Here's Why We Think Sheng Siong Group (SGX:OV8) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Sheng Siong Group (SGX:OV8). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Sheng Siong Group

How Fast Is Sheng Siong Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Sheng Siong Group has grown EPS by 10% per year. That's a good rate of growth, if it can be sustained.

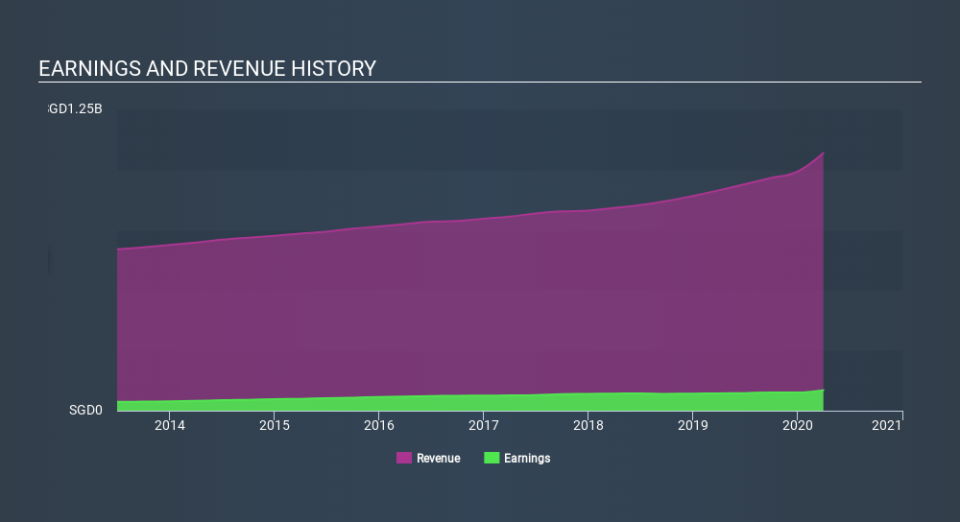

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Sheng Siong Group's EBIT margins were flat over the last year, revenue grew by a solid 17% to S$1.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Sheng Siong Group's future profits.

Are Sheng Siong Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first; I didn't see insiders sell Sheng Siong Group shares in the last year. But the really good news is that CEO & Executive Director Hock Chee Lim spent S$1.1m buying stock stock, at an average price of around S$1.09. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

Along with the insider buying, another encouraging sign for Sheng Siong Group is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth S$649m. That equates to 29% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Is Sheng Siong Group Worth Keeping An Eye On?

As I already mentioned, Sheng Siong Group is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. However, before you get too excited we've discovered 1 warning sign for Sheng Siong Group that you should be aware of.

The good news is that Sheng Siong Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance