Hershey's (HSY) Pricing & Buyouts Solid, Stock Up 17% YTD

The Hershey Company HSY appears to be well-placed, courtesy of its effective pricing actions. This leading snacks company’s brand strength and focus on innovations are yielding results. In addition, strategic acquisitions are boosting portfolio strength.

The aforementioned aspects were evident in its second-quarter 2022 results, wherein the top and bottom lines surpassed the Zacks Consensus Estimate and increased year over year. Considering the solid performance and impressive second-half 2022 projections, management raised its 2022 guidance.

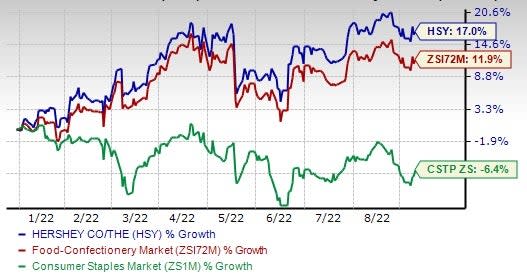

This Zacks Rank #2 (Buy) stock has rallied 17% year to date compared with the industry’s 11.9% growth. The stock has outperformed the Zacks Consumer Staples sector, which has declined 6.4% decline in the period. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s delve deeper.

Image Source: Zacks Investment Research

Solid Q2 Results & Raised View

Higher prices, improved volumes and buyout contributions drove Hershey’s second-quarter 2022 performance. HSY witnessed broad-based growth, with every segment registering double-digit sales growth and generating impressive earnings. The company posted adjusted earnings of $1.80, increasing 22.4% year over year. Consolidated net sales of $2,372.6 million rose 19.3%. On the basis of constant-currency (cc), organic net sales rose 14.1% along with favorable pricing and volume in all segments.

Management now envisions net sales growth in the band of 12-14% for 2022. Pretzels, Dot's and Lily's buyouts are likely to result in a 4-5 point benefit to net sales growth. Earlier, net sales were expected to grow 10-12%. Hershey now expects adjusted earnings per share (EPS) to increase 12-14% for 2022, while reported EPS growth is likely to be in the 9-12% band. Management had earlier projected adjusted EPS to increase 10-12%, while reported EPS growth was likely to be in the 8-11% band.

Pricing & Brand Strength Bodes Well

Hershey is undertaking strategic pricing initiatives to improve performance. In the second quarter of 2022, net price realization contributed 9.5 points to net sales growth, fueled by higher list price and moderately reduced levels of promotional activity. In the North America Confectionery segment, net price realization contributed 9.8 points of growth, led by higher list price increases and reduced promotional activity. In the North America Salty Snacks segment, net price realization contributed 14.6 points to the upside. Price realization contributed 3 points to sales in the International unit.

Hershey regularly brings innovation to its core brands to meet consumer demand. On its last earnings call, management highlighted that it expects increased inventory levels, advertising and merchandising to fuel everyday sales and share performance in the second half of 2022. It expects seasonal consumer engagement with high single-digit sales growth during Halloween and the holiday season. In addition, it is committed to support brands through solid media marketing.

Buyouts: A Key Driver

Hershey has been undertaking buyouts to augment portfolio strength and boost revenues. In December 2021, Hershey acquired Dot’s Pretzels LLC — the owner of Dot’s Homestyle Pretzels, a leading brand in the pretzel category. The addition of Dot’s Pretzels is a perfect match for Hershey’s growing salty snacking portfolio. On its last earnings call, management highlighted that Dot’s Pretzels growth continues to significantly outperform the pretzel category. The company also purchased Pretzels Inc. from an affiliate of Peak Rock Capital. The acquisition further expands Hershey’s production capabilities.

On Jun 25, 2021 Hershey concluded the acquisition of Lily's, a leading better-for-you (BFY) confectionery brand. The buyout was in tandem with Hershey’s focus on creating an impressive BFY confection portfolio as part of its multipronged better-for-you snacking strategy. In the second quarter of 2022, net sales included a 5.3-point benefit from the Pretzels, Dot's and Lily's buyouts.

Other Food Players Benefiting From Buyouts

Several other companies in the food space, like The Kraft Heinz Company KHC, Hormel Foods Corporation HRL and McCormick & Company, Incorporated MKC are benefiting from acquisitions.

In April 2022, Kraft Heinz acquired a majority stake in a Brazil-based condiments and sauces company — Companhia Hemmer Indústria e Comércio ("Hemmer"). The buyout has widened Kraft Heinz's International Taste Elevation platform and enhanced its presence across emerging markets. In January 2022, KHC acquired an 85% stake in Germany-based Just Spices GmbH (“Just Spices”). The buyout enhanced its direct-to-consumer operations and go-to-market expansion.

Hormel Foods is strengthening its business through strategic acquisitions. In June, HRL acquired the Planters snacking portfolio from Kraft Heinz. Prior to this, it acquired Texas-based pit-smoked meats company Sadler's Smokehouse in March 2020. The buyout was in sync with Hormel Foods’ initiatives to strengthen its position in the foodservice space.

McCormick has strategically increased its presence through acquisitions and strengthened its portfolio. In December 2020, MKC bought a 100% stake in FONA International, LLC and some of its affiliates. FONA’s diverse portfolio helps McCormick bolster its value-add offerings and expand the flavor solutions segment into attractive categories. In November 2020, McCormick acquired the parent company of Cholula Hot Sauce — a premium Mexico-based hot sauce brand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

Hormel Foods Corporation (HRL) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance