Here's Why We're Not Too Worried About Antisense Therapeutics' (ASX:ANP) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Antisense Therapeutics (ASX:ANP) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Antisense Therapeutics

Does Antisense Therapeutics Have A Long Cash Runway?

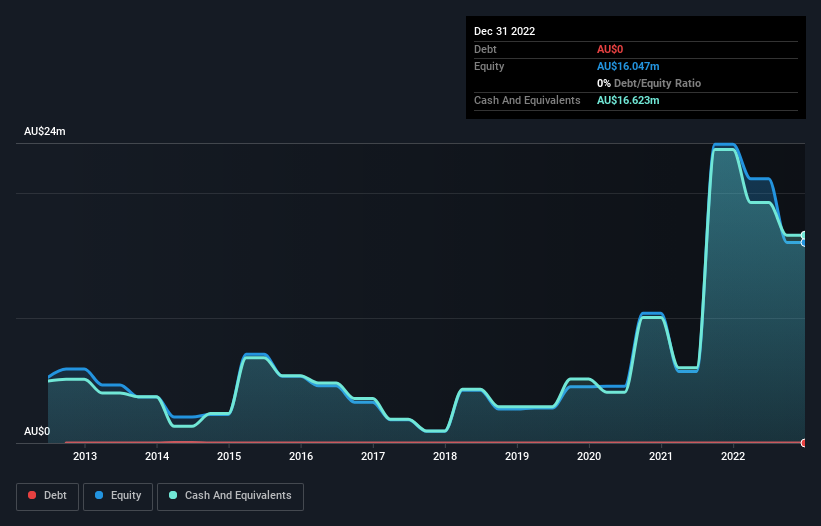

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Antisense Therapeutics last reported its balance sheet in December 2022, it had zero debt and cash worth AU$17m. Importantly, its cash burn was AU$6.8m over the trailing twelve months. Therefore, from December 2022 it had 2.4 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. The image below shows how its cash balance has been changing over the last few years.

How Is Antisense Therapeutics' Cash Burn Changing Over Time?

Although Antisense Therapeutics had revenue of AU$2.0m in the last twelve months, its operating revenue was only AU$168k in that time period. Given how low that operating leverage is, we think it's too early to put much weight on the revenue growth, so we'll focus on how the cash burn is changing, instead. As it happens, the company's cash burn reduced by 10% over the last year, which suggests that management are maintaining a fairly steady rate of business development, albeit with a slight decrease in spending. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Antisense Therapeutics Raise More Cash Easily?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Antisense Therapeutics to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of AU$47m, Antisense Therapeutics' AU$6.8m in cash burn equates to about 14% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Antisense Therapeutics' Cash Burn A Worry?

The good news is that in our view Antisense Therapeutics' cash burn situation gives shareholders real reason for optimism. Not only was its cash burn relative to its market cap quite good, but its cash runway was a real positive. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, Antisense Therapeutics has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance