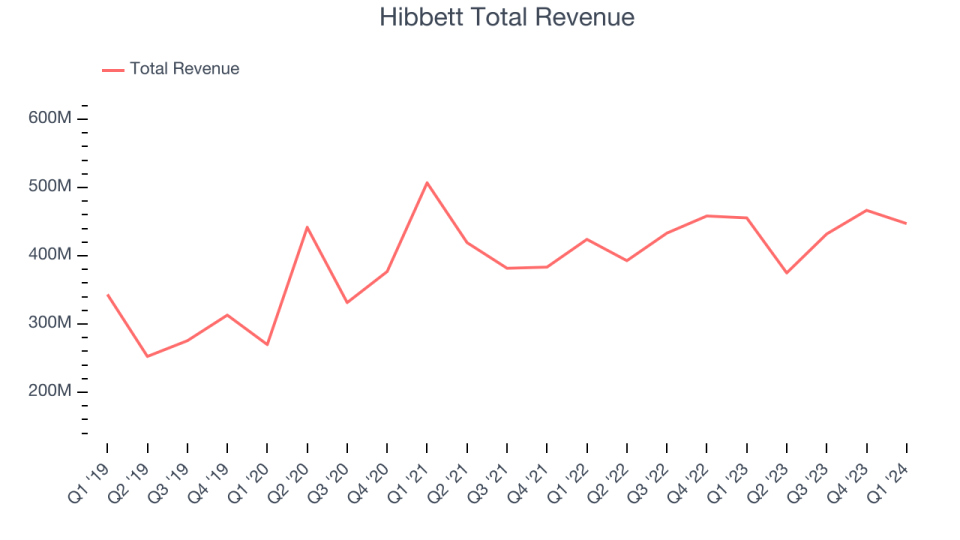

As you can see below, the company's annualized revenue growth rate of 9.8% over the last five years was mediocre as it opened new stores and expanded its reach.

This quarter, Hibbett missed Wall Street's estimates and reported a rather uninspiring 1.8% year-on-year revenue decline, generating $447.2 million in revenue.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Hibbett's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 0.2% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Hibbett's same-store sales fell 5.8% year on year. This decline was a reversal from the 4.1% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Hibbett's Q1 Results

We were impressed by how significantly Hibbett blew past analysts' gross margin expectations this quarter. On the other hand, its revenue unfortunately missed analysts' expectations. None of this matters, however, as JD Sports will acquire the company for $87.50 per share in a $1.1 billion transaction. The deal is expected to close in the second half of 2024, and the stock is flat after reporting. It currently trades at $86.55 per share.

So should you invest in Hibbett right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance