Here's Why I Think Iluka Resources (ASX:ILU) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Iluka Resources (ASX:ILU). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Iluka Resources

How Fast Is Iluka Resources Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Iluka Resources's EPS went from AU$0.086 to AU$0.75 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

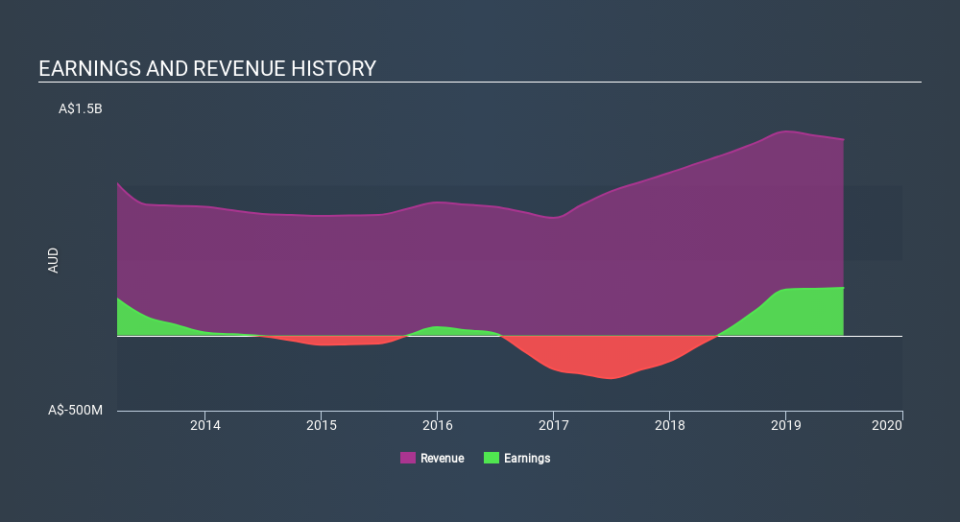

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Iluka Resources is growing revenues, and EBIT margins improved by 18.6 percentage points to 39%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Iluka Resources's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Iluka Resources Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Iluka Resources insiders spent AU$77k on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident.

It's me that Iluka Resources insiders are buying the stock, but that's not the only reason to think leader are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like Iluka Resources with market caps between AU$2.9b and AU$9.2b is about AU$3.3m.

Iluka Resources offered total compensation worth AU$2.8m to its CEO in the year to December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Iluka Resources Deserve A Spot On Your Watchlist?

Iluka Resources's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Iluka Resources may be at an inflection point. If so, then it the potential for further gains probably merit a spot on your watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Iluka Resources.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Iluka Resources, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance